Importing from SAGE 50 Payroll - using a CSV File (start of year)

BrightPay facilitates the importing of employee information in CSV format from SAGE 50 Payroll.

A CSV import of both employee and their mid-year pay information can be performed in BrightPay at any point in the tax year.

Importing into BrightPay at the Start of the Tax Year

Apologies for the poor representation of Sage screens below. We were asked by Sage to desist from using actual screen shots.

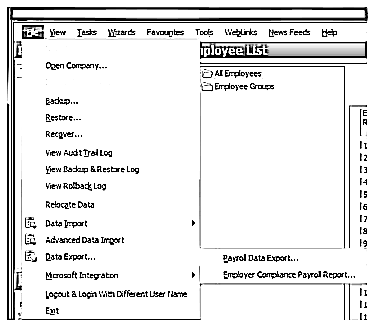

1a) First export your CSV file containing your employee information from within your SAGE 50 Payroll software.

Within SAGE 50 Payroll, go to 'File > Data Export > Payroll Data Export':

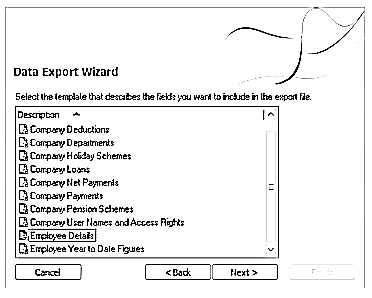

1b) Select Employee Details and click 'Next'

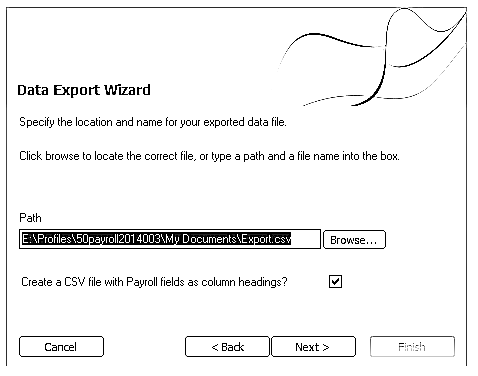

1c) Select the location where you would like to save your file to using the 'Browse' button - click 'Next' when ready.

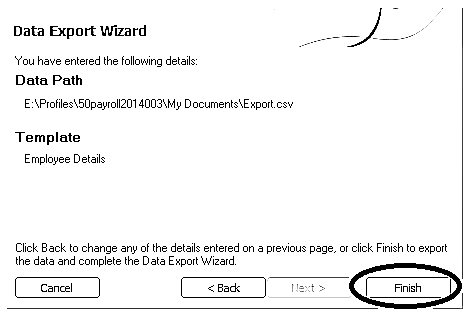

1d) Click 'Finish'

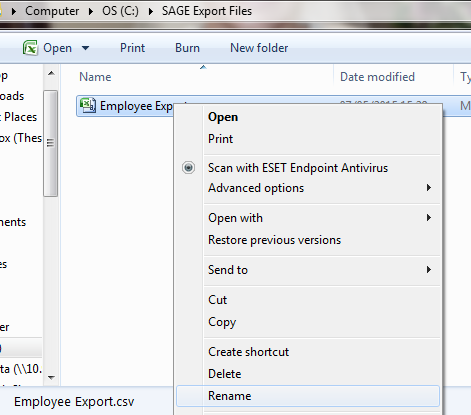

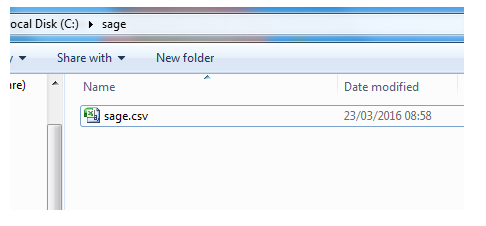

1e) Now go to the location where you have saved your CSV file to and change the name of the file to 'sage.csv'. This can be done by right-clicking on the file name and selecting 'Rename'.

By doing this, BrightPay will be able to recognise that you are importing from SAGE 50 Payroll.

Important note: Do not open the CSV file, as Excel will format items such as sort code and account numbers and they may no longer be importable into BrightPay.

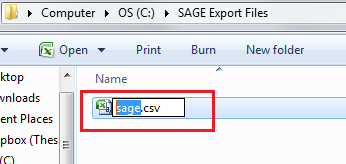

2. Open BrightPay and 'Create New Employer':

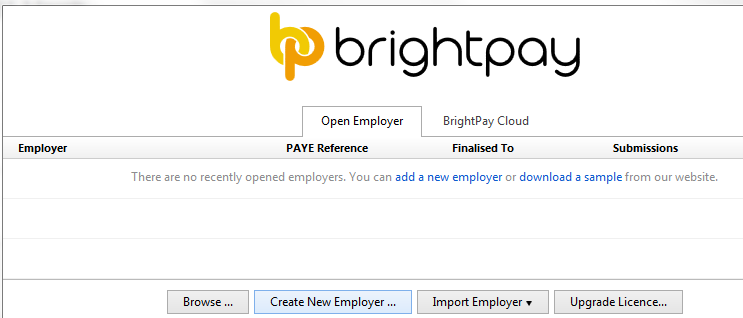

3. Select how you wish to use BrightPay:

If you wish to import employee information at the start of the tax year, select 'Start at Beginning of the Tax Year'.

4. Complete each screen accordingly with your relevant employer information.

For further assistance with this, please see our support section on Adding a New Employer

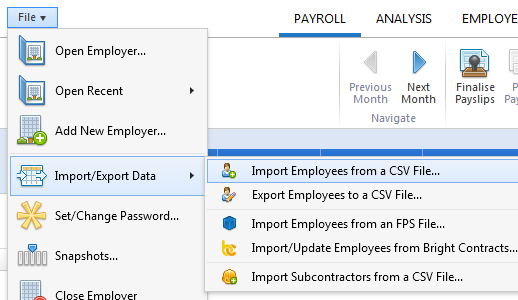

5. Once you have entered and saved your employer information, go to 'File > Import/Export Data > Import Employees from a CSV file'

6. Browse to the location of your SAGE CSV file, select it and press 'Open'

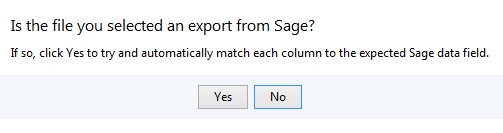

7. BrightPay will ask you to confirm that this is a SAGE file - click Yes to confirm this.

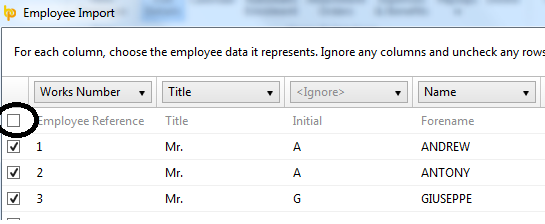

Your employee information will be displayed on screen. BrightPay will automatically match up your column information.

8) Untick the header row as well as any rows you do not wish to be imported.

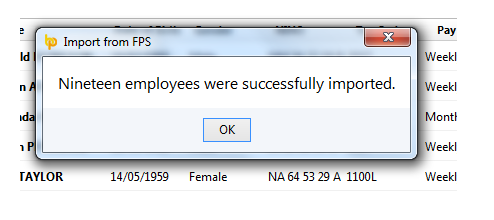

9) Click Import to complete the import of your employee information.

Following the import, further employee information can be manually entered within 'Employees', if required. Alternatively you may wish to update missing employee information using CSV file.

It is also recommended that all employee details are reviewed before processing any payroll to ensure information imported in is correct and applicable for the tax year in question.

After reviewing your employee information, simply click the 'Payroll' tab to commence processing payroll.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.