CJRS & BrightPay - where pay periods cross 2 calendar months

The Furlough Pay Calculator

Where a pay period straddles two calendar months, BrightPay’s furlough pay calculator will automatically apportion using a daily basis approach.

Example:

An employee’s weekly pay period runs from 29th June 2021 – 5th July 2021. Their regular wage is £500 and they are being fully furloughed.

Therefore 2 days of the pay period fall in June and 5 days in July.

1. Work out the daily pay rate = £500/ 7 days = £71.43

2. Perform the June calculation = £71.43 x 2 days = £142.86 x 80% = £114.28

3. Perform the July calculation = £71.43 x 5 days = £357.15 x 70% = £250.00

4. Total up the 2 amounts = £114.28 + £250 = £364.28*

* In some instances, users may see a few pence difference if comparing HMRC's calculations or a manual calculation with those calculated in BrightPay. This is because the published HMRC calculations are based on rounded amounts for making manual calculation easier. BrightPay uses a more direct and accurate algorithmic version of the calculation instead.

The Claim Report

Where a pay period straddles two calendar months (and thus 2 claims are required), BrightPay will apportion the pay period's gross pay into each claim period on a daily basis. Each day then has a relative weighting in line with the maximum reclaimable daily wage amounts as stipulated by HMRC. This is the only method that guarantees accuracy in all scenarios.

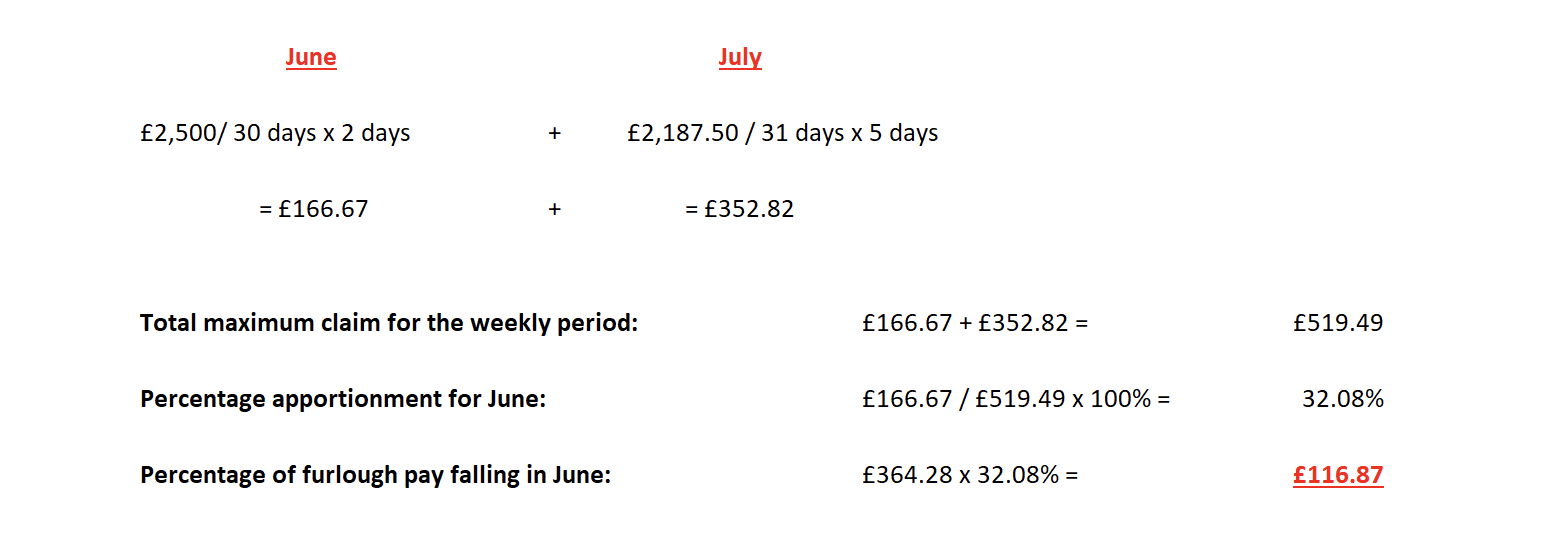

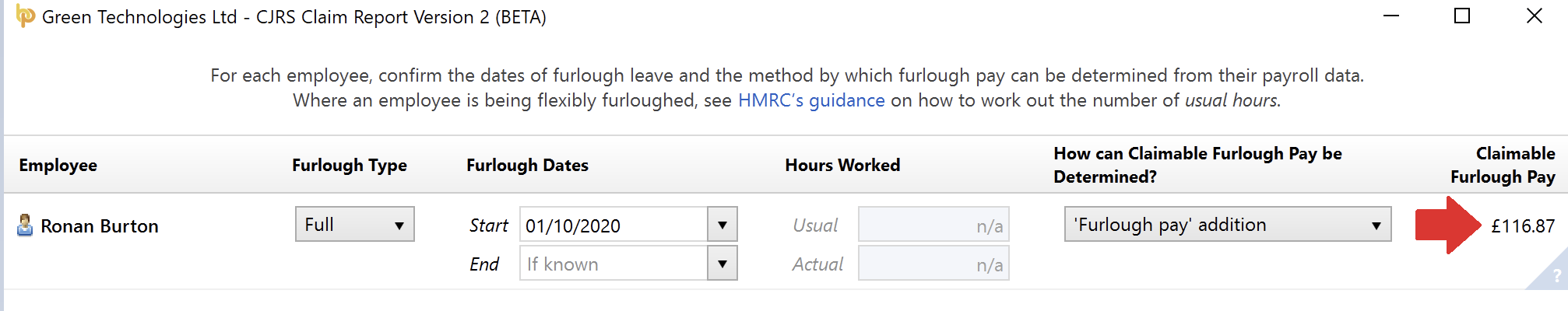

Example:

- Claim period is 29th June – 30th June

- Weekly pay period falling in claim period = 29th June – 5th July

- Employee is paid a reclaimable furlough pay amount of £400.00 in the pay period

- Therefore, there are 2 days in this claim period that will be accounted for.

In this instance, the pay period straddles the claim period, so we have to work out the percentage apportionment.

This is done using the ‘maximum reclaimable wage’ amounts for June (£2,500) and July (£2,187.50) as follows:

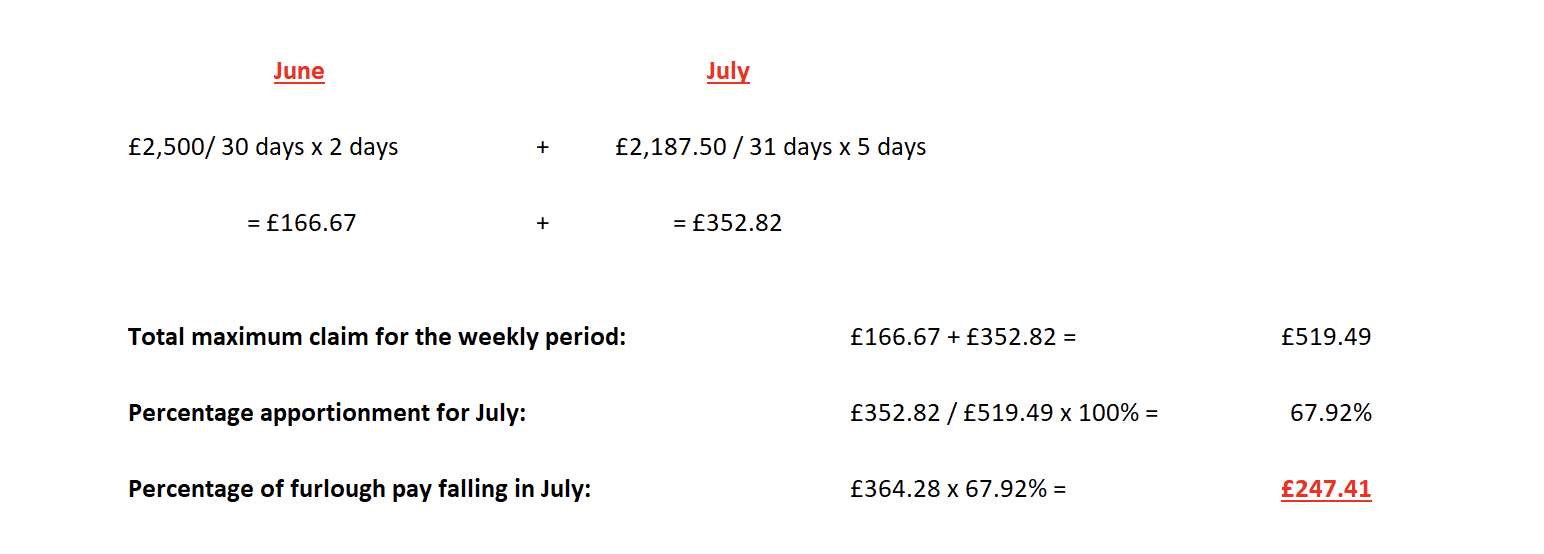

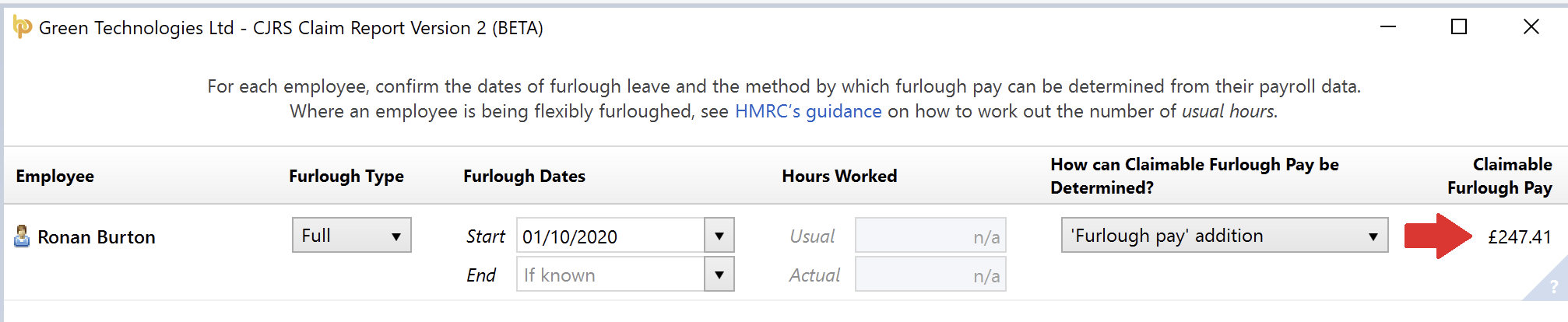

Likewise, the calculation being performed and the amount included in the July claim will be:

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.