Council Tax Attachment of Earnings Order (CTAEO)

What is a Council Tax Attachment of Earnings Order?

Where there is non-payment of council tax ,the local authority can apply to a magistrates' court for a liability order against the defaulter. If a court grants a liability order, an authority has a number of options for recovering the outstanding amount. One of these is a Council Tax AEO (CTAEO).

The CTAEO will be in a form prescribed in the regulations. It contains the name of the debtor, his payroll number (if known) and the local authority reference. It confirms that the named person is liable for council tax and specifies the amount of council tax that has still to be paid.

On receiving a CTAEO the employer must:

- seek to make deductions from the employee's net earnings under the CTAEO as soon as possible

- calculate the deductions using the tables in the regulations*

- tell the employee the total deductions made under the order, normally at the same time as his pay statement is issued

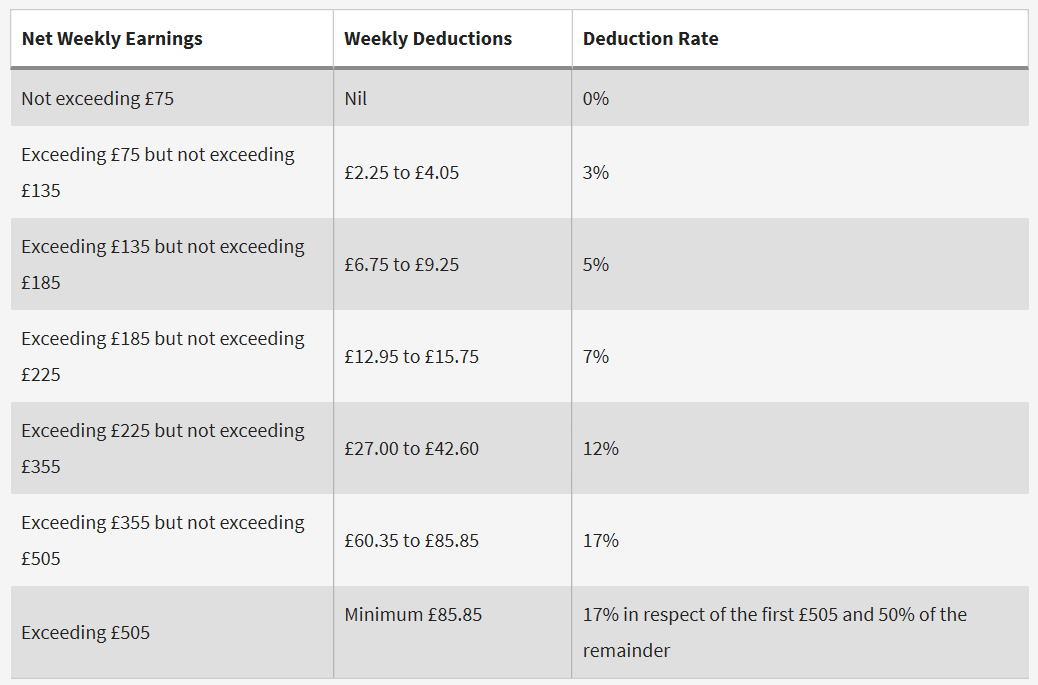

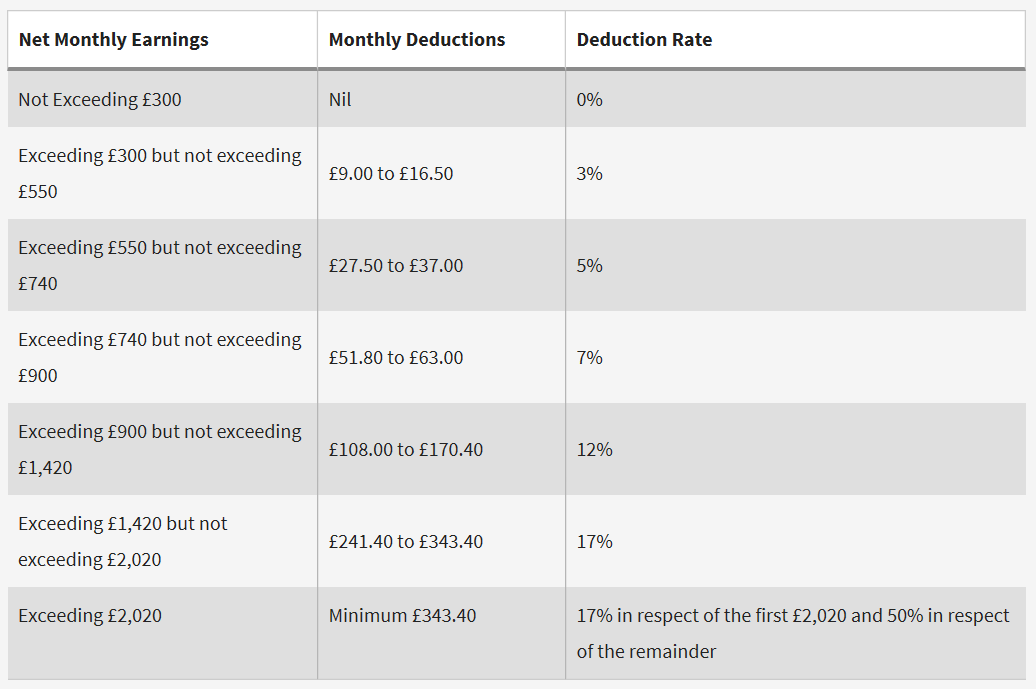

*BrightPay will automatically calculate the employee's periodic deduction based on the below tables:

Weekly Table:

Monthly Table:

Guidance for Employers

If you are an employer and have been contacted by the courts with an Attachment of Earnings instruction, an Attachment of Earnings Order Employer’s Guide is available at gov.uk should you require further assistance.

Admin Charge

Please note: you cannot deduct the admin charge of £1 if it takes your employee's income below the National Minimum Wage. It's a criminal offence for employers to not pay someone the National Minimum Wage or National Living Wage.

Employers should check The National Minimum Wage and Living Wage or contact the ACAS helpline for advice.

Attaching an Order to an Employee within BrightPay

1) Go to Payroll, and select the employee from the listing

2) Under Additions & Deductions, click the Add button

3) Select Attachment Orders…

4) Click ‘Add Attachment Order’ and select the appropriate Attachment Order from the listing.

Setting up the Order in BrightPay

Type and Dates

1) Enter a description for the Attachment Order.

2) Enter the reference number of the Attachment Order, which can be found on the documentation received.

3) Enter the date the Order was made.

4) Enter the date to apply the Order from.

5) Enter the date to stop – the Order should only be stopped once the full amount of the Order has been paid or you have received notification from the Courts to stop it.

Amount and Status

1) Priority – tick the box provided if the Order is a priority order.

2) Admin Charge – tick the box provided if you, the employer, wish to deduct £1 as an administration charge for operating the Order.

3) Enter the total amount to be paid.

4) Cumulative amount paid at start - if the employee has already paid some of the attachment (for example in a previous employment) enter the amount here.

5) Enter any Year to Date deductions, if applicable

6) Click Save.

Notes

Use the Notes section to enter any relevant notes relating to the employee's attachment order

BrightPay will now apply the Attachment Order on the employee’s payslip from the relevant period.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.