Statutory Shared Parental Pay (Birth)

Employees may be entitled to Shared Parental Leave (SPL) and Statutory Shared Parental Pay (ShPP), SPL and ShPP must be taken between the baby’s birth and first birthday.

An employee can start SPL if they are eligible and they or their partner end their maternity pay (or Maternity Allowance) early.

The remaining leave will then be available as SPL and the remaining weeks of pay will be available as ShPP.

An employee can share the leave with their partner if they’re also eligible for SPL, and can choose how much of the leave each of them will take.

Example

A mother and her partner are both eligible for SPL. The mother ends her maternity leave after 12 weeks, leaving 40 weeks (of the total 52 week entitlement) available for SPL. She takes 30 weeks and her partner takes the other 10 weeks.

SPL also lets an employee decide a flexible pattern of leave with their employer. Employees have the right to take SPL in up to 3 separate blocks but an employer can agree to more.

Eligibility

Sometimes only one parent in a couple will be eligible to get Shared Parental Leave (SPL) and Statutory Shared Parental Pay (ShPP). This means that they can’t share the leave.

If an employee is eligible then they can use SPL to book their leave in separate blocks.

To qualify for SPL, the child’s mother must be eligible for either:

- Maternity Leave or Pay

- Maternity Allowance

Your employee must also:

- have worked for you continuously for at least 26 weeks by the end of the 15th week before the due date

- still be employed by you while they take SPL

- give you the correct notice including a declaration that their partner meets the employment and income requirements which allow your employee to get SPL

Statutory Shared Parental Pay

Your employee can get ShPP if one of the following applies:

- they qualify for Statutory Maternity Pay

- they qualify for Statutory Paternity Pay and have a partner who qualifies for Statutory Maternity Pay or Maternity Allowance

Entitlement

If an employee is eligible and they or their partner end their maternity pay (or Maternity Allowance) early, then they can:

-

take the rest of the 52 weeks of leave (up to a maximum of 50 weeks) as Shared Parental Leave (SPL)

-

take the rest of the 39 weeks of pay (up to a maximum of 37 weeks) as Statutory Shared Parental Pay (ShPP)

A mother must take a minimum of 2 weeks’ maternity leave following the birth (4 if she works in a factory).

For tax year 2021/22, ShPP is paid at the rate of £151.97 a week or 90% of an employee’s average weekly earnings, whichever is lower.

Starting Shared Parental Leave

For Shared Parental Leave (SPL) to start, the mother must do one of the following:

- end their maternity leave by returning to work

- give you ‘binding notice’ (a decision that can’t normally be changed) of the date when they’ll end their maternity leave

- end maternity pay or Maternity Allowance (if they’re not entitled to maternity leave, e.g. they’re an agency worker or self-employed)

A mother can’t return to work before the end of the compulsory 2 weeks of maternity leave following the birth (4 if she works in a factory)

The mother must give their employer notice (at least 8 weeks) to end her maternity pay.

SPL can start for the partner while the mother is still on maternity leave if she’s given binding notice to end her leave (or pay if she’s not entitled to leave). This is different to Additional Paternity Pay and Leave.

Example

A mother and her partner are both eligible for SPL.

The mother goes on maternity leave 10 weeks before her baby is born. She decides that she’ll take 16 weeks of maternity leave and gives her employer notice.

Since the mother has given binding notice, her partner can start SPL as soon as the baby has been born (as long as they’ve given at least 8 weeks’ notice).

What the employee must do

The employee must give their employer written notice of their entitlement to SPL and ShPP, including:

- their partner’s name

- maternity leave start and end dates

- the total amount of SPL and ShPP available and how much they and their partner intend to take

- that they’re sharing childcare responsibility with their partner

It must also include a signed declaration from the partner stating:

- their name, address and National Insurance number

- that they satisfy the qualifying requirements for your employee to take SPL and ShPP

- that they agree to your employee taking SPL and ShPP

Notice period

An employee must give at least 8 weeks’ notice of any leave they wish to take. If the child is born more than 8 weeks early, this notice period can be shorter.

Your employee has a statutory right to a maximum of 3 separate blocks of leave, although you can allow more if you wish.

Shared parental leave in touch (SPLIT) days

Your employee can work up to 20 days during SPL without bringing it to an end. These are called ‘shared parental leave in touch’ (or SPLIT) days.

These days are in addition to the 10 ‘keeping in touch’ (or KIT) days already available to those on maternity leave.

Blocks of leave

An employee taking Shared Parental Leave (SPL) can split their leave into up to 3 separate blocks instead of taking it all in one go, even if they aren’t sharing the leave with their partner.

If both parents are taking SPL then they can take their leave at the same time as each other or at different times.

The employee must give you at least 8 weeks’ notice before a block of leave begins.

Splitting blocks

If you agree, the employee can split a block of leave into shorter periods of at least a week. For example they could work every other week during a 12-week block, using a total of 6 weeks of their SPL.

You can’t turn down a request for a block of leave if the employee is eligible and gives you the right notice. You don’t have to agree to the employee breaking the block of leave into shorter periods.

Calculating ShPP in BrightPay

To access this utility, simply click 'Payroll' and select the employee’s name on the left:

- Under Statutory Pay, click Calendar

- On the Calendar, click on the date on which the SPL will start

- Select Shared Parental Leave from the Parenting Leave section at the top right of the screen

Leave Details

- Within the 'Leave Details' section, enter all relevant information and dates accordingly. (This only needs to be done once)

Blocks of Leave

- Within the 'Blocks of Leave' section, record each block of leave accordingly. Once ShPP payments for any given block have started, they will no longer be changeable.

Partner's Details

- Under 'Partner's Details', enter the partner's name and national insurance number.

Average Weekly Earnings

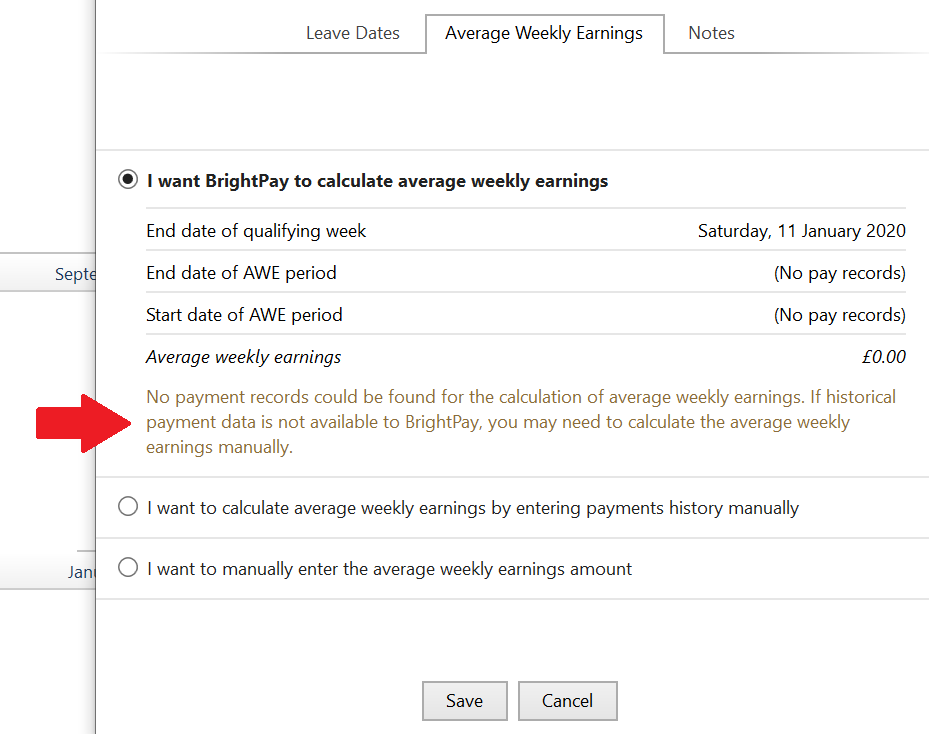

Within the Average Weekly Earnings section, BrightPay will now offer you three ways of establishing the employee’s average weekly earnings for the purpose of calculating ShPP due.

- I want BrightPay to calculate the average weekly earnings (AWE) - with this option, BrightPay will attempt to automatically calculate the employee's AWE. Where a calculation is possible, full details of the calculation will be displayed. Where the software detects any potential issues with the calculation (e.g. no payment history, more/fewer earnings than expected, unsupported pay schedule) a warning will be given to the user:

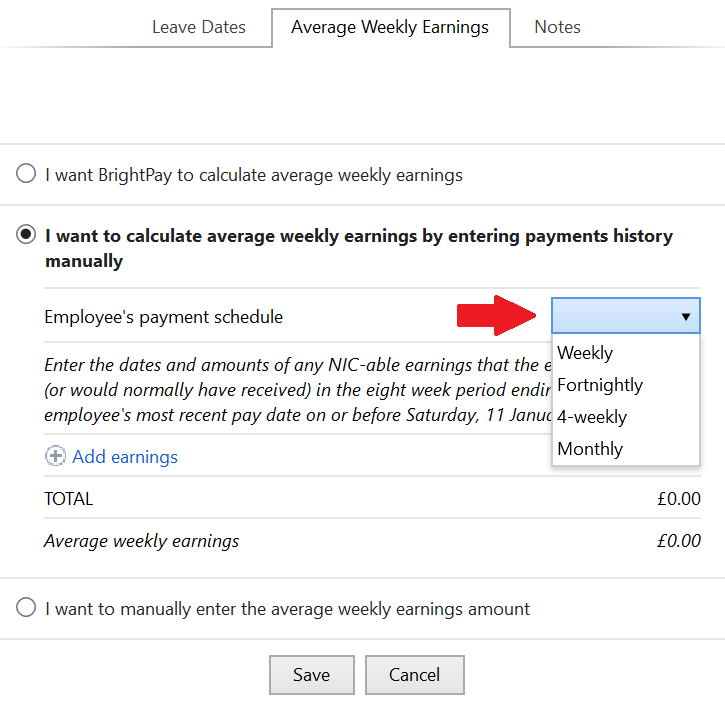

- I want to calculate average weekly earnings by entering payments history manually - where BrightPay is unable to calculate the employee's AWE automatically (e.g. where a different software was used previously and historical pay data is not available to BrightPay), this option allows users to enter the dates and amounts of the employee's earnings history manually, which BrightPay will then use to calculate the employee's AWE.

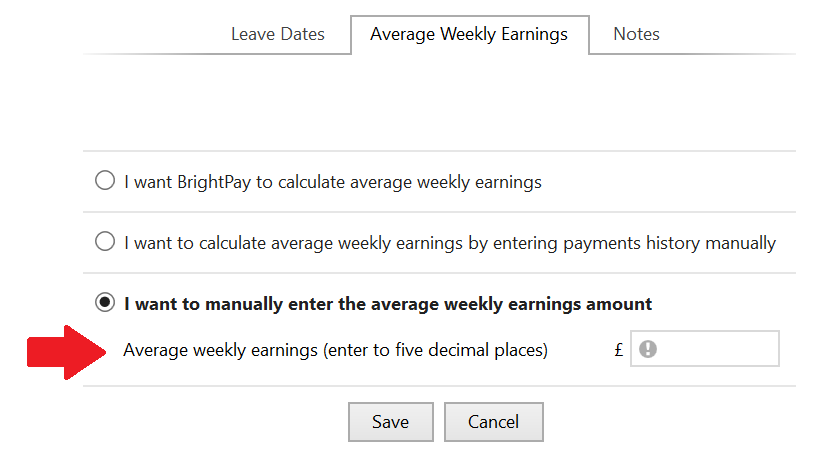

- I want to manually enter the average weekly earnings amount - the user can at their discretion use this option instead to enter the employee’s average weekly earnings figure, where this is known.

Notes

Use the Notes section to enter any relevant notes relating to the employee's parenting leave.

Click 'Save' when the parenting leave details are completed. The program will automatically update the calendar accordingly and apply the ShPP due.

Recording SPLIT days in BrightPay

An employee can work up to 20 days during SPL without bringing it to an end. These are called ‘shared parental leave in touch’ (or SPLIT) days.

These days are in addition to the 10 ‘keeping in touch’ (or KIT) days already available to those on maternity leave.

To record SPLIT Days in BrightPay:

1. Under Employees, select the employee from the listing and click their Calendar tab.

2. On the Calendar, select the date of the SPLIT day and click 'SPLIT Day' on the right hand side

3. Repeat if further SPLIT Days are taken

As soon as the number of SPLIT Days recorded in the employee's calendar exceeds 20 days, BrightPay will notify you in the relevant pay period that the employee is no longer entitled to ShPP due to having taken their 21st (or higher) SPLIT day.

How BrightPay calculates ShPP

BrightPay uses the full statutory week method when calculating & applying ShPP.

Monthly Payroll Example:

Shared Parental Leave begins on a Wednesday. Therefore the last day of the ShPP week will be a Tuesday.

ShPP will thus begin in the pay period in which the first Tuesday of the shared parental leave falls.

BrightPay will then establish how many Tuesdays fall in the pay period and apply the weekly ShPP rate to the number of Tuesdays there are.

Weekly Payroll Example:

Shared Parental Leave begins on a Wednesday. Therefore the last day of the ShPP week will be a Tuesday.

ShPP will thus begin in the weekly pay period in which the first Tuesday of the shared parental leave falls.

Shared Parental Leave Template Letters and Forms

The statutory notification process for Shared Parental Leave is quite specific, requiring the parents to provide specific information to their employer within specific time periods.

A set of template letters and forms are available here to assist employers guide their employees through the Shared Parental Leave process.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.