Statutory Sick Pay (Normal Sick Leave)

Statutory Sick Pay (SSP) is paid to employees who are unable to work because of illness. SSP is paid at the same time and in the same way as you would pay wages for the same period.

As an employer you're responsible for paying SSP to employees who meet certain qualifying conditions.

You'll need to:

- determine whether an employee meets the qualifying conditions

- calculate how much SSP they're due

- pay the SSP to them

- keep a record of the SSP you pay

Employers may choose to opt out of fully operating the SSP Scheme in favour of their own Occupational Sick Pay scheme.

SSP Entitlements

Period of Incapacity To Work

SSP is only payable if there's a period of incapacity for work (PIW). This is a period of four or more days in a row when the employee can't work because they're sick or incapacitated.

The days that make up a PIW don't need to be working days. If an employee normally works from Monday to Friday and they're sick on Friday, Saturday, Sunday and Monday - then that's a PIW. Similarly if they only work Tuesdays and Fridays but are sick on both of these days and also sick on Wednesday and Thursday then a PIW exists.

Waiting Days

The first three qualifying days (days the employee normally works for you) of a PIW are called 'waiting days' and SSP isn't payable for these waiting days. SSP is payable from the first qualifying day after the three waiting days. However, if several PIWs are linked, the waiting days only apply to the first PIW.

Qualifying Days

These are the employee’s contractual or normal working days. SSP is paid for each qualifying day after the waiting days. You can however decide not to use the contracted working days if, for example, your workforce operates a varied work pattern each week but for simplicity you may want to have the same days each week as the QDs.

Calculating Average Weekly Earnings

The calculation of an employee’s average weekly earnings for SSP purposes simply determines if the employee is entitled to SSP and not how much. In order to qualify for SSP an employee must have weekly average earnings of at least the LEL for NIC, which is currently £120.00 per week.

The current weekly rate of SSP is £95.85

Recovery of Statutory Sick Pay (SSP)

The SSP reimbursement scheme known as the Percentage Threshold Scheme (PTS) was discontinued with effect from 06th April 2014.

Entering Statutory Sick Pay in BrightPay

To access this utility, simply click 'Payroll' and select the employee’s name on the left:

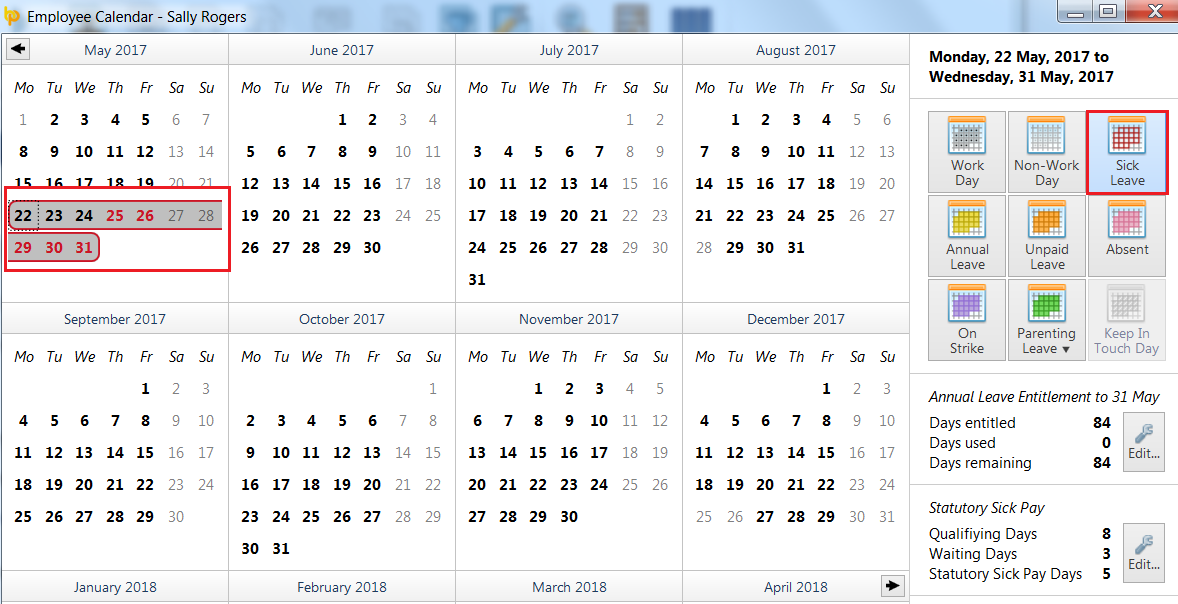

- Under Statutory Pay, click Calendar

- On the Calendar, select the date range the employee is out sick (include any non-working days which fall within the date range)

- Click Normal Sick Leave at the top right of the screen - the number of Qualifying Days, Waiting Days & SSP days will be displayed on the screen.

- Close the Calendar and the program will automatically apply any SSP due to the employee.

Overriding the 'Average Weekly Earnings' Calculation

If existing payment records have not been recorded in BrightPay or there is insufficient historical payroll data to determine the employee's AWE, the automatic calculation performed by the program after completing the above may be inaccurate or not possible. Where the user otherwise determines that the employee does qualify for SSP, they may override the AWE by doing the following:

- On the main Payroll screen, click the Edit icon in the employee’s Statutory Payments section

- In Sick Leave, select the option ‘Override average weekly earnings calculation’

- The program will now automatically calculate SSP

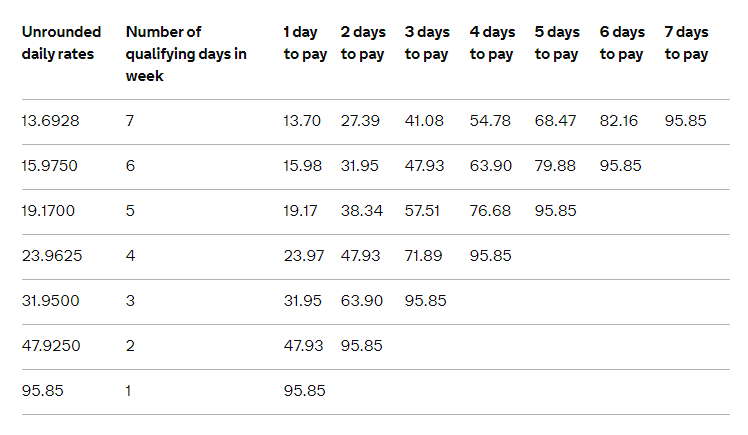

HMRC SSP Daily Tables for 2020-21

SSP & Finalised Pay Periods

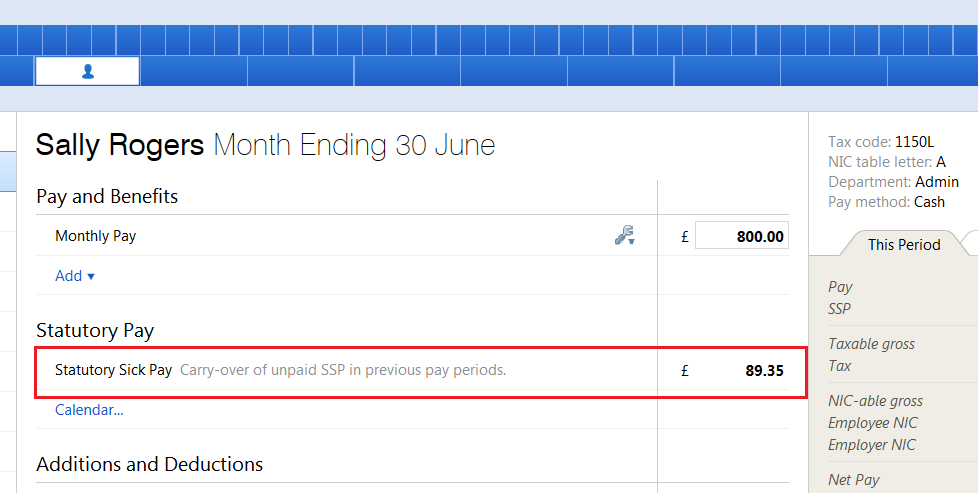

In the event that a payroll operator is notified of an employee's sick leave status after the pay period in which it falls has been finalised, BrightPay facilitates a retrospective adjustment to be made to the employee's calendar record which will simply pay or refund any SSP difference in the following (or later) pay period.

Examples of scenarios:

- An employer may only inform their payroll bureau in November that an employee was sick in October, but the October payroll has already been run and the employee paid.

- A company pays their employees on the 25th of every month for month ending the 31st of the month. An employee is out on sick leave at the pay date but continues to be sick up until the 31st of the month. These subsequent sick days may not have been accounted for in this pay period if there was uncertainty on whether the employee would be able to return to work after the 25th.

Making an SSP adjustment in BrightPay to already finalised pay periods:

- Click 'Payroll' and select the employee’s name on the left

- Select the employee's current open pay period

- Under Statutory Pay, click Calendar

- On the employee's Calendar, highlight or un-highlight the employee's sick days depending on the adjustment needed.

- Click Sick Leave at the right of the screen

- Close the Calendar to return to the employee's open payslip

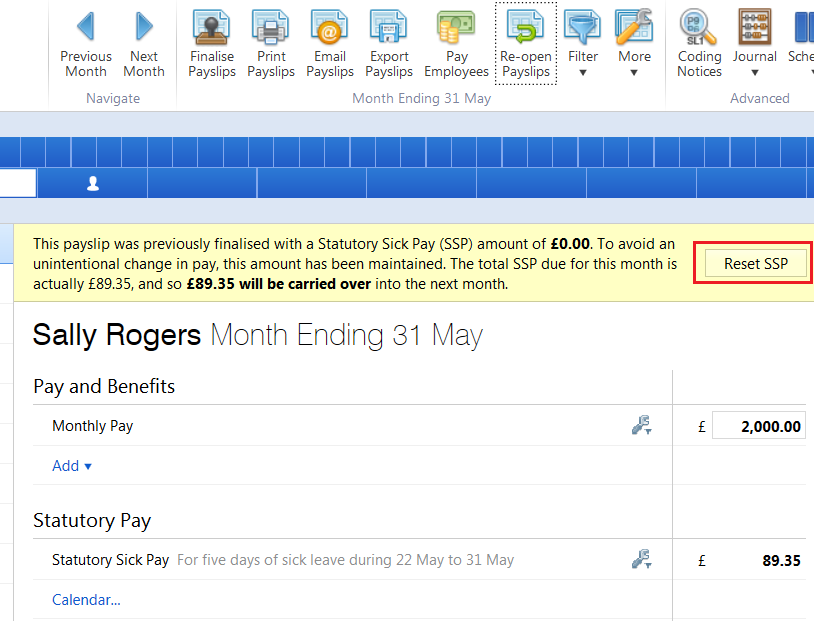

BrightPay will then compare the total SSP that should have been paid in previous pay periods against the total SSP that was actually paid in previous pay periods, and will calculate the difference. This difference will then be added to the employee's current open payslip as an SSP carry-over or refund amount.

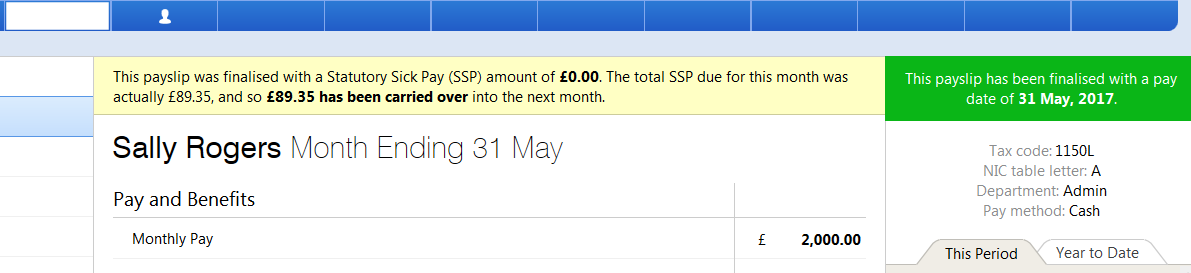

In addition, any previous payslips which has had some or all of its SSP carried forward to a future pay period will show a yellow alert explaining what has happened and will reference the amount carried forward.

In the event you don't wish the SSP amount to carry forward, but instead wish to re-open the previous payslip and apply the SSP to this:

- In Payroll, select the finalised payslip and click 'Re-open Payslips' on the menu toolbar

- If you wish to apply the SSP amount to this payslip, simply click 'Reset SSP'

SSP1 Form

In the event that an employee is not entitled to SSP or their SSP has come or is coming to an end, employers are to provide the employee with form SSP1.

Form SSP1 can be completed in BrightPay and subsequently printed, emailed or exported to PDF.

To complete form SSP1:

a) Within Employees, select the employee in question from the left hand listing

b) Click 'More' on the employee's menu bar, followed by 'SSP1...'

c) Complete the SSP1 form accordingly

d) Click Create/ Preview to view the completed form

e) Click Print, Email or Export PDF, as required.

Managing Sick Leave

Managing sick leave can be a challenge for every employer. It is essential that businesses find the balance between supporting those employees who are genuinely sick and minimising unnecessary absences in order to reduce costs.

Guidance for employers on how to manage sickness absences can be found here.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.