Student Loan Deductions

Student Loans are part of the Government's financial support package for students in higher education in the UK. They are available to help students meet their expenses while they are studying.

HMRC is responsible for collecting repayments of Income Contingent Student Loans in cases where the borrower is within the UK tax system and no longer in higher education.

Since 6 April 2016, two types of Student Loans are to repaid via deduction through payroll - Plan 1 and Plan 2 loans.

Plan 2 applies if you studied in England and Wales and started your studies on or after 1 September 2012. Otherwise Plan 1 repayments apply wherever you studied in the UK.

HMRC will notify an employer of when student loan deductions are to start for an employee via form SL1.

HMRC will notify an employer of when student loan deductions are to stop for an employee via form SL2.

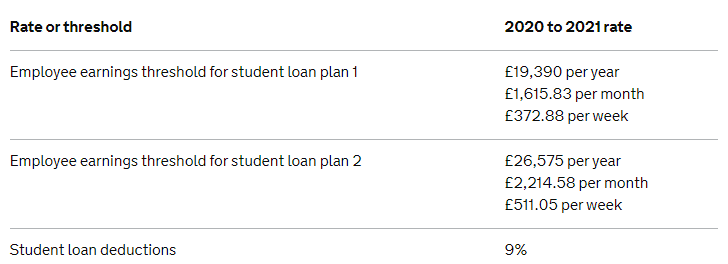

Thresholds for tax year 2020-21

Employer's Role

The employer is responsible for:

- making deductions of student loan repayments from an employee's earnings

- keeping records of the deductions made

- paying the deductions over to HMRC

- providing HMRC with details of the deductions within each FPS submission

- giving an employee details of their deductions on their payslips and P60 certificate

- on form P45, indicating if the student loan deduction should continue

Deductions

Once an employee's income goes over the relevant threshold, the employer will deduct 9% of their income that's over the threshold towards repaying their loan.

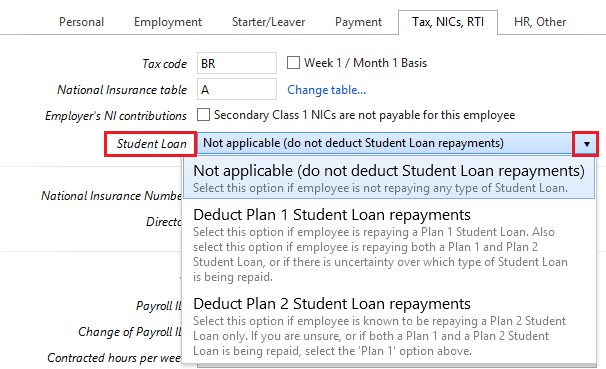

Applying Student Loan Deductions in BrightPay

To access this utility, simply go to ‘Employees’ and select the employee’s name on the left:

1) Click on the Tax/ NICs/RTI heading

2) Select the drop down arrow for "Student Loan" and choose the applicable Student Loan Plan

3) Enter a start date and stop date, if known

4) Click Save Changes

The payroll software will now automatically calculate and apply the appropriate student loan deduction as per the current Student Loan Deduction Tables.

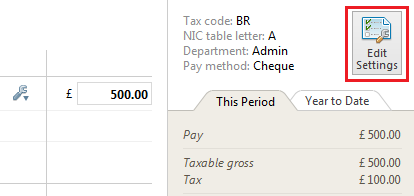

Quick Edit for Student Loan Deductions

A quick-edit facility for student loan deductions can also be found in ‘Payroll’:

1) Select the employee’s name from the listing

2) Click Edit Settings at the top right of the employee's payslip

3) Within Tax/NIC Details, select the applicable Student Loan Plan

4) Enter a start date and stop date, if known

5) Click Save

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.