Mileage Allowance Payments (MAPs)

Mileage Allowance Payments (MAPs) are what you pay your employees for using their own vehicle for business journeys.

You can pay your employees an ‘approved amount’ of MAPs each year without having to report them to HMRC. To work out the ‘approved amount’, multiply your employee’s business travel miles for the year by the rate per mile for their vehicle.

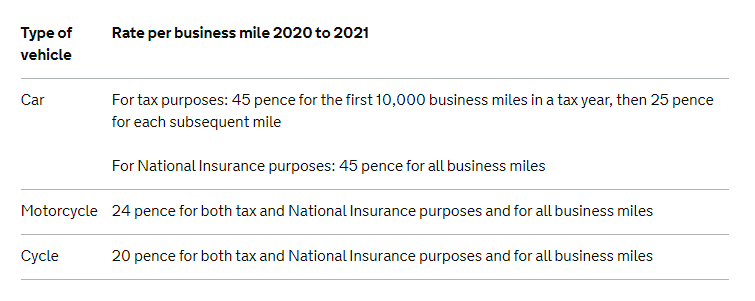

Current MAP rates as per HMRC:

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.