Processing Covid-19 related SSP in BrightPay

Please note: the Coronavirus Statutory Sick Pay Rebate Scheme will close on 17th March 2022. Claims can be submitted up until 24th March 2022.

From 25th March 2022, entitlement to receive SSP from day one for Covid-related absences will come to an end. BrightPay users should select the normal SSP option when recording any sickness-related absences, regardless of whether or not it is COVID-19 related.

Processing Covid-19 related Statutory Sick Pay in 21-22 BrightPay

21-22 BrightPay has been programmed to automate Covid-19 related SSP, where this is to apply.

1. Click 'Payroll' and select the employee’s name on the left

2. Under Statutory Pay, click Calendar

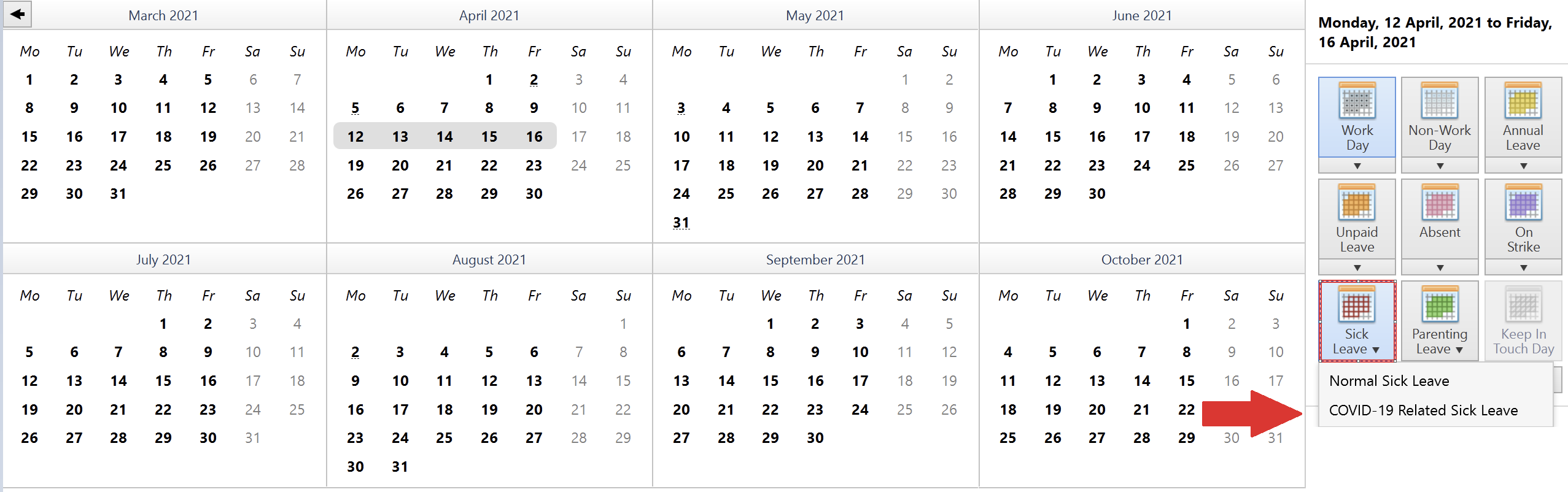

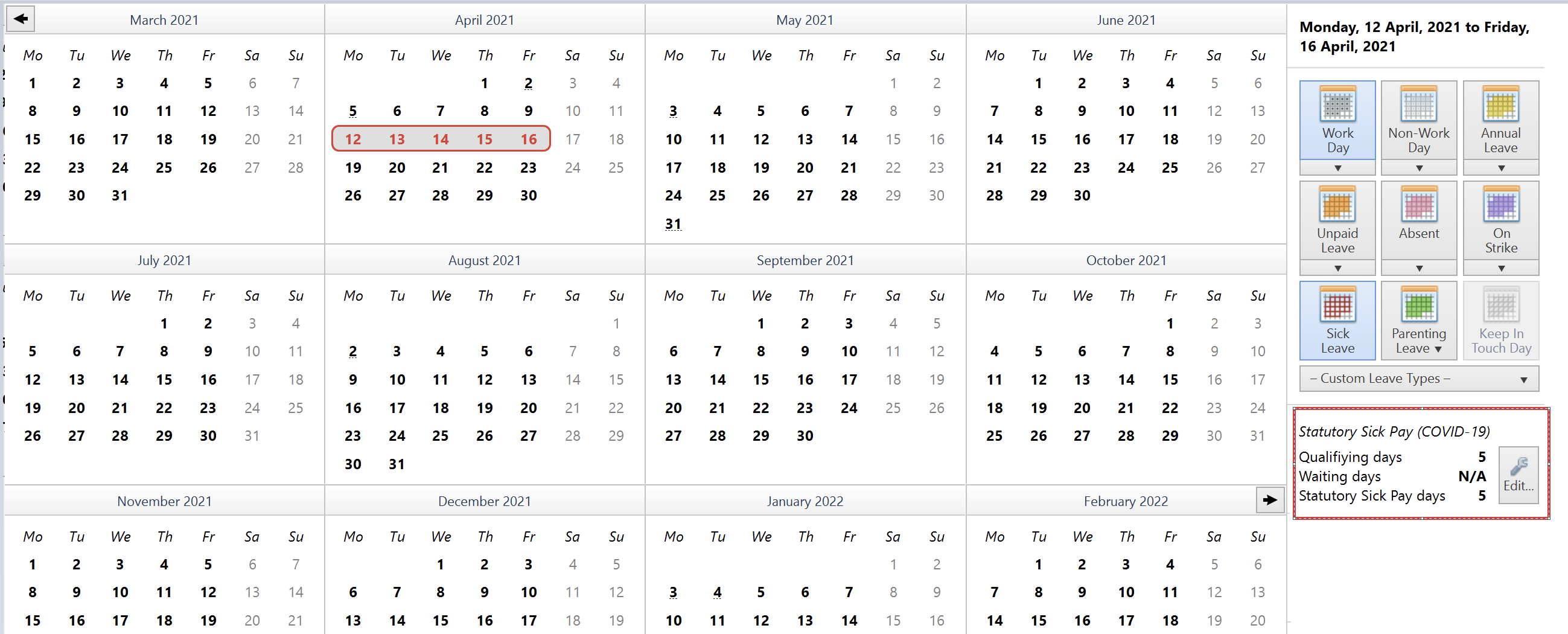

3. On the Calendar, select the date range the employee is out on sick leave

4. Click Sick Leave from the options on the right of the screen and choose 'COVID-19 Related Sick Leave'

The number of Qualifying Days & SSP days will be displayed on the screen:

5. Close the Calendar and the program will automatically apply any SSP due to the employee.

Overriding the 'Average Weekly Earnings' Calculation

If existing payment records have not been recorded in BrightPay or there is insufficient historical payroll data to determine the employee's AWE, the automatic calculation performed by the program after completing the above may be inaccurate or not possible. You may override the AWE by doing the following:

1 On the main Payroll screen, click the Edit icon in the employee’s Statutory Payments section

2 In Sick Leave, select the option ‘Override average weekly earnings calculation’

3 The program will now automatically calculate SSP

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.