Expenses & Benefits - Setting the Tax Accounting Method

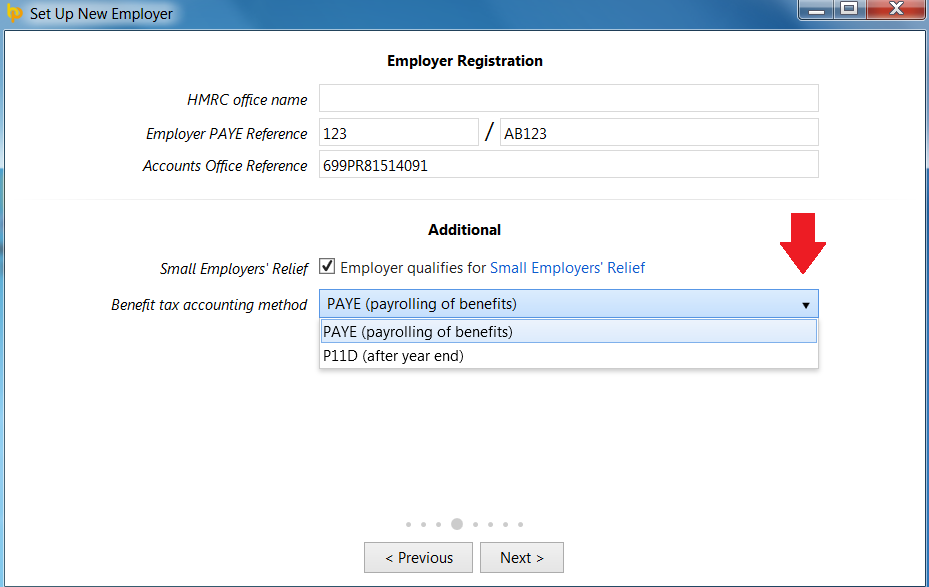

When setting up an employer on BrightPay you will be asked for the "Benefit tax accounting method" - i.e. payrolling of benefits or P11D.

The benefit tax accounting method selected for the employer is used as a default when adding expenses or benefits to an employee record, however the method can be changed for employees where applicable.

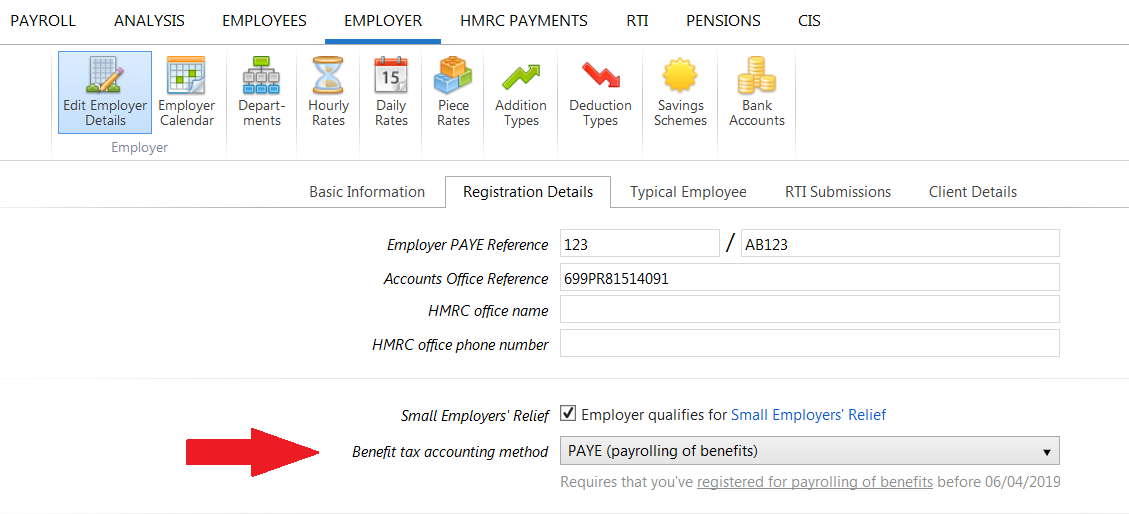

The benefit tax accounting method can be viewed or amended any time by selecting Employer > Edit Employer Details > Registration Details.

Please note: to payroll benefits for tax year 2020/21, you need to have registered to payroll using this service by 5 April 2019. You won’t be able to register after this date for the 2020/21 tax year as HMRC can’t process changes in-year.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.