Rates & Thresholds 2020-21

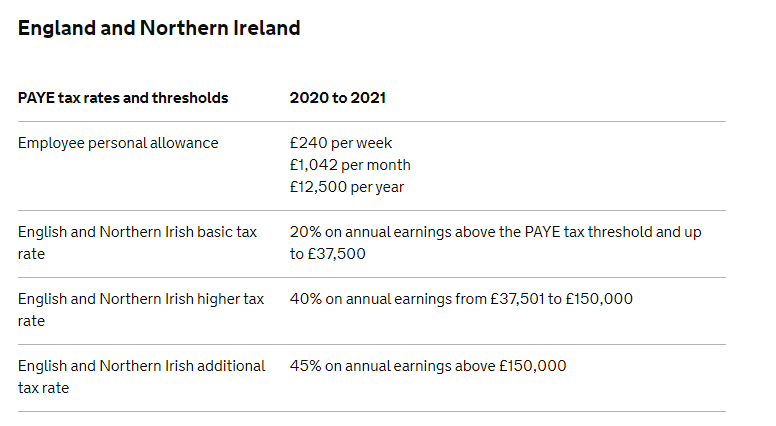

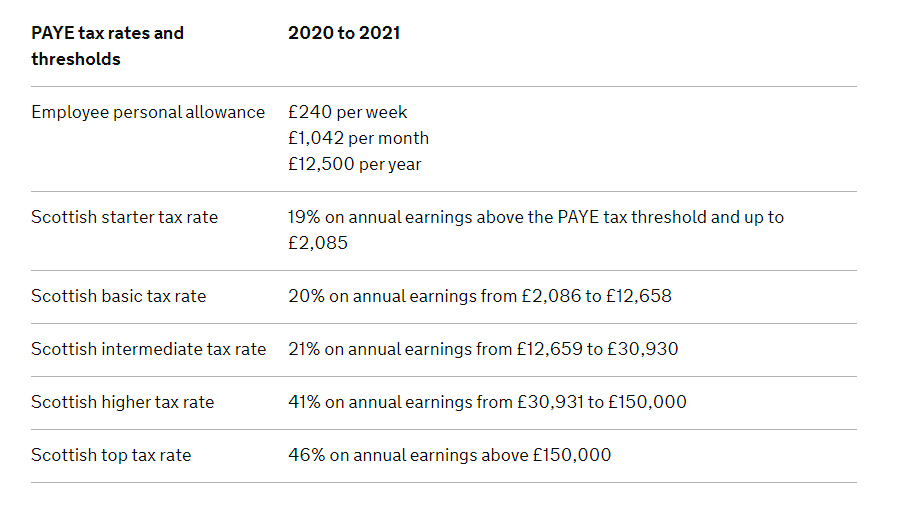

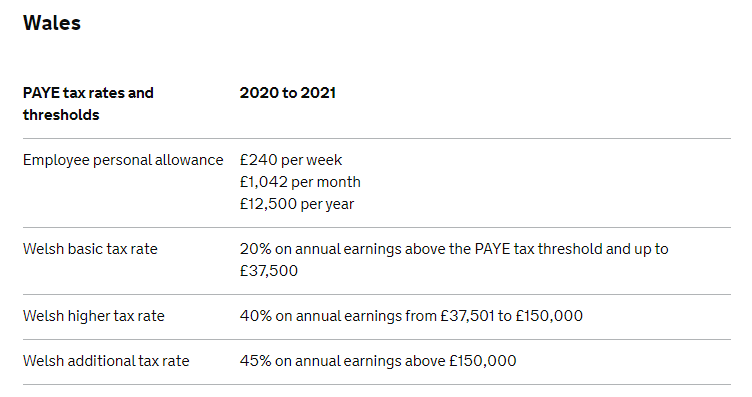

Tax Rates and Thresholds

![]()

Please note: 2019 to 2020 rates will remain operative until 10 May 2020, after which they will be superseded by the rates shown below:

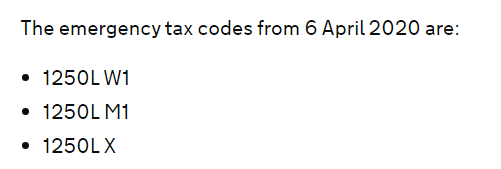

Emergency Tax

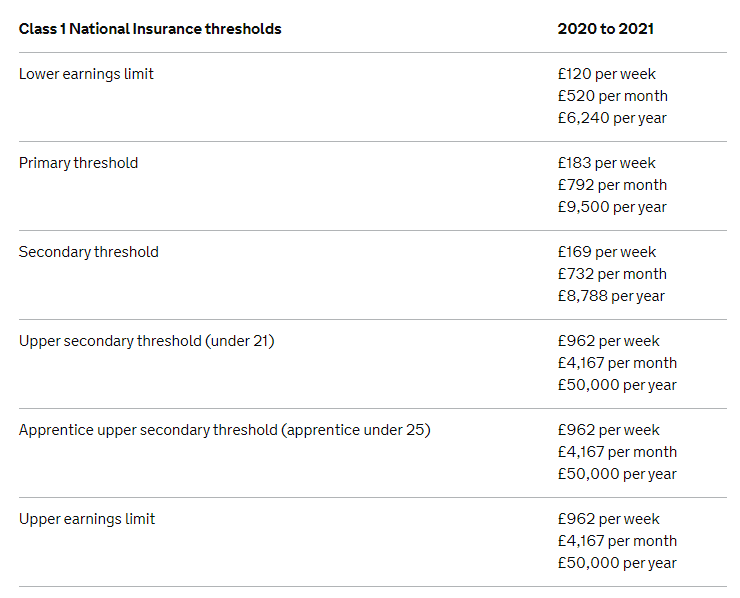

Class 1 National Insurance Thresholds

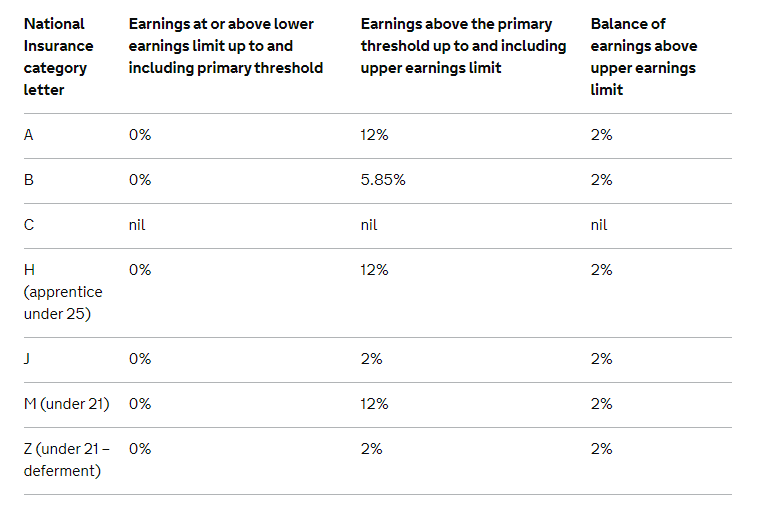

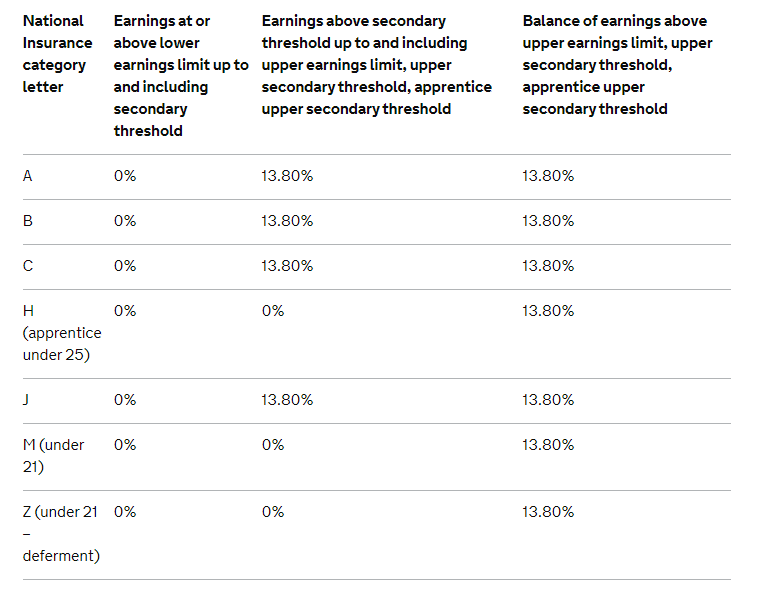

Class 1 National Insurance Rates

Employee (primary) contribution rates:

Employer (secondary) contribution rates:

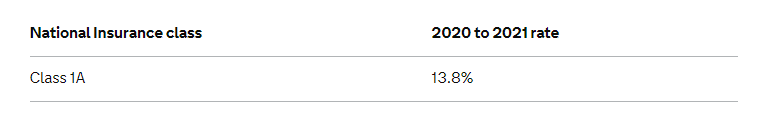

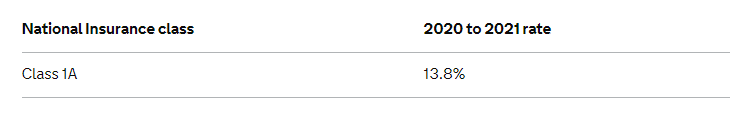

Class 1A National Insurance Rate for Expenses and Benefits

Class 1A National Insurance Rate for Termination Awards and Sporting Testimonials

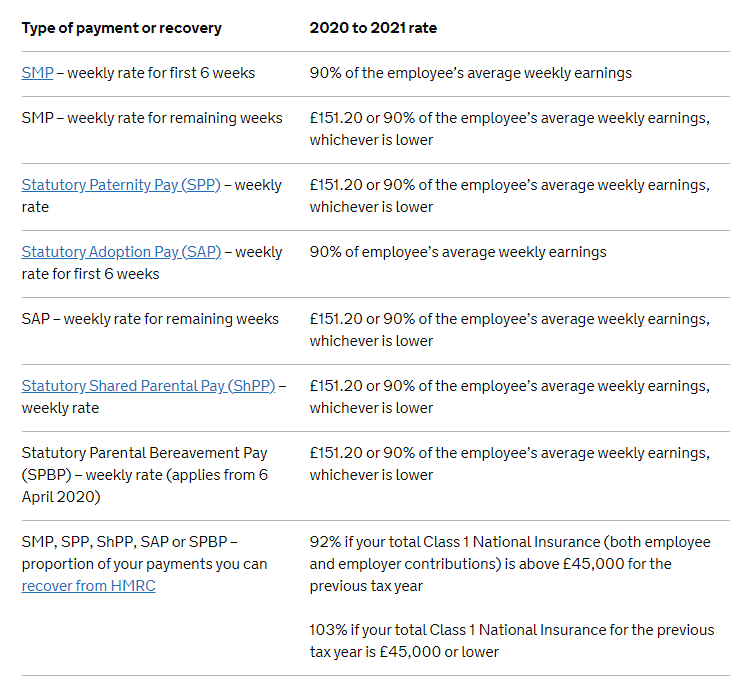

Statutory Payments

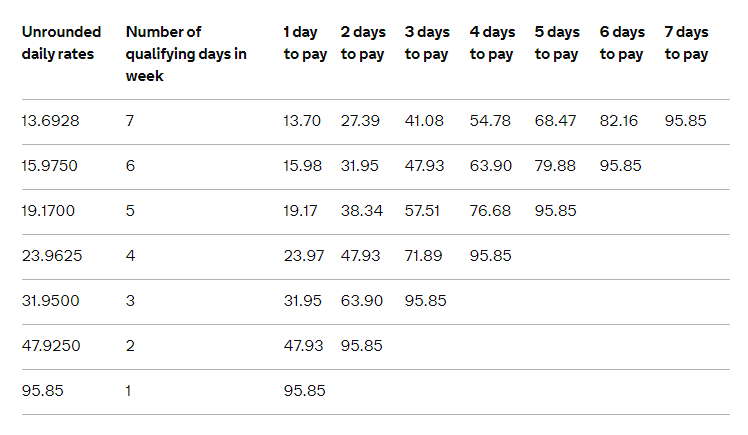

Statutory Sick Pay (SSP)

The same weekly SSP rate applies to all employees. However, the amount you must actually pay an employee for each day they’re off work due to illness (the daily rate) depends on the number of ‘qualifying days’ (QDs) they work each week.

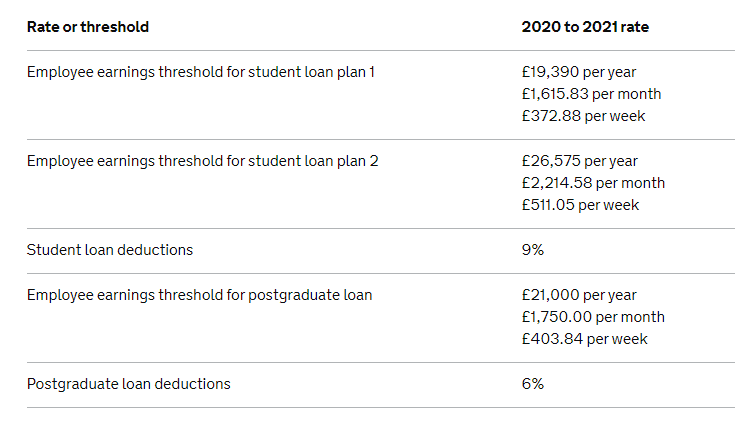

Student loan and Postgraduate loan recovery

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.