Updating Existing Subcontractor Details from a CSV File

20-21 BrightPay provides the option to import updates for existing subcontractors using CSV file.

This is a useful feature for users wishing to import, for example, address changes, rate changes, update bank details, etc.

To access this utility, go to 'File' > 'Import/Export Data' > 'Import/Update Subcontractors from a CSV File'.

1) Browse to the location of your Subcontractor CSV File

2) Select the required file and click 'Open'

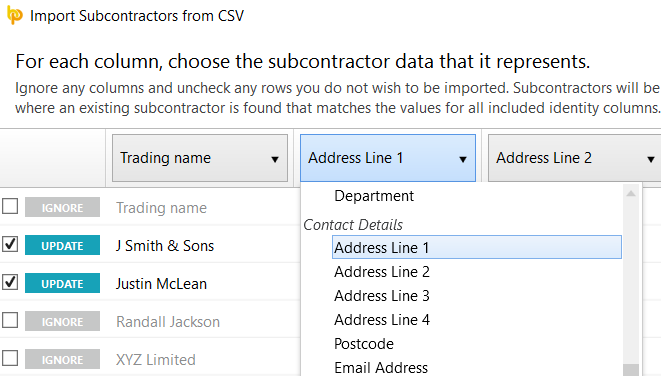

3) Your subcontractor information will be displayed on screen. For each column, choose the subcontractor data it represents. Ignore any columns and uncheck any rows you do not wish to be imported

Important Note:

In order for BrightPay to match row data against existing subcontractors, it will use the 'identity columns'. These 'identity columns' are

- Trading Name

- Unique Tax Reference (UTR)

At least one of the above columns must be selected by the user to trigger a match attempt. Rows will be deemed to match only if the values for all selected identity columns equal those for the subcontractors.

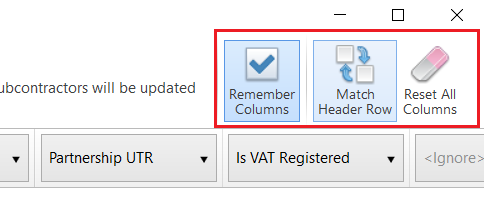

- To assist with column selection, simply select 'Match Header Row'. BrightPay will try and match as many columns as it can for you.

- Should you have subcontractor CSV files to import for more than one company e.g. you are moving a number of companies across from a previous software, simply instruct BrightPay to 'Remember Columns'. BrightPay will subsequently remember the column selection used in the previous import when next importing a new subcontractor CSV file.

- Should you wish to reset your column selection at any time, 'Reset All Columns'.

4) Click 'Import' to complete the update of your subcontractor information.

Points to Note

- Invalid updates will be prevented.

- Where the subcontractor has a currently open pay period, relevant updates will be applied to that period and going forward (e.g department changes)

- This utility cannot be used to change subcontractor data that is classed as an 'identity column' i.e. trading name or Unique Tax Reference.

Subcontractor data which can be imported in to update existing subcontractor records are:

Identity:

Trading Name

Unique Tax Reference (UTR)

Subcontractor Details:

Business Type

Person's first name (sole trader/ partner)

Person's middle name (sole trader/ partner)

Person's surname (sole trader/ partner)

National Insurance number (NINO

Company name

Company registration number (CRN)

Partnership name

Partnership UTR

Is VAT Registered

VAT registration number (VRN)

Tax payment status

Verification number

Verification date

Daily pay rate

Hourly pay rate

Works number

Department

Contact Details:

Address Line 1

Address Line 2

Address Line 3

Address Line 4

Postcode

Email Address

Phone Number

Payment:

Payment frequency

Payment method

Payment bank name

Payment bank branch

Payment sort code

Payment bank account name

Payment bank account number

Payment bank reference

HR:

Document password

Notes

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.