Processing Covid-19 related SSP in BrightPay

HMRC have advised that if an employee needs to take time off sick or to self isolate due to Covid 19, the first 3 waiting days that normally apply for SSP will be disregarded and the employee will be entitled to receive SSP from the first day.

Processing Covid-19 related Statutory Sick Pay in 20-21 BrightPay

20-21 BrightPay has been programmed to automate Covid-19 related SSP, where this is to apply.

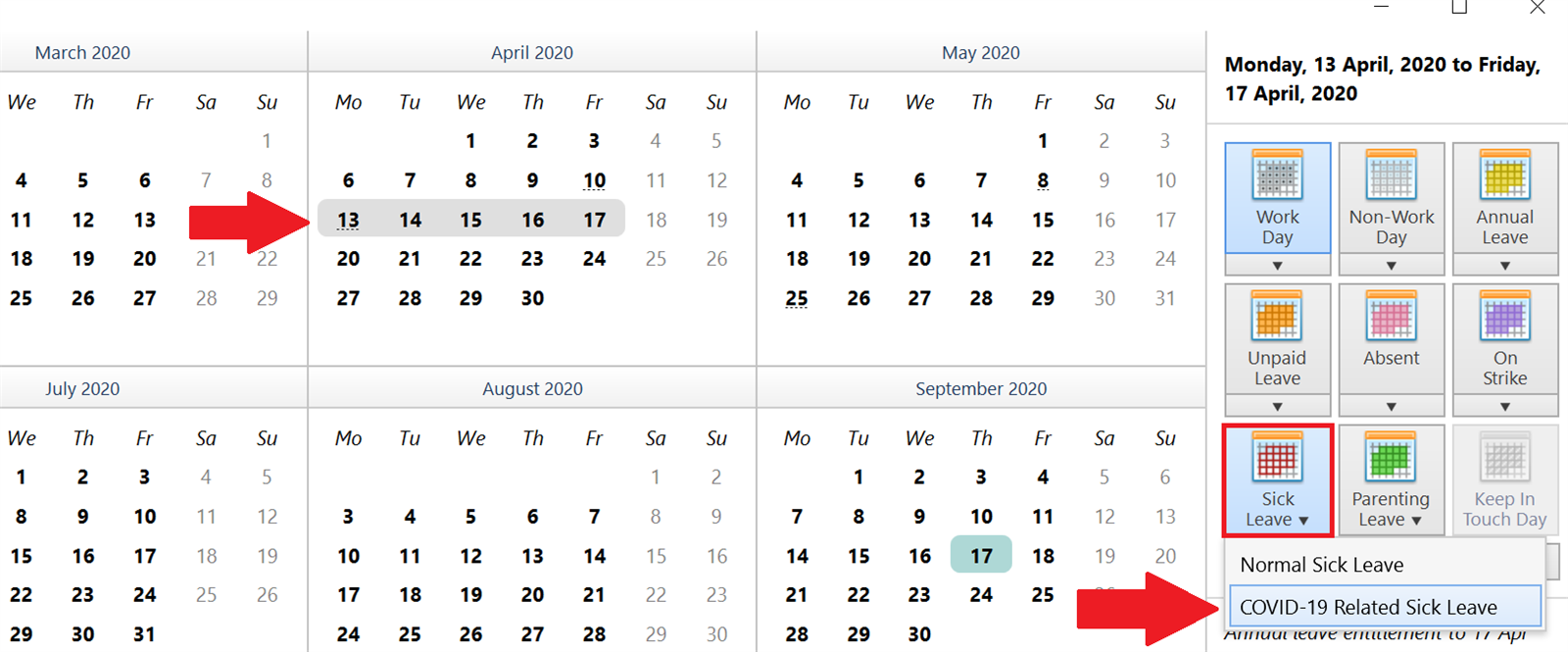

1. Click 'Payroll' and select the employee’s name on the left

2. Under Statutory Pay, click Calendar

3. On the Calendar, select the date range the employee is out on sick leave

4. Click Sick Leave from the options on the right of the screen and choose 'COVID-19 Related Sick Leave'

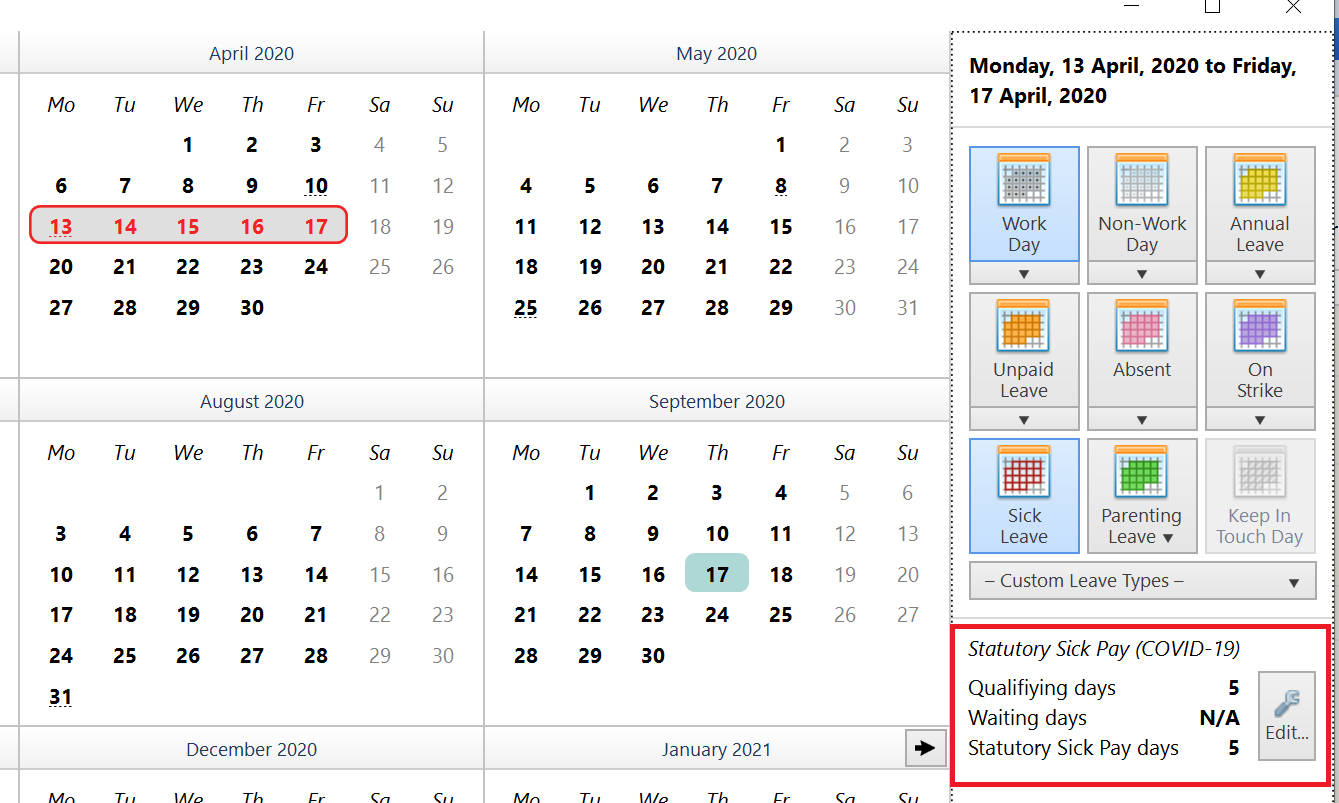

The number of Qualifying Days & SSP days will be displayed on the screen:

5. Close the Calendar and the program will automatically apply any SSP due to the employee.

Overriding the 'Average Weekly Earnings' Calculation

If existing payment records have not been recorded in BrightPay or there is insufficient historical payroll data to determine the employee's AWE, the automatic calculation performed by the program after completing the above may be inaccurate or not possible. You may override the AWE by doing the following:

1 On the main Payroll screen, click the Edit icon in the employee’s Statutory Payments section

2 In Sick Leave, select the option ‘Override average weekly earnings calculation’

3 The program will now automatically calculate SSP

Processing Covid-19 related Statutory Sick Pay in 19-20 BrightPay

If you need to process Covid-19 related SSP in 19-20 BrightPay, the software is programmed to take into account the usual 3 waiting days. In this instance, an override should be performed in 19-20 BrightPay by simply marking the previous 3 days on the employee's calendar as sick leave. The SSP to be applied will then be from their first actual day of self-isolation/sick leave.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.