CIS - VAT Domestic Reverse Charge

The Domestic Reverse VAT Charge for Building and Construction Services (DRC) came into effect on 1st March 2021.

The aim of the measure is to reduce VAT fraud in the construction sector. In brief, it represents a significant change to the way that VAT is collected within the construction industry, in that VAT-registered subcontractors supplying construction services to VAT-registered contractors will no longer charge VAT for services supplied. Instead, the main contractor will be responsible for paying the VAT over to HMRC on the subcontractor's behalf.

For the reverse charge to apply, the following is a summary of the key conditions that are to be met:

- The supply for VAT consists of construction services and materials (click here for HMRC's listing of qualifying services)

- It is made at a standard or reduced-rate of VAT.

- It is between a UK VAT registered supplier and UK VAT registered customer.

- Both the supplier and customer are registered for CIS.

- The customer intends to make an ongoing supply of construction services to another party.

- The supplier and customer are not connected.

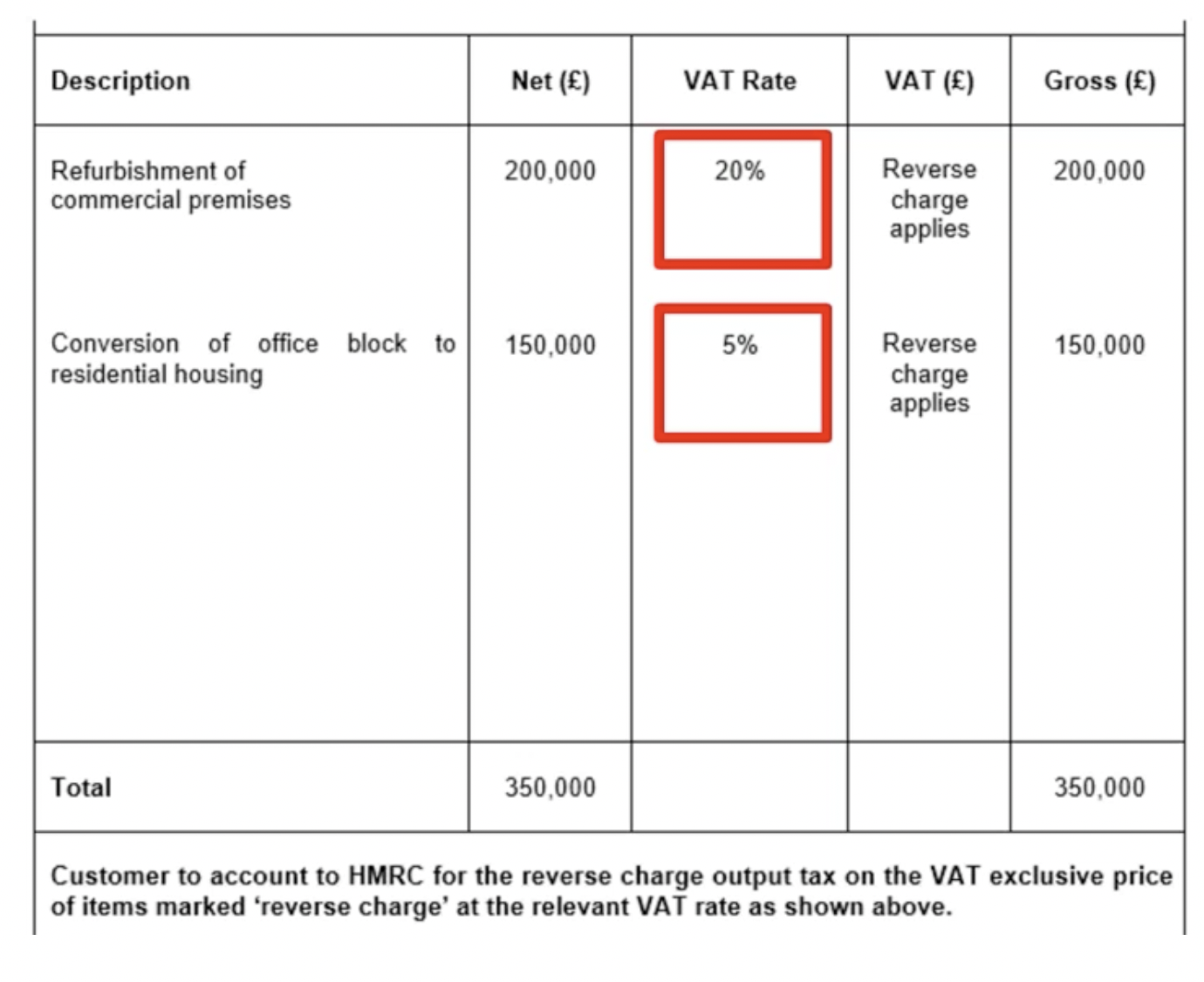

When supplying a service subject to the domestic reverse charge, subcontractors must issue an invoice which:

- shows all the information normally required on a VAT invoice

- makes clear that the domestic reverse charge applies and that the customer is required to account for the VAT

- clearly states how much VAT is due under the reverse charge, or the rate of VAT if the VAT amount cannot be shown, but the VAT should not be included in the amount charged to the customer

HMRC provide the following example:

Comprehensive HMRC guidance on the operation of the domestic reverse charge can be found here. We recommend fully familiarising yourself with this guidance if you are uncertain of whether the domestic reverse charge is to apply.

Reverse Charge & BrightPay

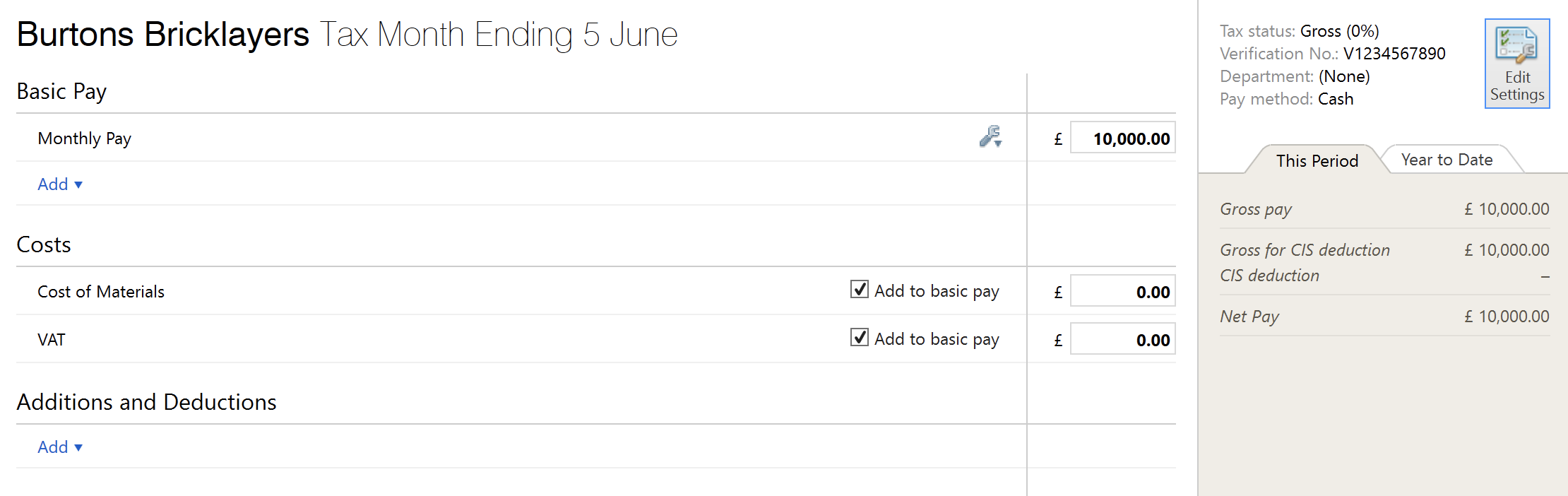

On receipt of a subcontractor invoice to which the domestic reverse charge applies, the contractor will not be required to enter any VAT amount through the CIS utility in BrightPay when processing the payment for the subcontractor.

The contractor will simply pay the subcontractor the amount due to them NET of any VAT and after any relevant CIS deduction has been taken into account.

The contractor is then responsible for recording the reverse charge on their VAT return to HMRC (click here for HMRC guidance on this).

Example:

- Burton's Bricklayers invoices ABC Contractors for £10,000 for construction services supplied, to which a domestic reverse charge at a VAT rate of 20% applies.

- Burton's Bricklayers are verified with a gross payment status of 0%.

- ABC Contractors pays Burton's Bricklayers the net amount of £10,000.

- ABC Contractors then accounts for the output and input VAT of £2,000 on the supply on its own VAT return.

- Burton's Bricklayers does not account for any output VAT in their accounting system as they have only been paid the net amount of £10,000.

To aid completion of the necessary entries subsequently required in your accounting software and in turn the associated VAT return, you may wish to utilise the notes section on the subcontractor's payment screen to indicate when the reverse charge applies, as per the following example:

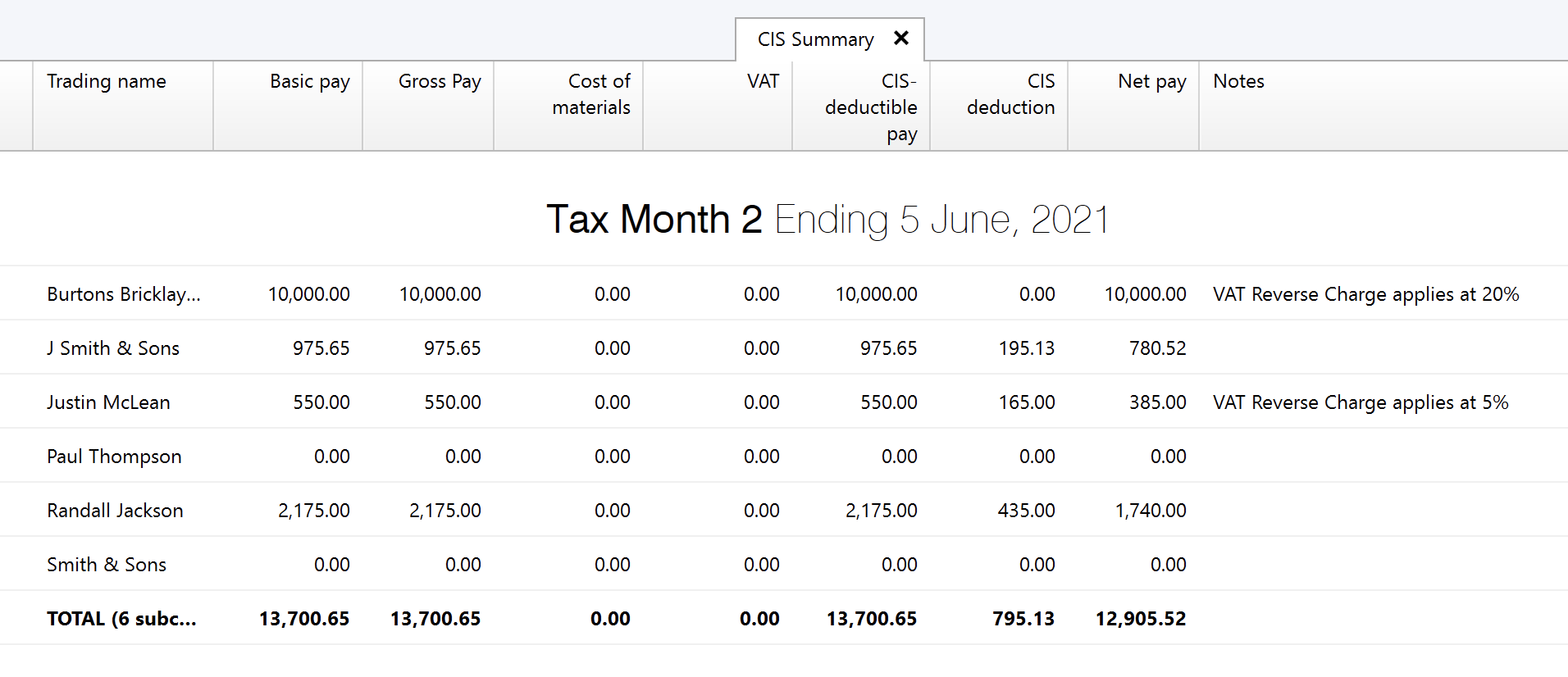

A CIS report can then be generated within 'Analysis' to include the 'Notes' column:

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.