Inviting Employees to use Self Service

BrightPay Connect provides a web-based portal where employees can view/ download their payslips and other payroll documents, view their calendar, request annual leave and view/ edit their personal details.

As soon as you have enabled Self Service access for employees (for assistance with this click here), you must send invitation emails to those employees to notify them that they now have access to their Self Service portal.

Sending Self Service Invitation Emails

1) Log in to your BrightPay Connect account and access the employer in question within 'Employers'.

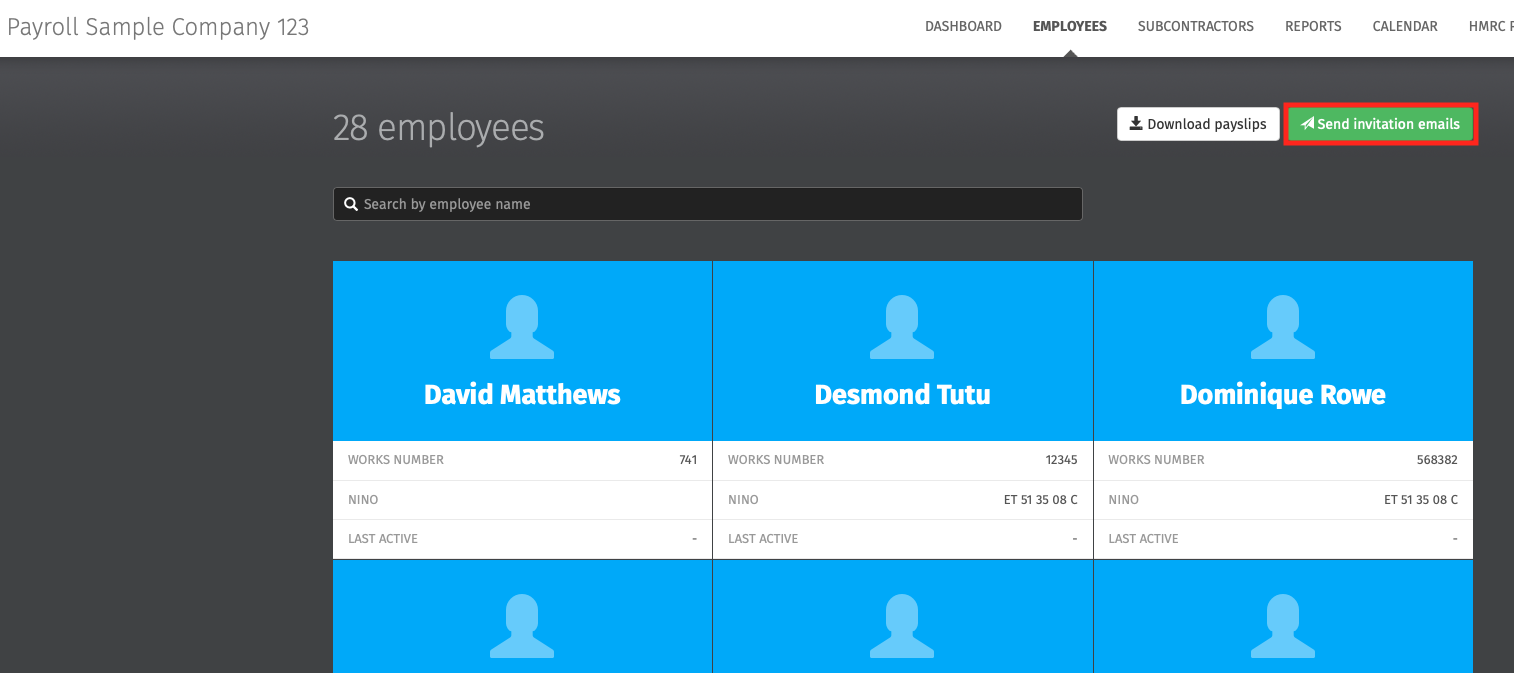

2) Click 'Employees' - here you will find the employees that are within the BrightPay employer file that has been connected to BrightPay Connect.

3) At the top right of the screen, click 'Send Invitation Emails'.

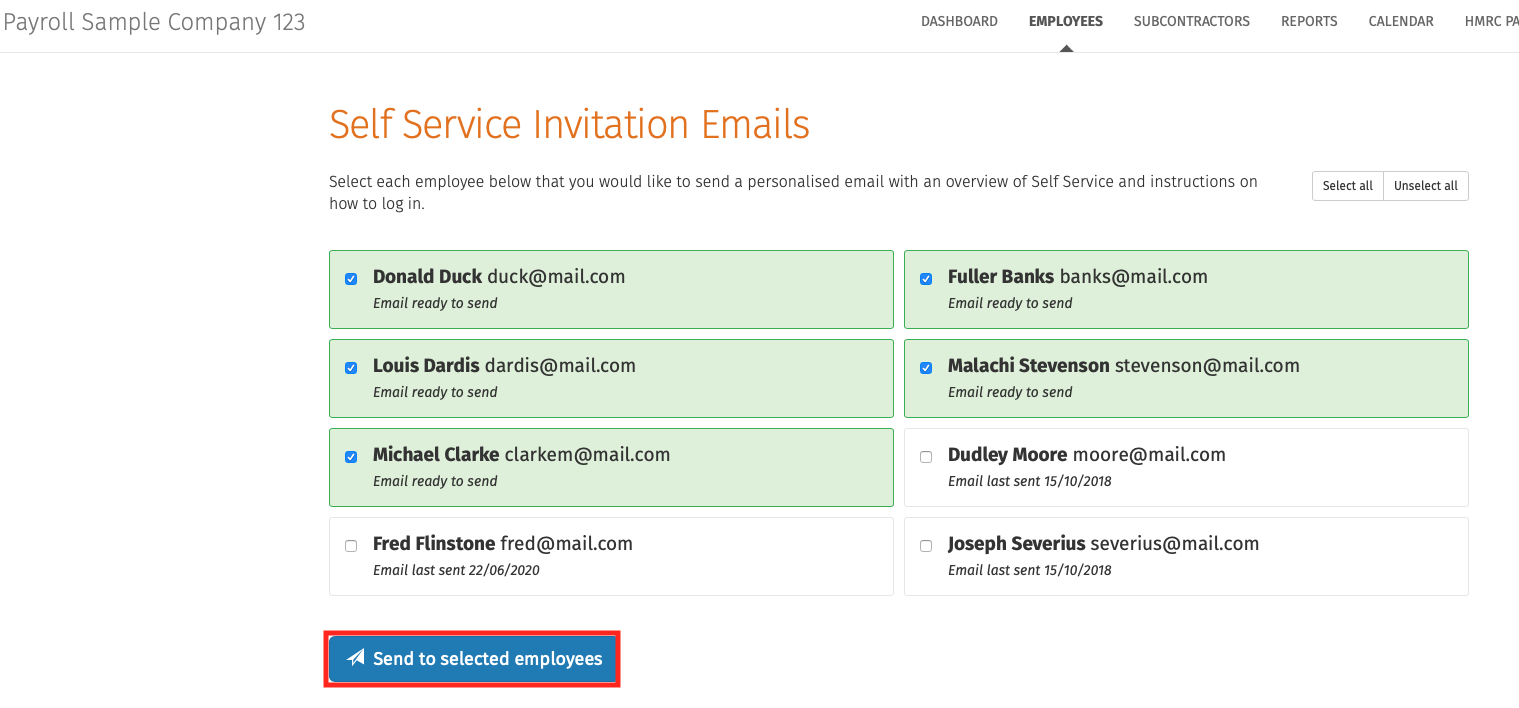

4) Select each employee that you would like to send a personalised email to with an overview of Self Service and instructions on how to log in.

Please note: employees for whom self service has not been enabled will not be available for selection.

5) Click 'Send to Selected Employees' when ready and click 'OK'.

All employees selected will be sent a welcome email containing instructions on how they can log in to their own self service portal.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.