Generating Employee Works Numbers

Employee works numbers can either be entered manually or the software can be instructed to automatically generate these for you.

Manual Entry of Works Numbers

To enter a works number manually, within 'Employees':

- choose the employee from the left-hand listing to access their employee record

- enter their works number within their 'Employment' section

- Save changes

Auto-Generation of Works Numbers

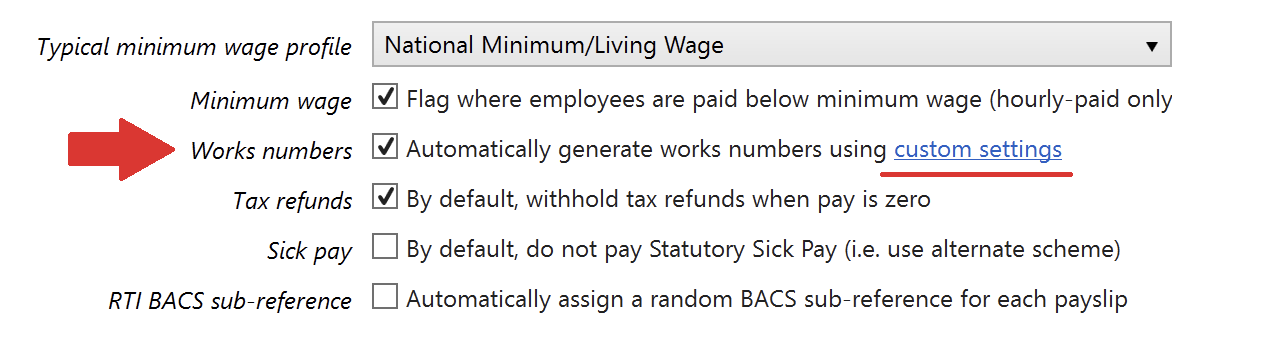

Should you wish the software to automatically generate works numbers for you using your own custom settings, this option can be set up within Employer > Edit Details > Typical Employee:

- Tick the box to indicate you wish the software to automatically generate works numbers for you

- Click the 'custom settings' link

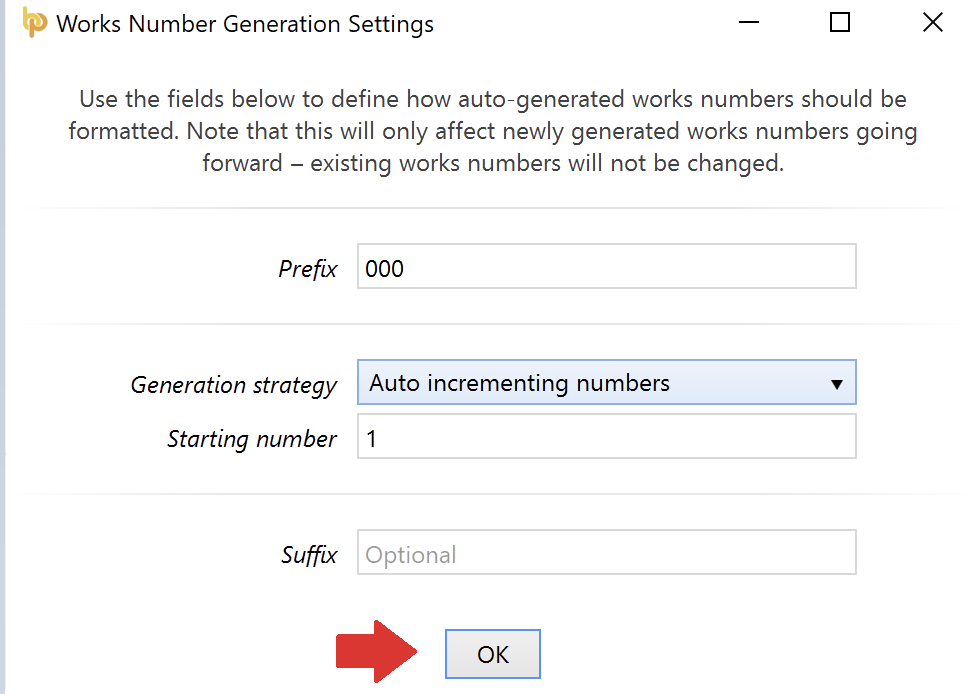

- Use the fields provided to define how your auto-generated works numbers should be formatted:

- Click 'OK', followed by 'Save Changes'

The next employee record you set up in the software will now see the auto-generation settings applied:

Please note: on customising your settings, these will only affect newly generated works numbers going forward - existing works numbers will not be changed.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.