Employer Notifications

Notification emails can be sent from Connect to an employer to advise when payslips are finalised and can be viewed on the Employer's portal in Connect and to remind the employer when the payment for liabilities to HMRC are due.

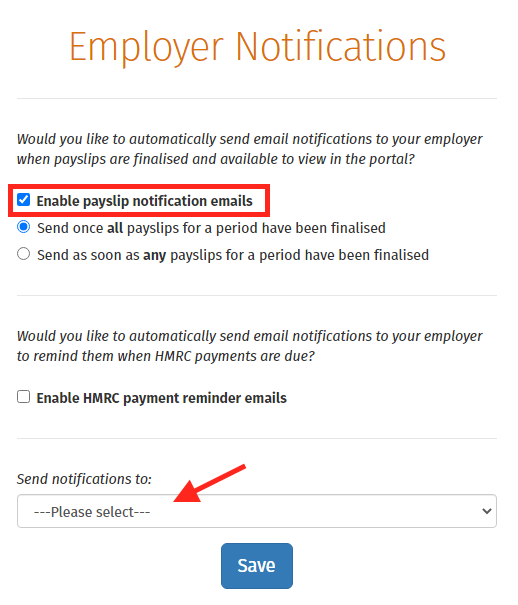

Payslip Notification Email for Employer

1) Within the Employer Portal, select Settings on the menu bar and select 'Employer Notifications'.

2) Select whether you would like to have a notification email to send to the employer when the payslips are finalised and are available to view in Connect.

3) The options for the notification email to send when 'all' payslips for a pay period are finalised or as soon as 'any' payslips for a pay period are finalised.

4) Select the user in the dropdown menu that you wish the notifications to send to and select Save.

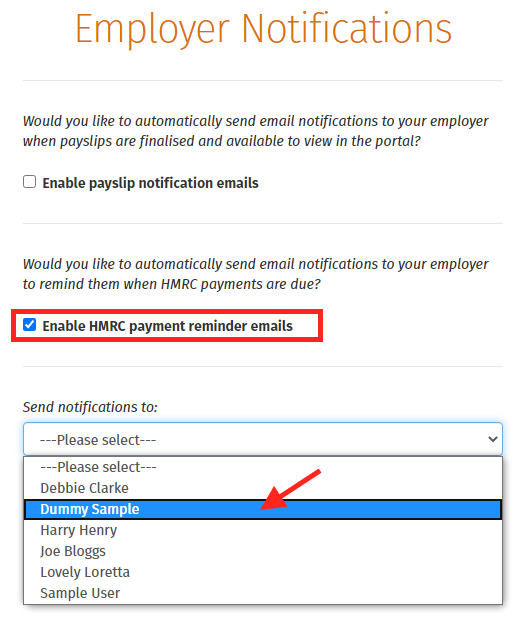

HMRC Payment Reminder Notifications

1) Within the Employer Portal, select Settings on the menu bar and select 'Employer Notifications'.

2) Select whether you would like to have a notification email to send to the employer to remind the employer when the HMRC Payments are due. The notification email will automatically be sent on the 15th of the tax month when the payment is due.

3) Select the user in the dropdown menu that you wish the notifications to send to and select Save.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.