Importing from Moneysoft - direct import (mid year)

BrightPay provides a quick and seamless import utility to bring across your company and employee details from Moneysoft mid tax year.

Please note: this import utility will import basic employer, employee and subcontractor information.

For a more comprehensive import option for a mid-year migration to BrightPay, please see the support section on 'Importing from Moneysoft using a CSV file (mid year)'.

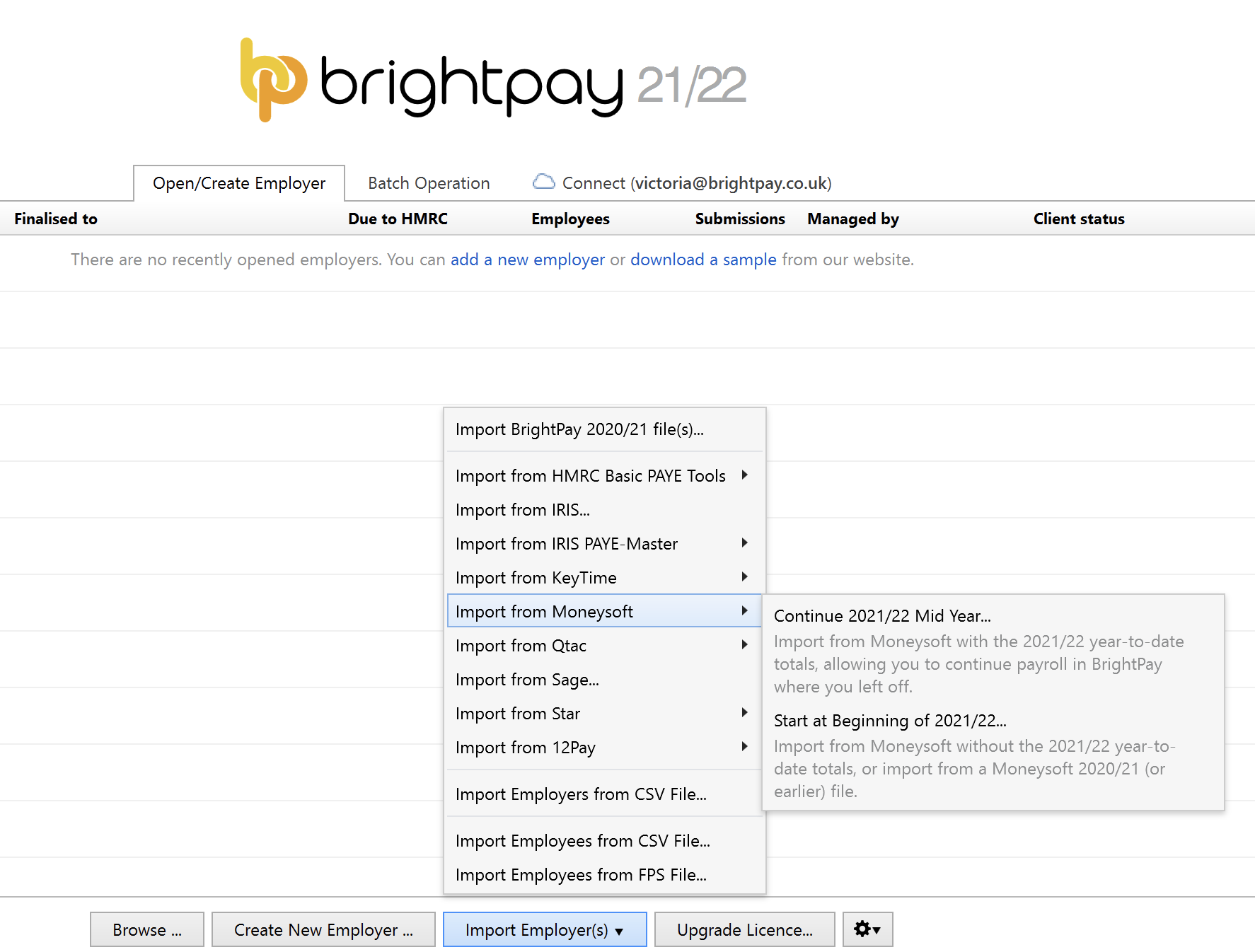

- To begin the import, simply click on the ‘Import Employer’ button at the bottom of the ‘Open Employer’ screen and select 'Import from Moneysoft > Continue 2021/22 Mid Year...'

- Read the message carefully and press Continue

- Browse to the location of your Moneysoft company file. The default location is typically 'My Documents > Payroll'.

- The file to select will be titled 'yourcompanyname 2021-22.pay'. Click 'Open' to begin the import.

- Once the import process is completed, simply open your new BrightPay company file to commence payroll.

Following the import, further employee information can be manually entered within 'Employees', if required. Alternatively you may wish to update missing employee information using CSV file.

It is also recommended that all employee details are reviewed before processing any payroll to ensure information imported in is correct and applicable for the tax year in question e.g. employee tax codes etc.

After reviewing your employee information, simply click the 'Payroll' tab to commence processing payroll.

Please note: if you have difficulty locating your Moneysoft file for importing into BrightPay, please contact our Migration Support team for assistance with at migration@brightpay.co.uk

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.