Nominal Ledger Mapping - Custom Items (e.g employment allowance)

The Nominal Ledger Mapping - Custom Items screen (available as part of the BrightPay journal process - please click here to access full journal guidance for a specific accounts software) allows users to add further adjustments to their payroll journal before posting into their accounting software.

This is an optional screen which can be used for example to record HMRC Payment adjustments such as employment allowance, recoverable statutory pay, etc.

Where a user wishes to include further adjustments of their choosing, it must be noted that it is the user's responsibility to determine the relevant debit and credit entries required, as well as ascertain the correct amounts to enter.

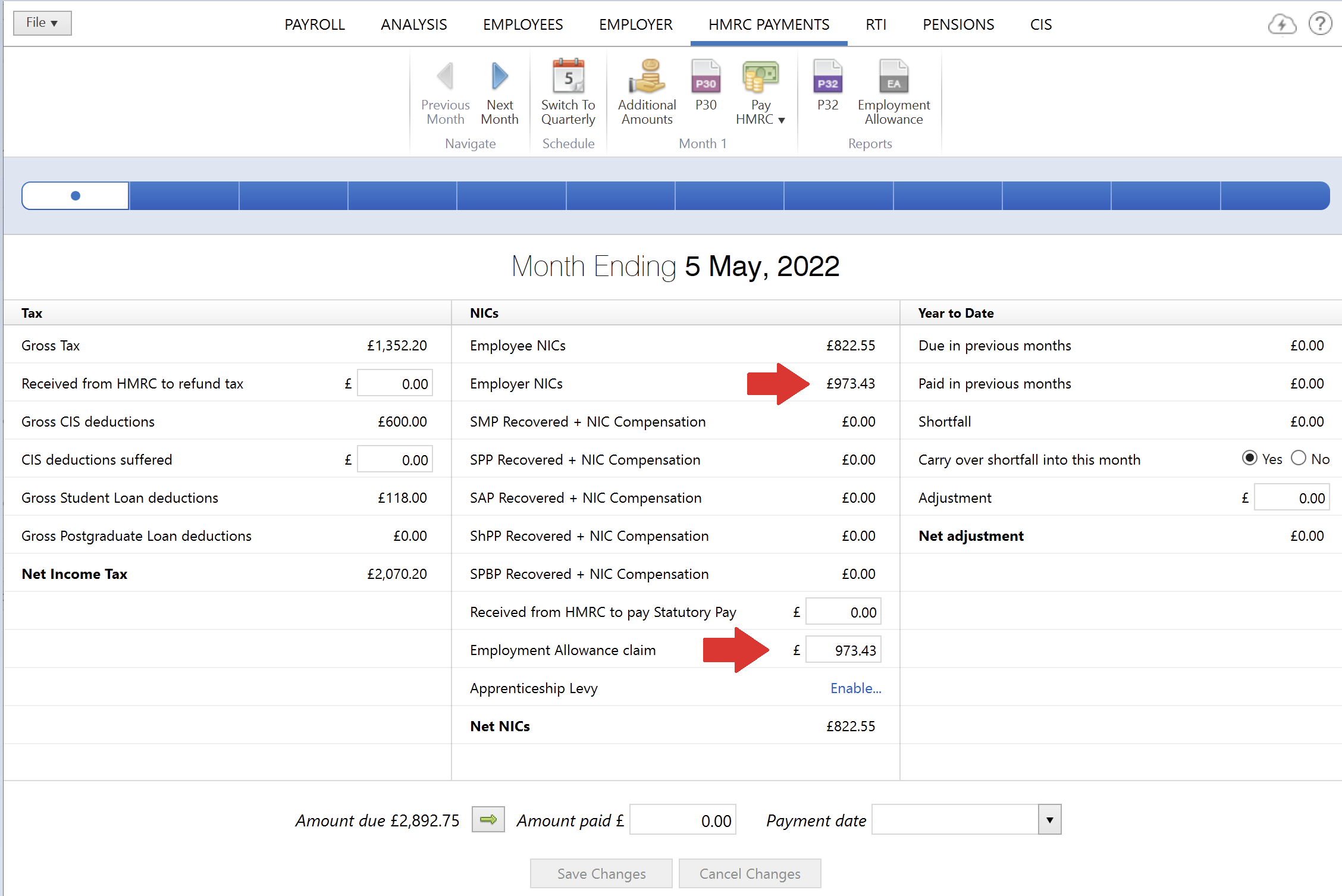

For HMRC Payment adjustments such as employment allowance, you may therefore wish to ascertain your amounts before starting your journal by accessing the HMRC Payments utility within BrightPay:

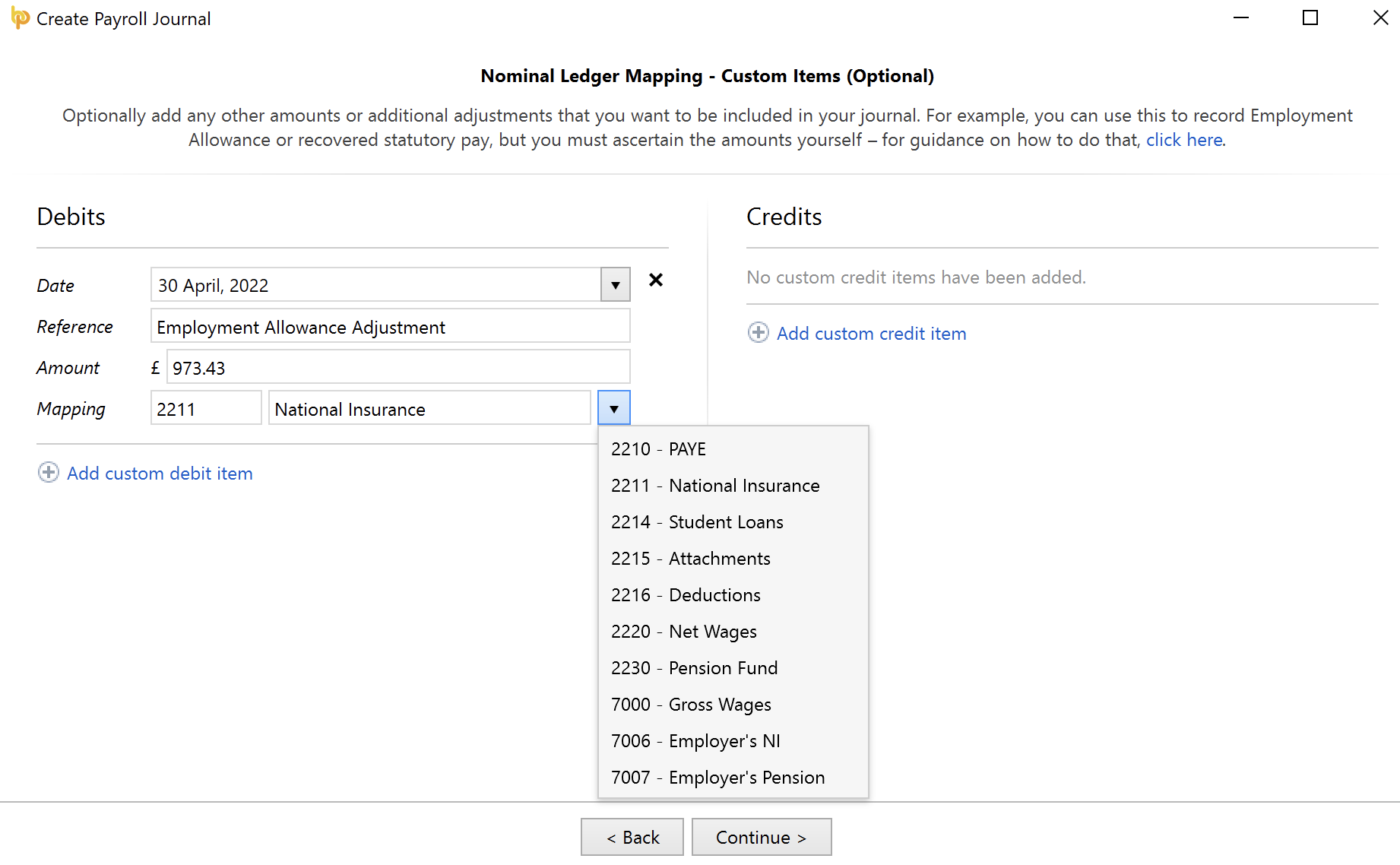

1) To add a custom journal item, first click Add custom debit item

- enter the relevant date

- enter the reference you wish to use

- enter the applicable amount

- map to the appropriate account

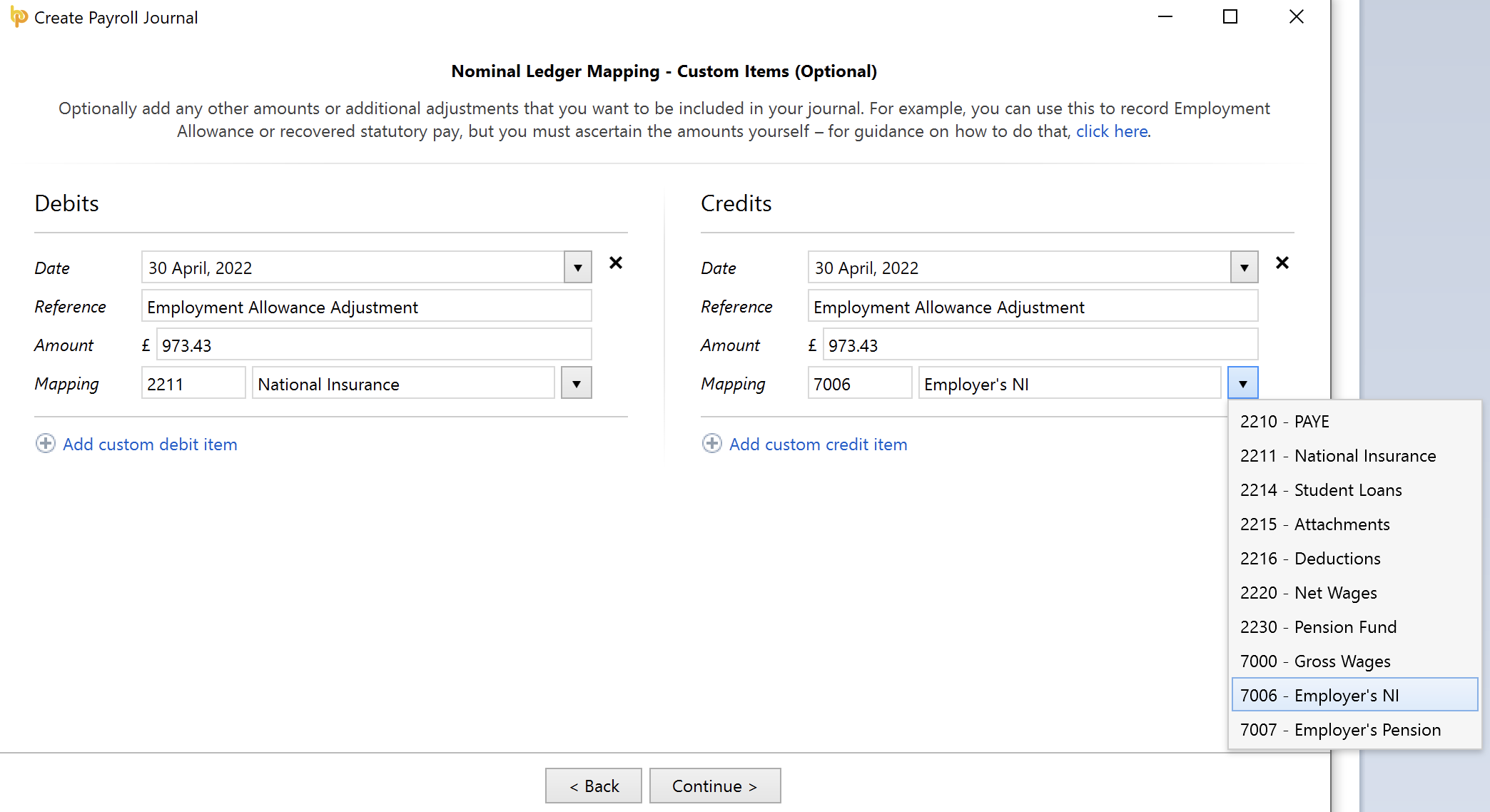

2) Next, click Add custom credit item

- enter the relevant date

- enter the reference you wish to use

- enter the applicable amount

- map to the appropriate account

3) Repeat steps 1 and 2 above for any additional journal adjustments you wish to include.

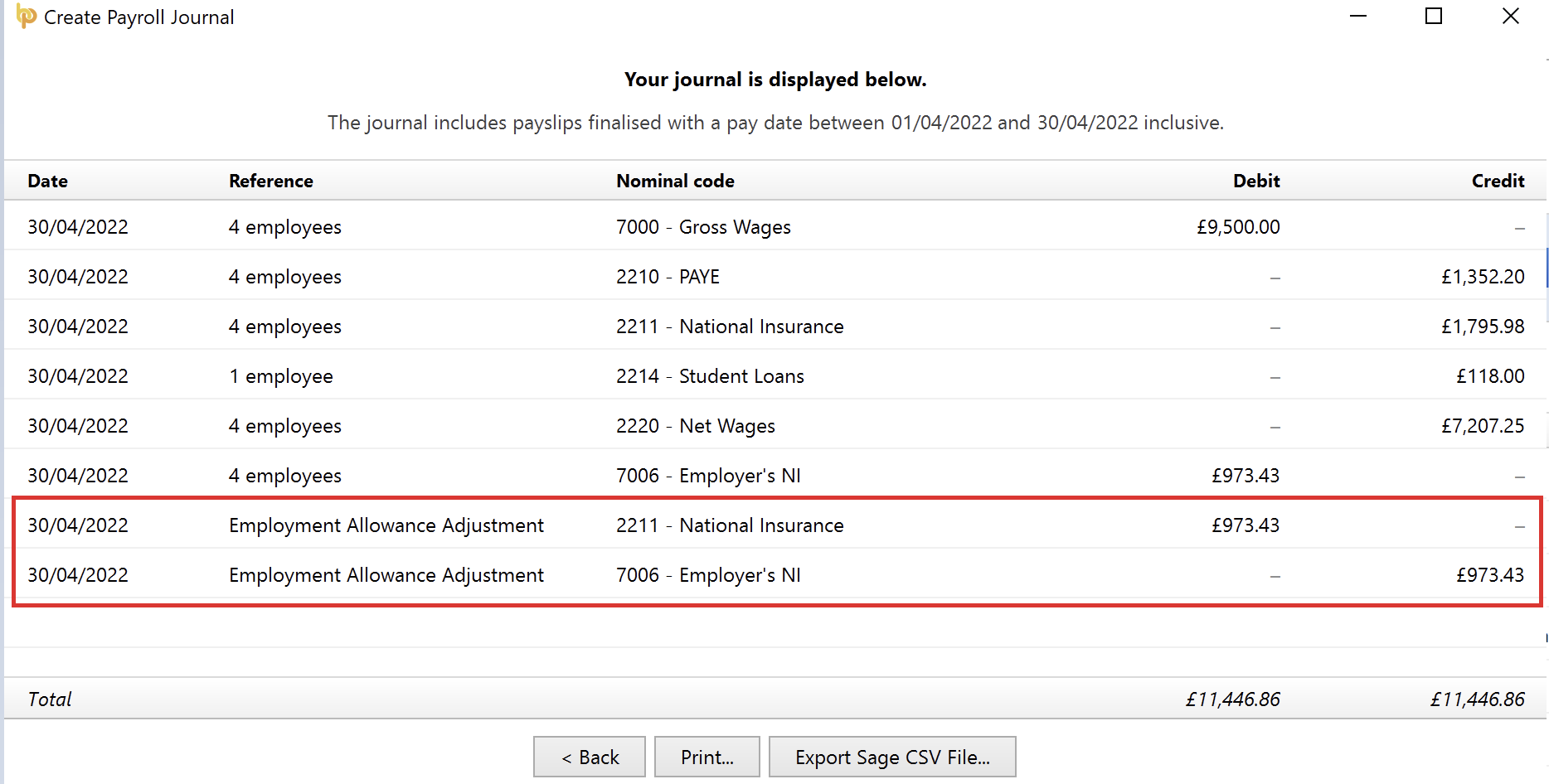

4) Click 'Continue' to review your journal and your adjustments before posting.

Notes to the above

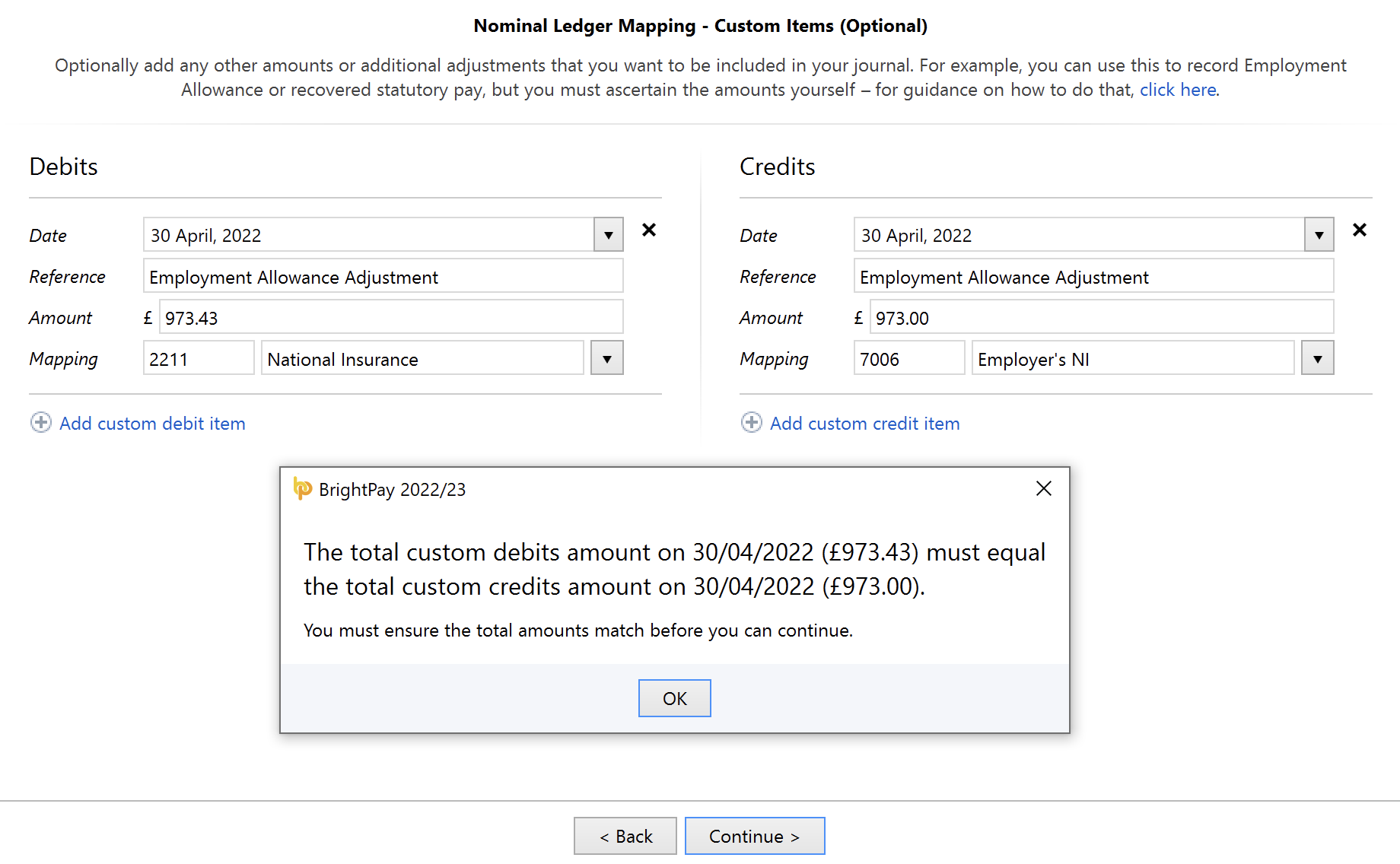

- When entering journal adjustments on this screen, the 'total custom debits amount' must equal the 'total custom credits amount' before you can continue to the final screen.

Where it is detected that the debit and credit amounts entered do not balance, this will be brought to your attention. Simply review your entries and amend accordingly.

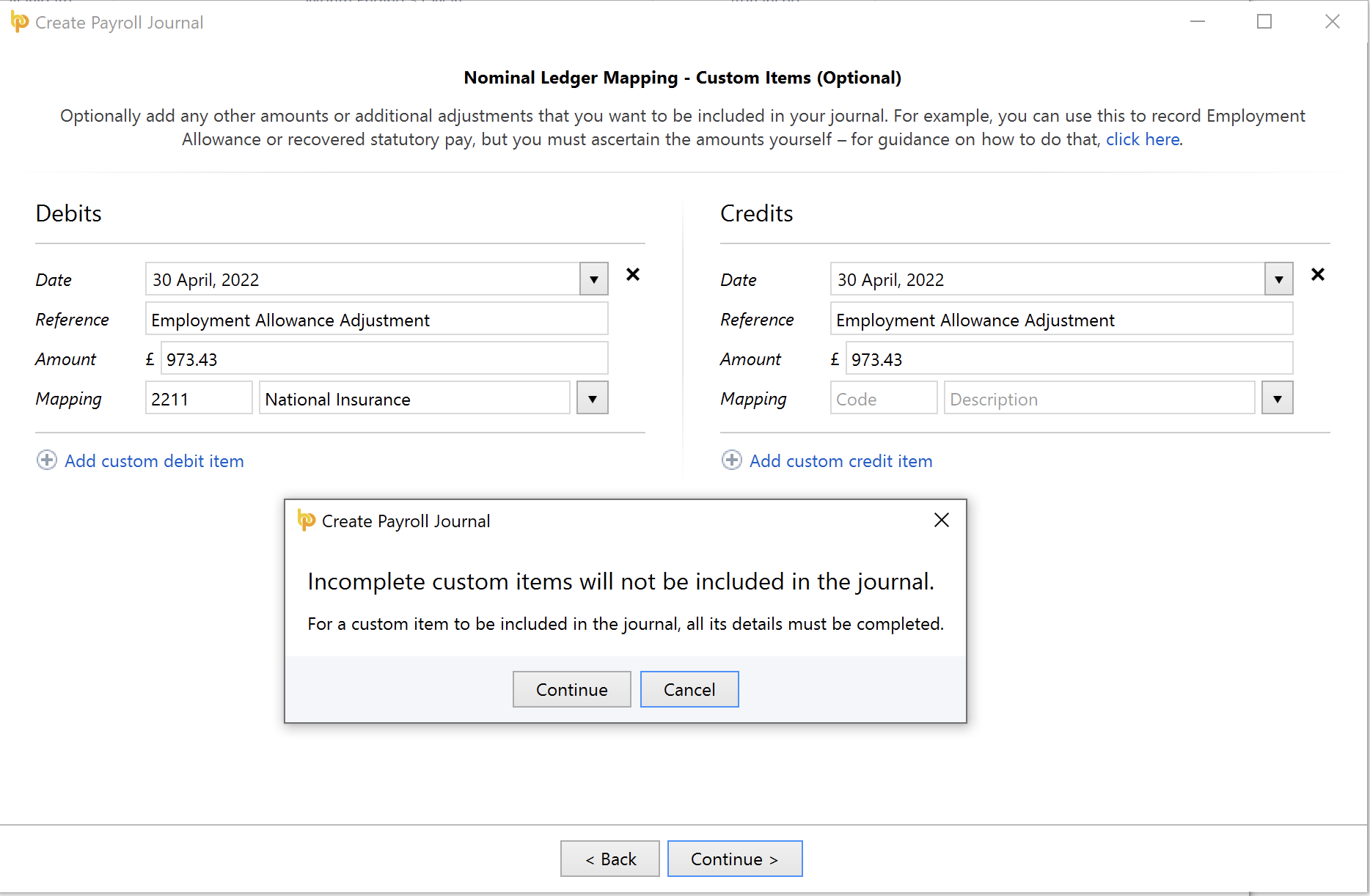

- For a custom item to be included in the journal, all its details (date, reference, amount and mapping) must be completed.

Where incomplete journal entries are detected, this will be brought to your attention. Users can choose to 'Continue', in which any incomplete entries won't be included in the journal, or press 'Cancel' in order to review journal entries and amend where necessary.

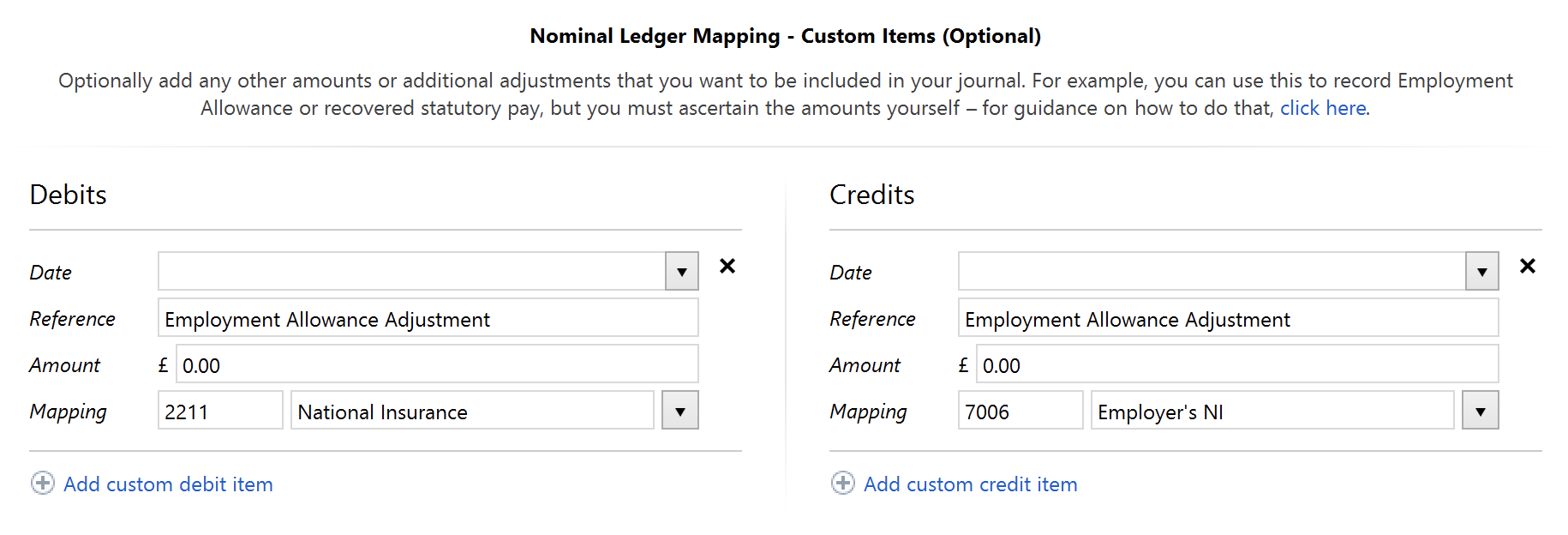

- When saving changes to your journal, any custom journal items that you have added will be saved for future use.

Simply the reference and the mapping will be remembered, allowing users to enter new dates and amounts accordingly.

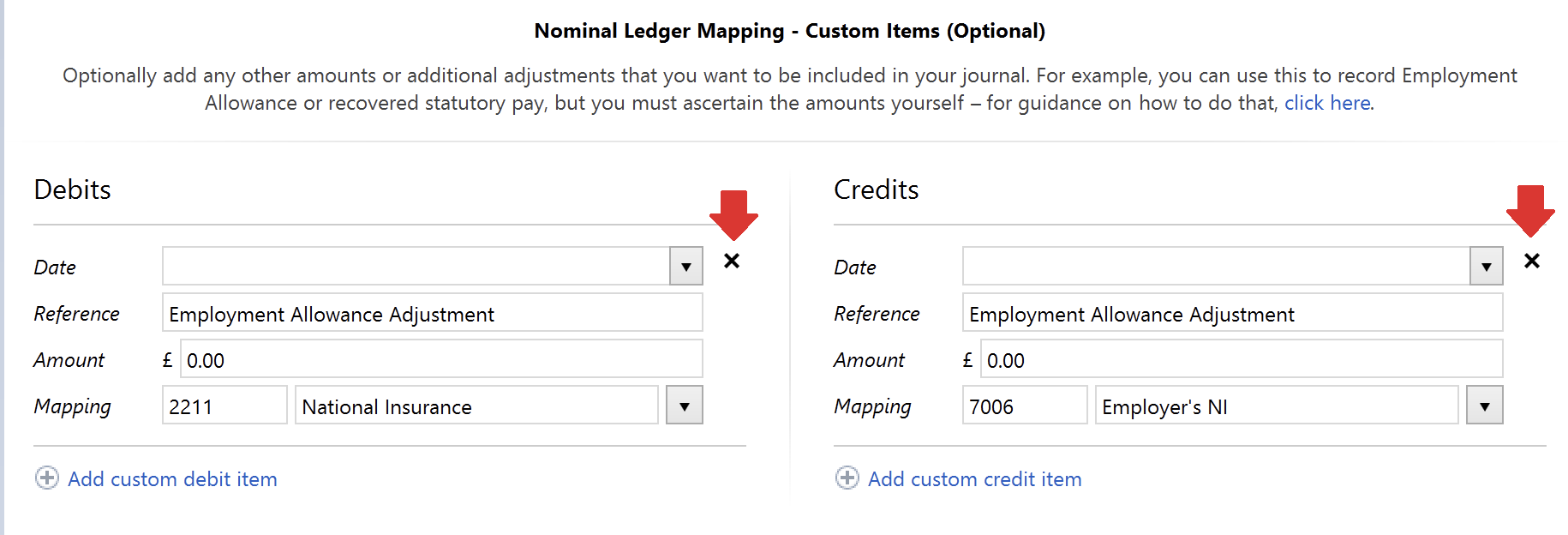

Where a custom item is no longer needed, this can be removed as follows:

Alternatively, users can choose to keep these custom items in case they are needed at a later date, as incomplete journal entries or entries with zero balances will not be included in the journal.

Why can’t BrightPay automatically include Employment Allowance amounts on journals?

The journals feature in BrightPay is a standalone utility. General settings and nominal account mappings are remembered between each usage, but the actual journal submission data is created from scratch each time and no logs of previously created journal submissions are stored. Because of this, when creating a new journal submission, BrightPay is not able to know whether Employment Allowance amounts had already been accounted for in a previous submission. This makes it impossible to automatically work out accurate Employment Allowance amounts in scenarios where multiple journals are submitted within the same tax period.

Even if BrightPay did have access to previous journal submission logs, there are still scenarios in which it would be unable to accurately determine Employment Allowance amounts. For example, re-opening, changing amounts and re-finalising payslips alters the source data, which would render previously submitted journal logs as no longer accurate.

It would hypothetically be possible to devise more and more advanced ways to try and get around all these obstacles, and maximise the chances of automatically including accurate Employment Allowance amounts on journals. But doing so would require an inordinate amount of complicated development, and worse, run the risk of ruining the simplicity and user experience of BrightPay. We don’t take such decisions lightly. In this case, we decided that manually entered custom journal amounts is the simplest and lowest risk solution.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.