Tax Codes to use for New Employees

For new employees, the tax code to use for them will depend on whether or not a valid P45 is given to the new employer.

New starter who provides their new employer with a P45

If the employee provides a valid P45, use the tax code as stated on the P45.

New starter who does not have a P45

Where a starter does not have a form P45 issued by a previous employer to give to their new employer before their first payday, the new starter should be asked to complete HMRC’s Starter Checklist .

This can be completed online and the finished form downloaded, saved and printed out. Alternatively, a black and white copy of the Starter Checklist can be printed using the link provided above. This can then be given to the starter to fill out.

This in turn will inform the new employer what PAYE tax code they should use for the starter’s first payday, based on whether they select statement A, B or C on the starter checklist ‘Employee Statement’:

Employee Statement

A – This is my first job since last 6 April and I have not been receiving taxable Jobseeker’s Allowance, Employment and Support Allowance, taxable Incapacity Benefit, State or Occupational pension.

OR

B – This is now my only job, but since last 6 April I have had another job, or received taxable Jobseeker’s Allowance, Employment and Support Allowance or taxable Incapacity Benefit. I do not receive a State or Occupational Pension.

OR

C – As well as my new job, I have another job or receive a State or Occupational Pension.

If Statement A

Use the tax code 1250L on a cumulative basis.

This gives the employee the standard tax free personal allowance of £12,500 for the 2020-21 tax year.

If Statement B

Use the tax code 1250L on a 'Week 1/ Month 1' basis.

As the employee has confirmed this to be their only job, they should be entitled to the full tax free personal allowance of £12,500 for the 2020-21 year. However, as the new employer has not been given any details of the employee’s pay and tax from their previous employer, they are unable to calculate their tax liability on a ‘cumulative’ basis’. Instead, the 1250L code will be applied, but only by considering the proportion of the allowances and tax rate bands available to the employee for each individual pay period.

1250L on a 'Week 1/ Month 1' basis is deemed to be a temporary code and HMRC will often issue a revised tax code shortly afterwards. In many cases, this is simply 1250L on a cumulative basis.

If Statement C

Use the tax code BR

As the employee has stated that they are receiving income from elsewhere, the assumption is made that they are already receiving their tax free personal allowance against that other source of income.

The BR code thus tells the new employer to collect tax at the basic rate (20%) against the employee’s full earnings.

This code should be correct if the employee is a basic rate taxpayer and all of their personal allowance for the year is being fully utilised against earnings from another employment or pension.

Please note: When the user chooses one of the above starter declarations in the software, BrightPay will default to the applicable tax code associated with the statement selected. The tax code can subsequently be viewed in the employee's 'Tax/NIC/RTI'`section.

New starter who does not provide a P45 or Employee Statement

Use the tax code 0T on a 'Week 1/ Month 1' basis

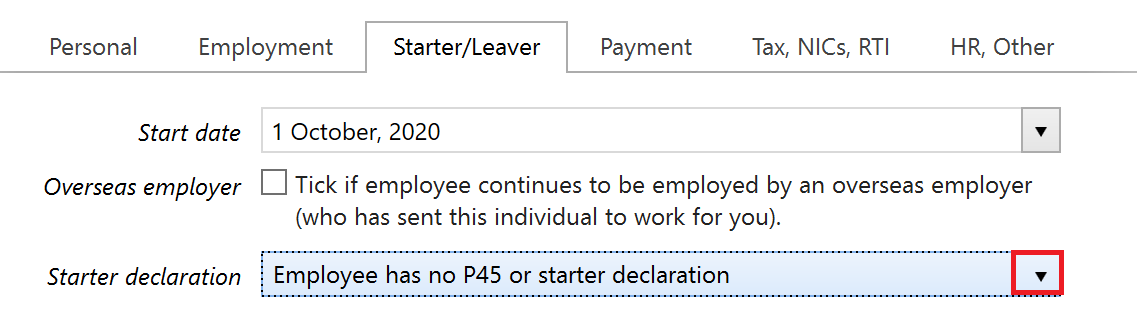

Employers should use this code if they haven’t enough information to complete a Starter Checklist for a new employee. If this applies to a new starter, choose the following option from the drop down menu provided in the software:

For a basic rate taxpayer, this tax code will produce the same result as a BR code (a flat rate 20% deduction), but for a higher or additional rate tax payer, the 0T code will charge tax at 40% and 45% respectively.

Please note: BrightPay will default to the applicable tax code of 0T on a Week 1/Month 1 basis when the user selects the option "Employee has no P45 or starter declaration".

Late P45 or Starter Checklist given after the first pay day

A new employee may sometimes give their new employer a P45 or a completed Starter Checklist after their first pay and after an FPS submission has been submitted to HMRC that includes them. This can arise if the employee has received their P45 late from their previous employer, or they may not have had enough time to give the required information to their new employer before their first pay day.

The action needed will depend on whether the new employer has received a new tax code for the employee from HMRC:

If HMRC have sent you a tax code

Use the tax code that HMRC have sent you if your employee gives you a P45 or starter checklist after you’ve first paid them. Deduct any student loan repayments from the date your employee started with you

If HMRC haven’t sent you a tax code

Late P45

Use the employee’s P45 to work out their tax code and update their details in their employee record within BrightPay. If the employee left their last job after 5 April 2020, you should also update both the ‘Total pay to date’ and ‘Total tax to date’ fields within the Starter/ Leaver section of their employee record in BrightPay for the first pay period you included this information.

Late starter checklist

Use your employee’s starter checklist to update their starter declaration information within BrightPay.

When you next pay your employee

Don’t enter another start date on the Full Payment Submission (FPS), even if you haven’t reported a start date before.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.