P30 & P32

P30 Employer's Payslip

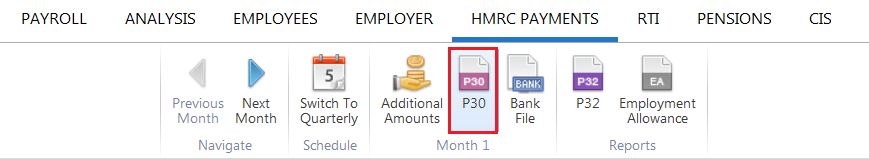

To access your P30 for the tax month or quarter in question, select HMRC Payments on the menu bar and select the tax period you wish to view on the payment schedule bar.

1) Click the P30 button on the menu toolbar

2) To print the P30, click 'Print' on the toolbar.

3) To email the P30, click 'Email' on the toolbar. (A default 'reply to' address and an email signature can be added by going to File > Preferences > Email > when complete > 'Save')

4) To export the P30 to PDF, select 'Export PDF' on the toolbar.

P32 Employer Payment Record

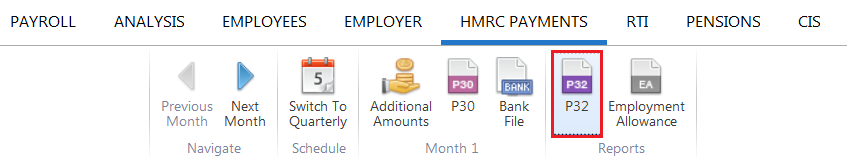

To access your P32 Employer Payment Record, select HMRC Payments on the menu bar.

1) Click the P32 button on the menu toolbar.

2) To print the P32, click 'Print' on the toolbar.

3) To email the P32, click 'Email' on the toolbar. (A default 'reply to' email address and an email signature can be added by going to File > Preferences > Email > when complete > 'Save')

4) To export the P32 to PDF, select 'Export PDF' on the toolbar.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.