Coronavirus SSP Rebate Scheme - Claim Report in BrightPay

A Claim Report is available in BrightPay to assist users in ascertaining the amounts needed for input into HMRC's Coronavirus SSP Rebate Scheme online service.

Comprehensive HMRC guidance on the Coronavirus SSP Rebate Scheme can be found here.

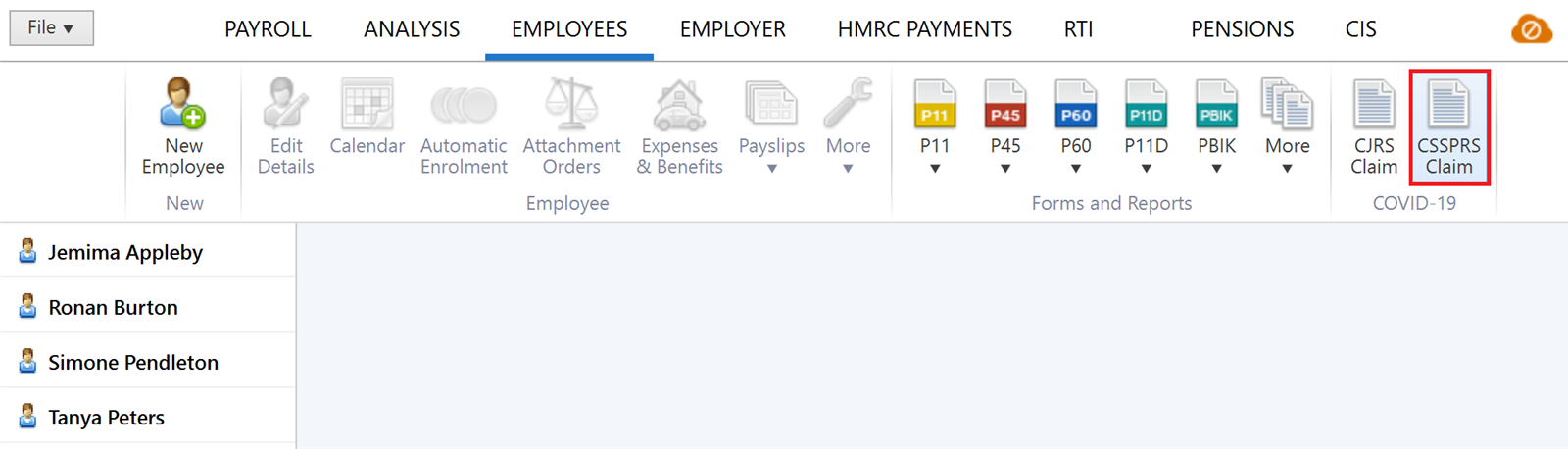

1) To access this report, go to Employees > CSSPRS Claim:

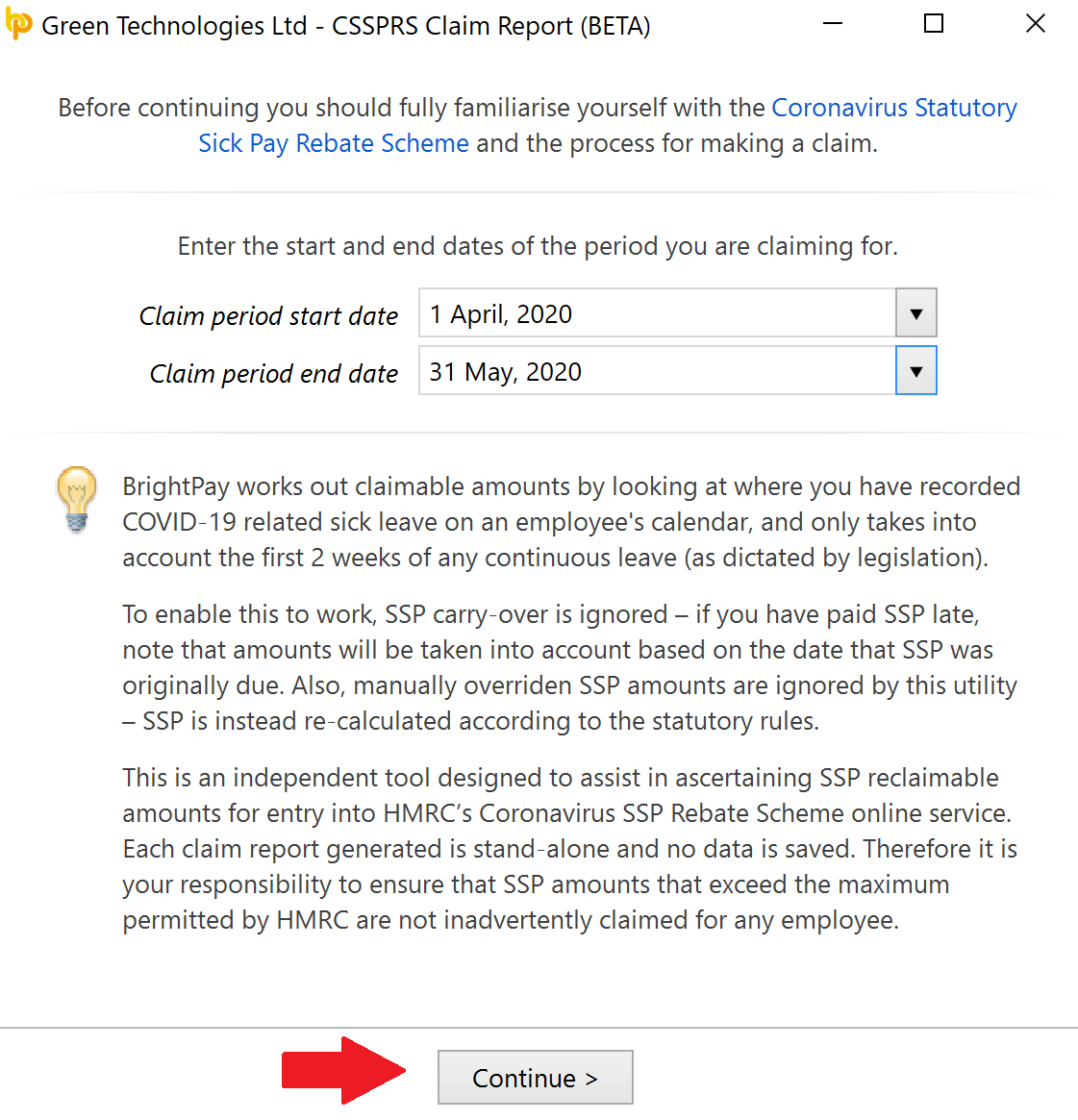

2) Enter the start and end date of the Claim Period you are claiming for, taking note of the guidance on this screen, and press Continue:

Points to note when entering claim dates:

- when determining Covid-19 related SSP amounts, these are auto-calculated from finalised pay periods with a pay date falling in the claim period you have entered. Care should therefore be taken when entering claim dates should you run your payroll e.g. a week in arrears.

- The claim report will ignore any SSP carry-over (i.e.where a retrospective Covid-19 related SSP adjustment has been made to an employee's calendar record and the SSP difference has been accounted for in a subsequent pay period) and instead will include the amounts in the pay period in which they would have been due.

Example:

A payroll operator has only been informed in May that an employee was on Covid-19 related sick leave in April, but the April payroll has been run and the employee paid. The payroll operator has subsequently recorded the sick leave for April, and has paid the Covid-19 related SSP due to the employee in May.

As the SSP related to April (and not May), claim dates must be entered for April in order for the retrospective adjustment to be included in the claim report. - In addition, where an SSP amount has been manually overridden by the user, such amounts will be ignored by the utility and SSP amounts will instead be re-calculated according to the statutory rules.

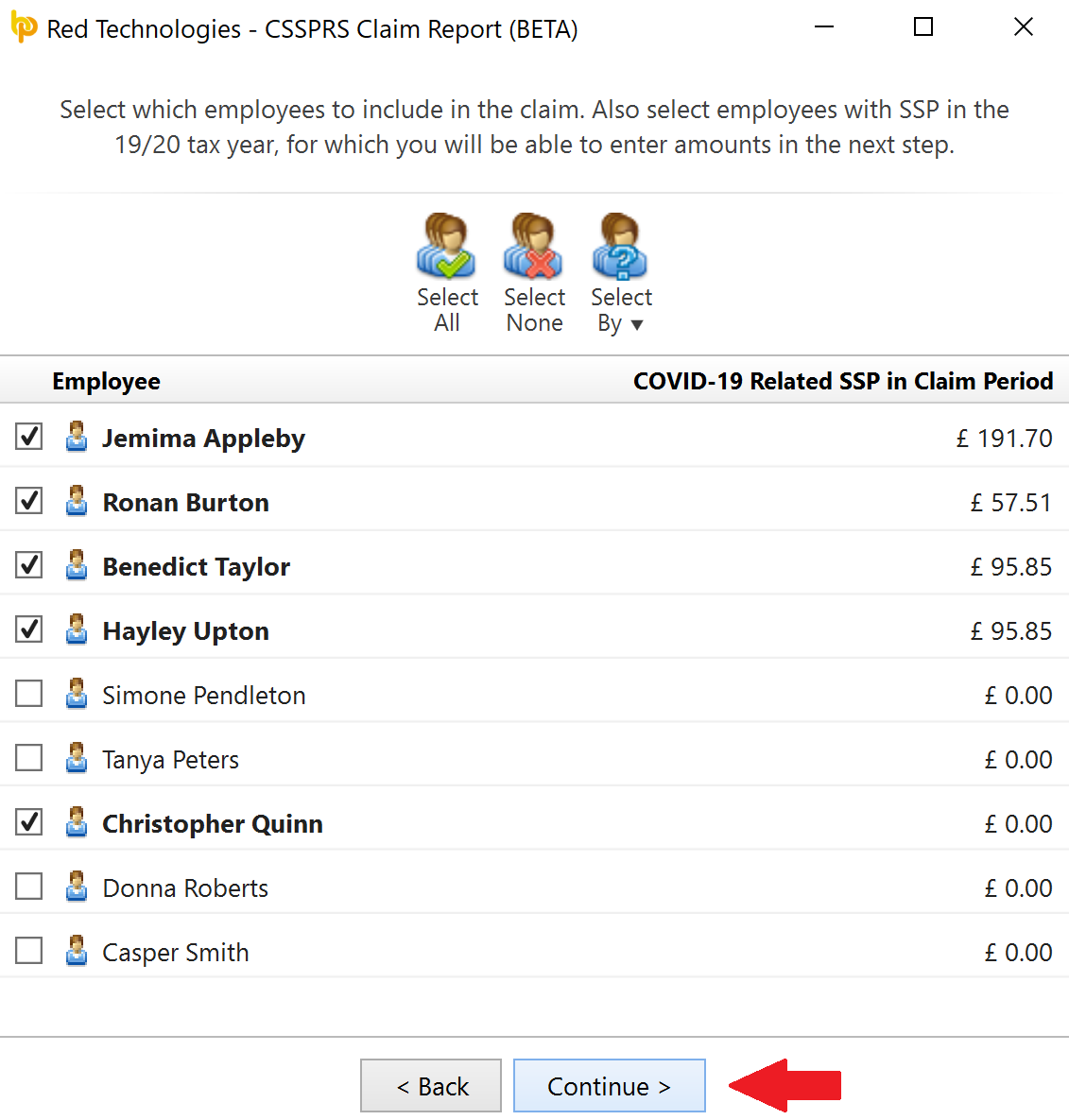

3) On the next screen, select the employees you wish to include in your claim.

If your chosen claim period covers some of the 19-20 tax year, also select any employees with Covid-19 related SSP in the 19-20 tax year for whom you wish to claim. The following screen will allow you to enter any 19-20 amounts you wish to claim for.

Press Continue

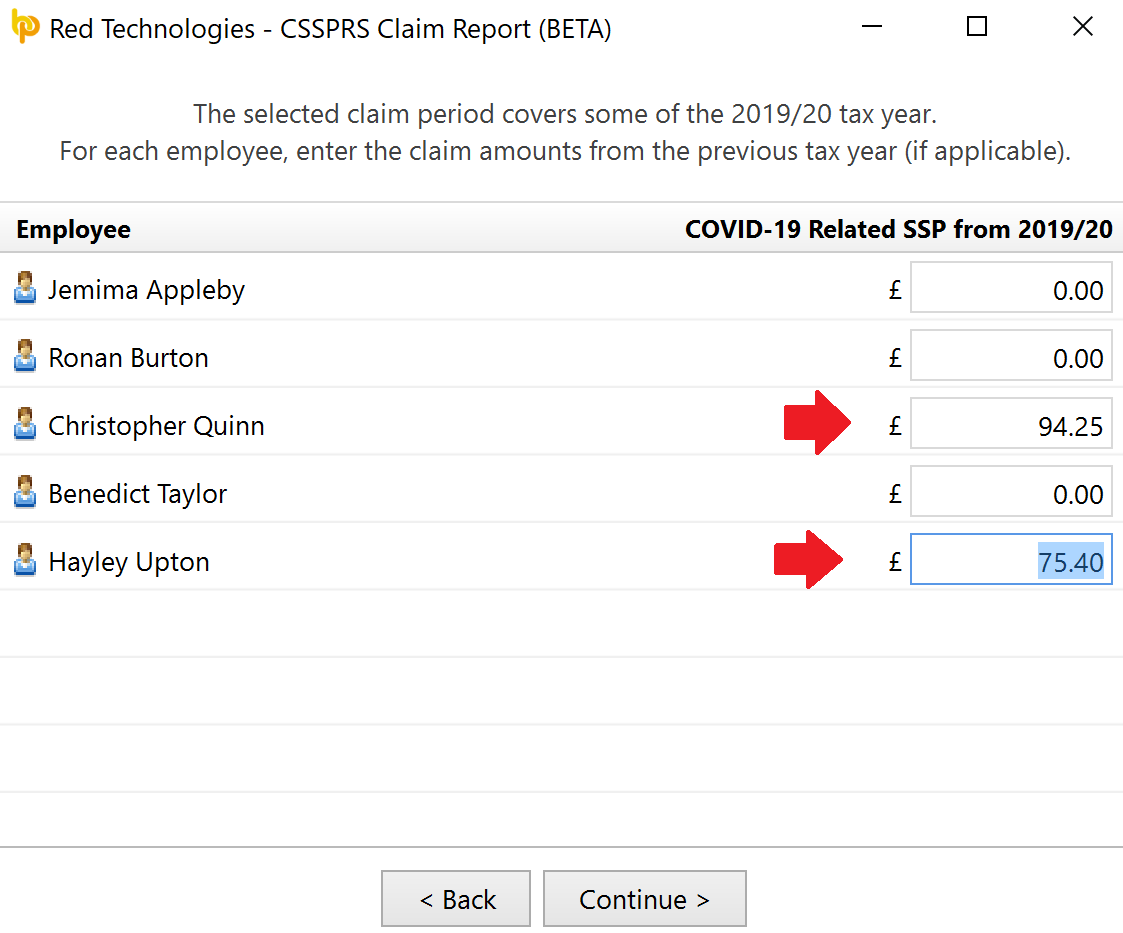

4) If your chosen claim period covers some of the 19-20 tax year and you wish to claim Covid-19 related SSP amounts for the previous tax year, you will be prompted to enter these amounts manually on the next screen:

- Click Continue

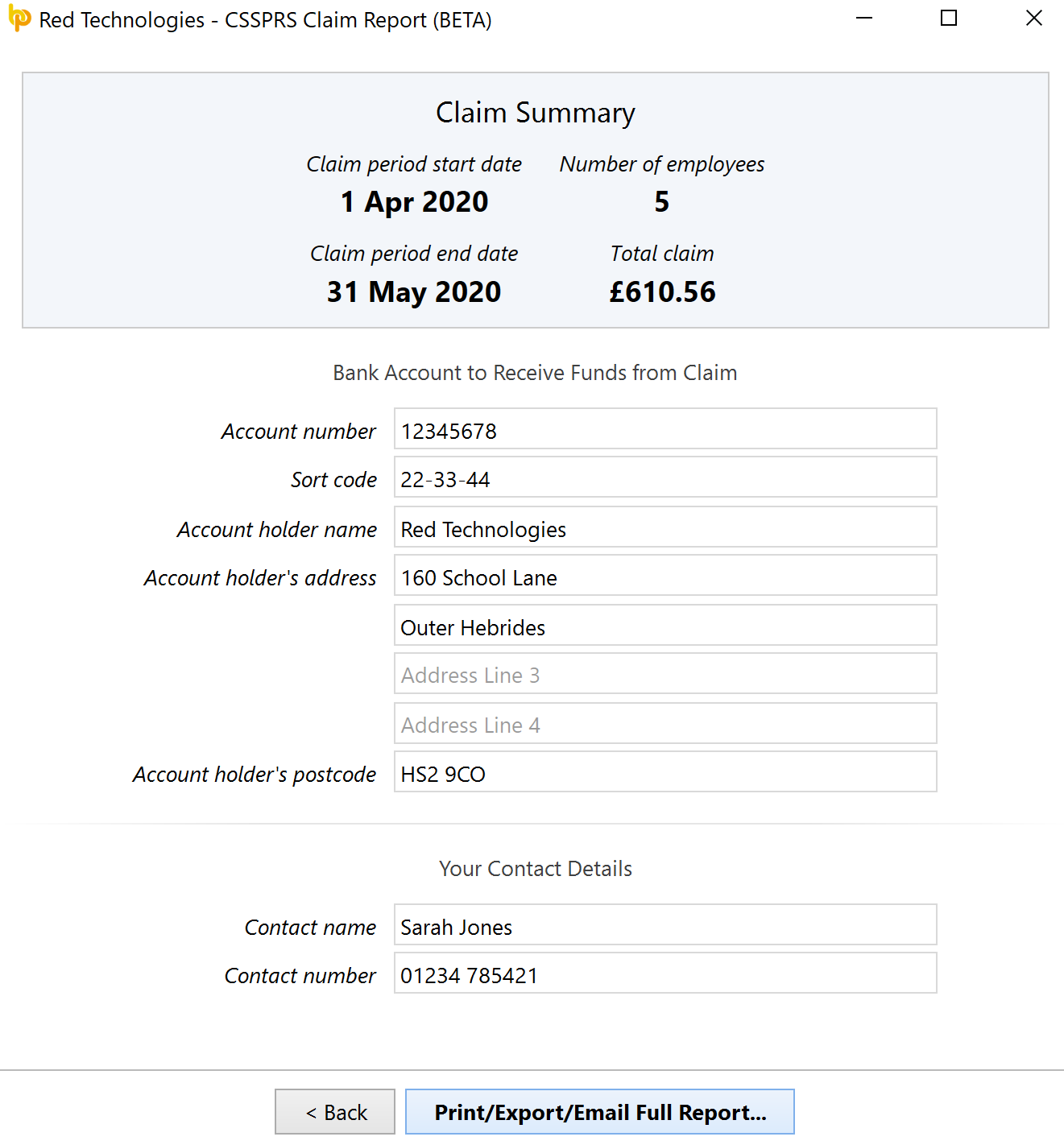

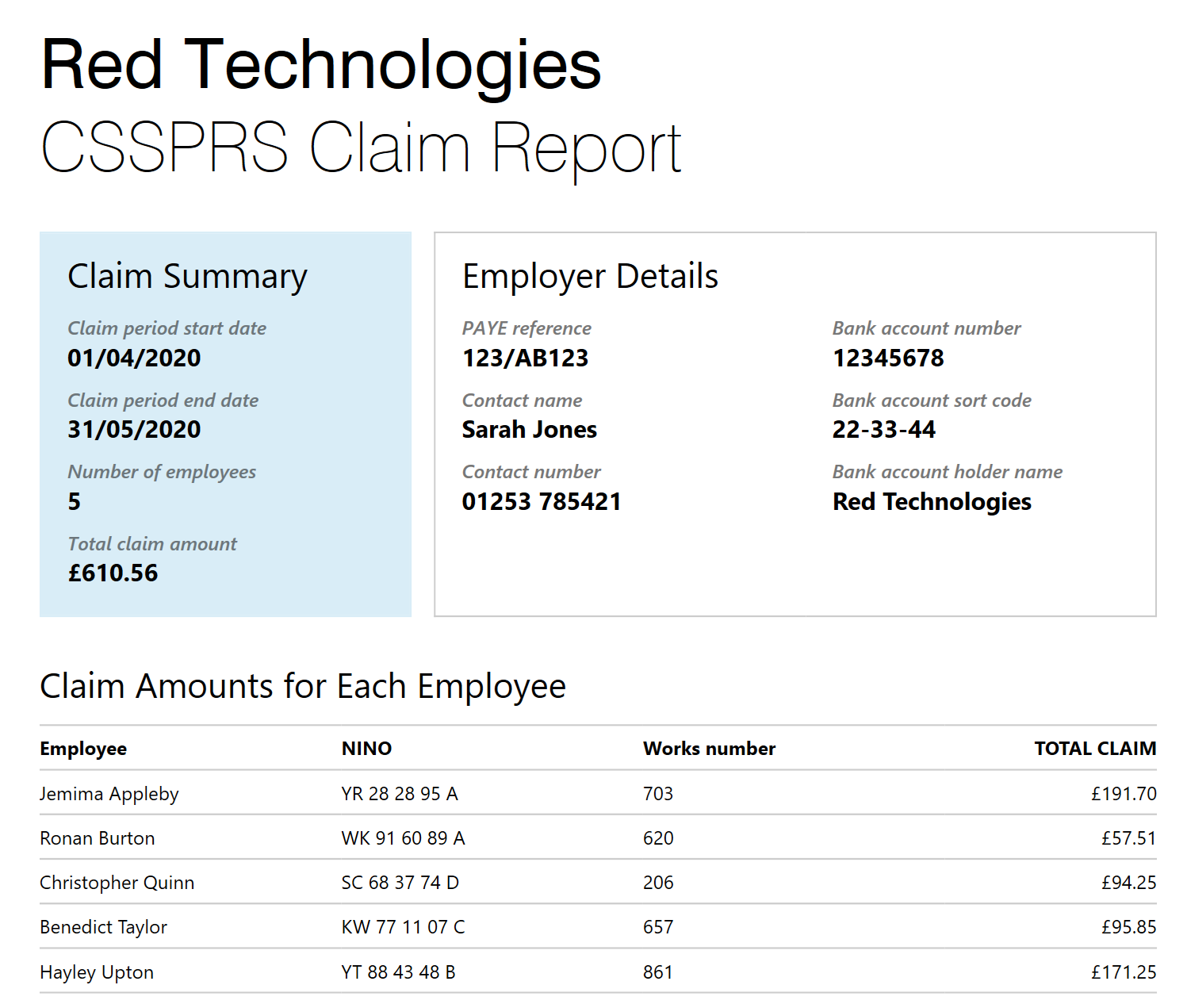

5) On the final screen, a summary of your claim will be displayed. Enter any additional information that HMRC require when making a claim.

- Should you wish to view the full report, click Print/Export/Email Full Report...

- The Full Report should subsequently be printed, exported or emailed for your records

6) Once your Claim Report is completed, simply close out of the utility.

- Before doing so, however, please ensure you have exported your report document, so not to lose your entered data.

Note to the above

The CSSPRS claim report in BrightPay is an independent tool designed to assist users in ascertaining SSP reclaimable amounts for entry into HMRC's Coronavirus SSP Rebate Scheme online service.

Each claim report generated in the software is stand-alone and no data is saved each time a claim report is run. Therefore it is user responsibility to ensure that SSP amounts that exceed the maximum permitted by HMRC are not inadvertently claimed for any employee.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.