Importing from Moneysoft - using a CSV File (mid year)

BrightPay facilitates the importing of employee information in CSV format from Moneysoft.

This is an alternative option to using an FPS file to perform your import and can be a little more time-consuming. However, this method allows you to import more employee information than an FPS import allows, thus minimising or eliminating the need for further manual entry after import.

A CSV import of both employee and their mid-year pay information can be performed in BrightPay at any point in the tax year.

Importing into BrightPay mid Tax Year

1a) First export your CSV file containing your employee and their year-to-date pay information from within your Moneysoft software.

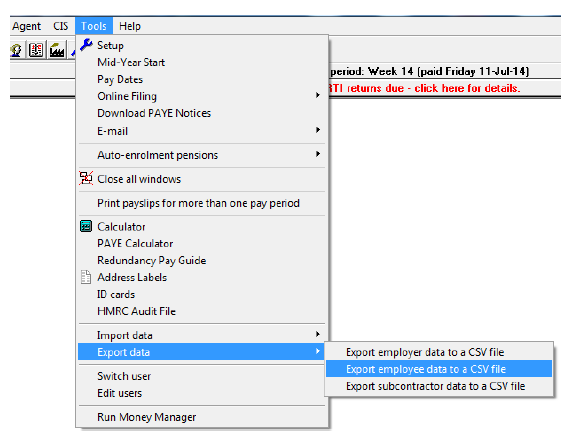

Within Moneysoft, go to 'Tools > Export Data > Export Employee Data to a CSV file':

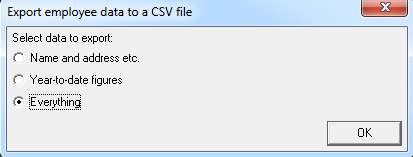

1b) You will now be given three options. Select 'Everything' and click 'OK':

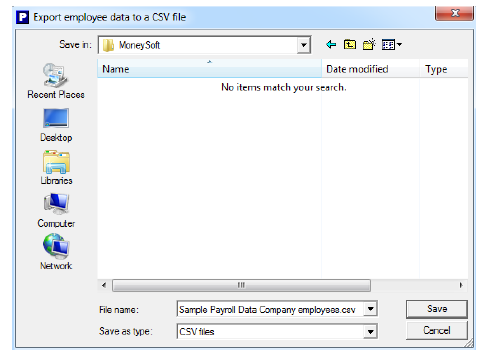

1c) Select a location to save your CSV file to and press 'Save'.

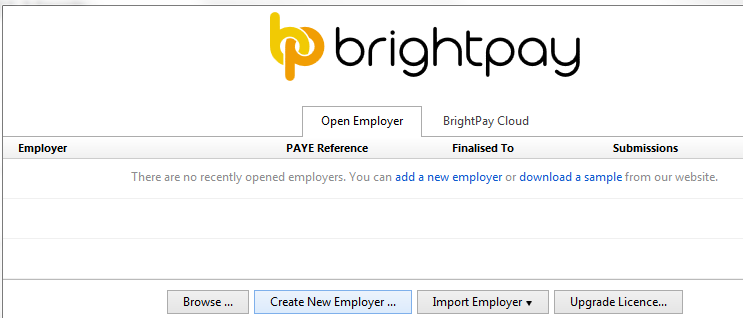

2. Open BrightPay and 'Create New Employer':

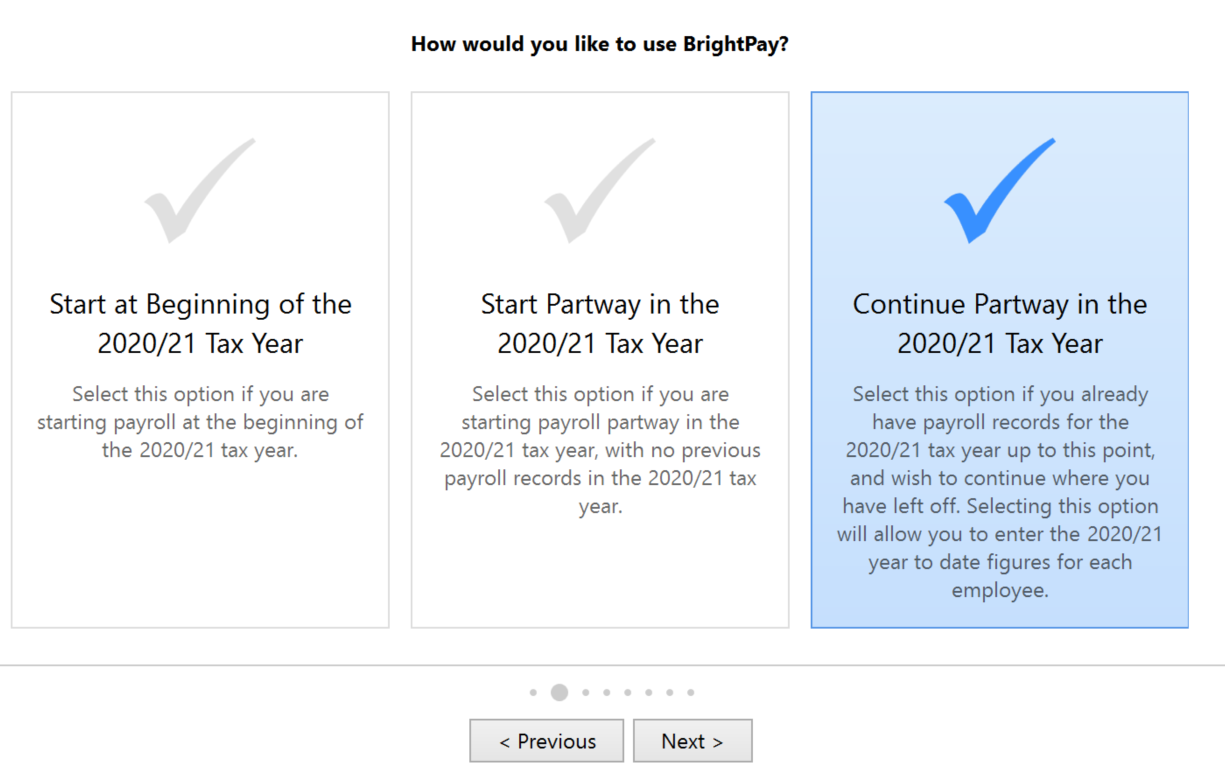

3. Select how you wish to use BrightPay:

If you have already processed payroll in your previous software for the current tax year and wish to import year-to-date pay amounts as well as your employee information, you must select 'Continue Partway in the Tax Year'.

4. Complete each screen accordingly with your relevant employer information.

For further assistance with this, please see our support section on Adding a New Employer

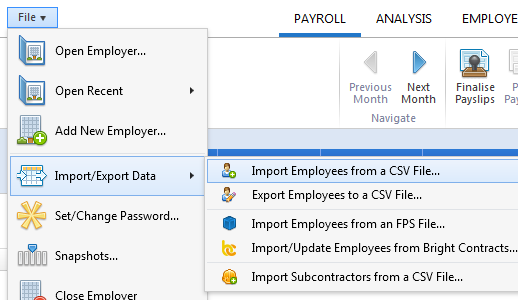

5. Once you have entered and saved your employer information, go to 'File > Import/Export Data > Import Employees from a CSV file'

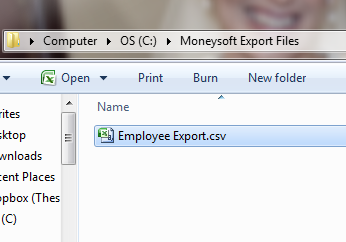

6. Browse to the location of your CSV file, select it and press 'Open'

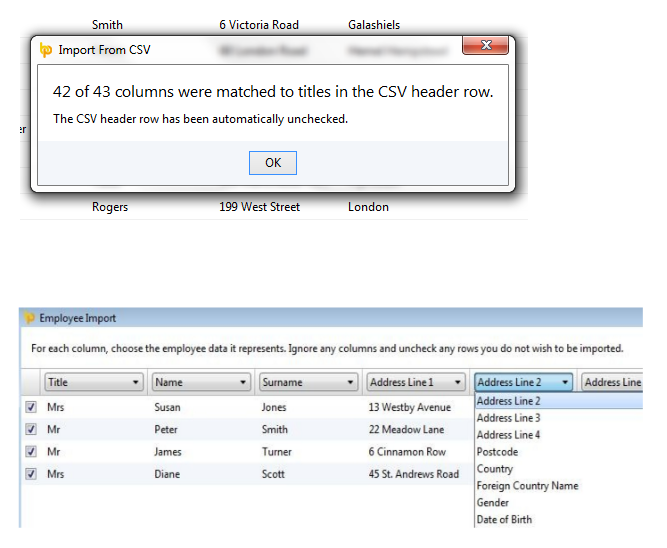

Your employee information will be displayed on screen. For each column, choose the employee data it represents. Ignore any columns and uncheck any rows you do not wish to be imported

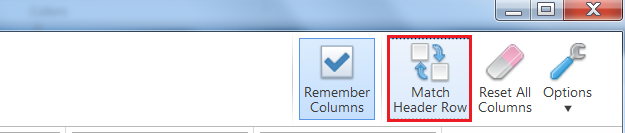

To assist with column selection, simply select 'Match Header Rows'. BrightPay will try and match as many columns as it can for you.

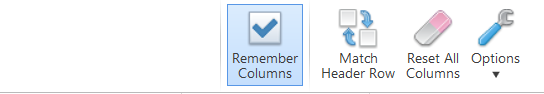

Please note: should you have employee CSV files to import for more than one company from Moneysoft, simply instruct BrightPay to 'Remember Columns'. BrightPay will subsequently remember the column selection used in the previous import when next importing a new employee CSV file.

Alternatively, should you wish to reset your column selection, select 'Reset All Columns'.

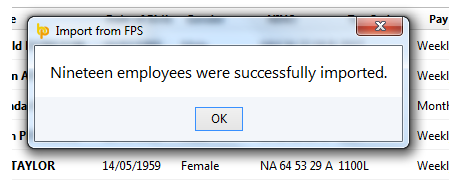

7) Click Import to complete the import of your employee information.

Following the import, further employee information can be manually entered within 'Employees', if required. It is also recommended that all employee details are reviewed before processing any payroll to ensure information imported in is correct and applicable for the tax year in question.

If you have migrated to BrightPay mid-year, any mid-year cumulative pay information imported in via your CSV file can also be viewed here in each employee’s ‘Mid-Year Totals’ section.

After reviewing your employee information, simply click the 'Payroll' tab to commence processing payroll.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.