Declaring a future period of inactivity

If you won’t be paying any employees in the future for a minimum period of one tax month, and a maximum of 12 months, this must be reported to HMRC using the Period of Inactivity indicator on the EPS.

To inform HMRC in advance of a period of inactivity:

1) Select 'RTI' on the menu bar.

2) Click 'New' on the menu toolbar and select 'Employer Payment Summary (EPS)':

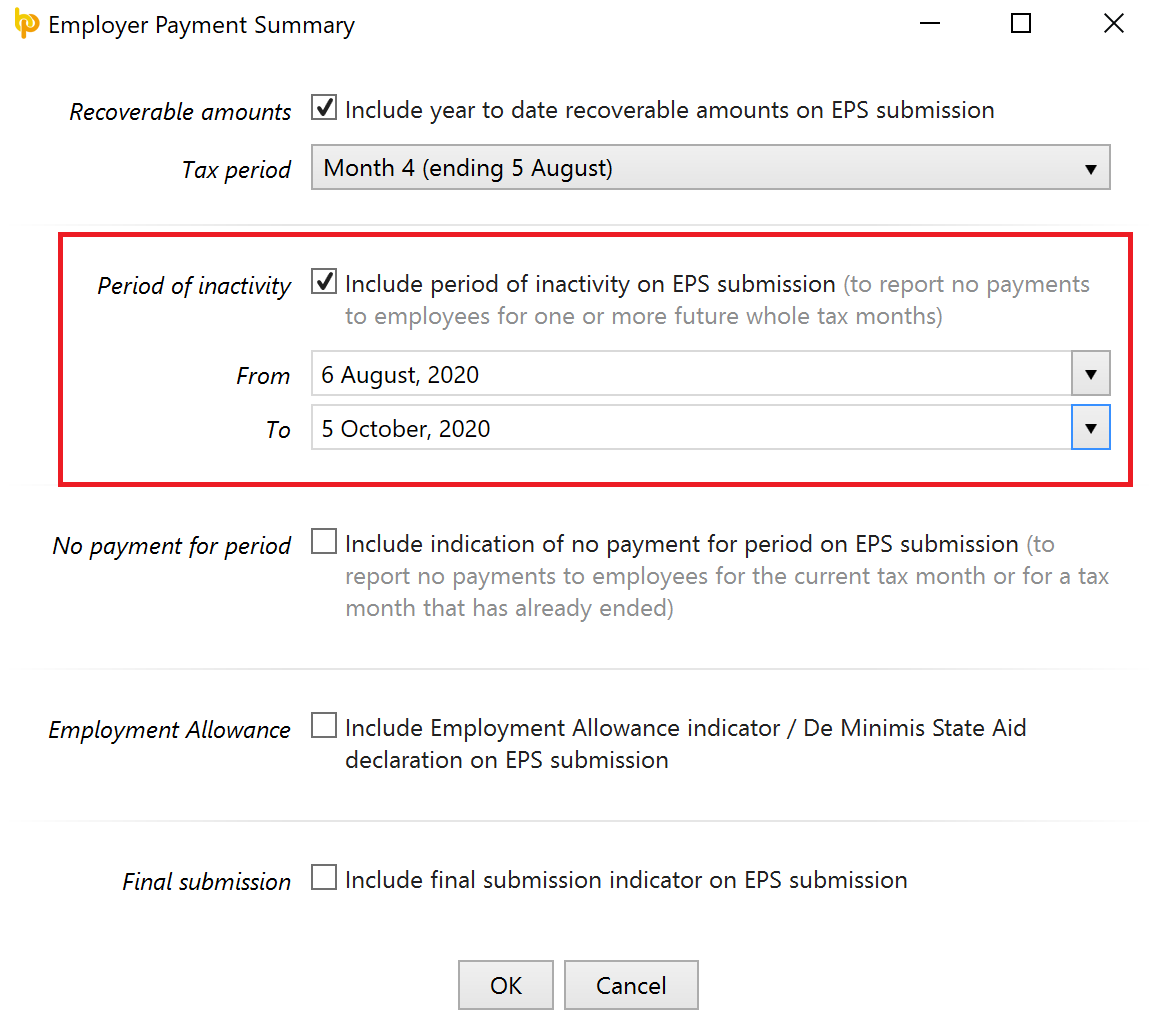

3) Tick the 'Period of Inactivity' marker

4) Enter the start date of the first tax month of your period of inactivity. This must be a period in the future and must be the 6th of the month

5) Enter the end date of the period of inactivity. This again must be a date in the future and must be the 5th of the relevant month

Example: if you know in July that you will have no paid employees or directors between 6 August and 5 October , this will be entered as follows on the EPS:

6) Click 'OK' and submit to HMRC when ready.

Please note: the 'period of inactivity' utility can only be used to report future periods of inactivity in advance to HMRC. To report no payment for a current or previous tax period, a 'no payment for period' must be completed instead on the EPS. For assistance with this, click here.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.