Adding a Note to Employee Payslips

- To add an employee note to an individual employee's payslip, click on 'Add' followed by 'Note for Employee' and type in your narrative. Click the spanner symbol to set the repetition, if required. When payslips are finalised, this note will subsequently appear on the payslip.

- To add an individual employer note, click on 'Add' followed by 'Note for Employer' and type in your narrative. Click the spanner symbol to set the repetition, if required. An employer note will not appear on the employee's payslip.

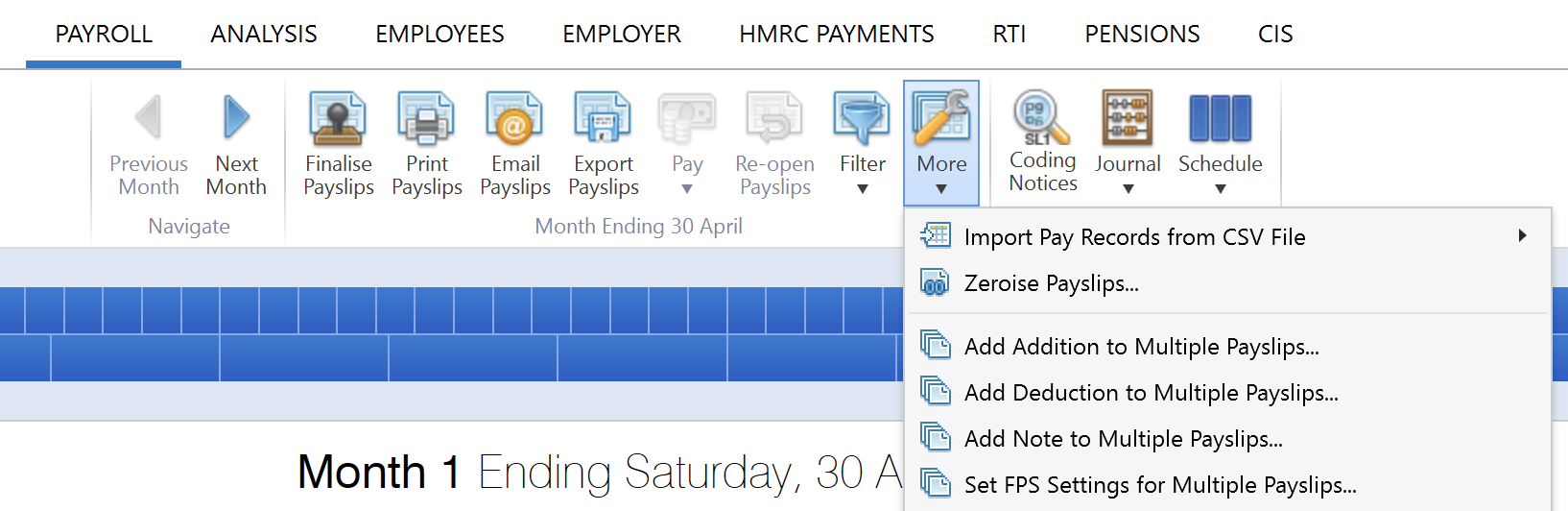

- Alternatively, to batch add an employee/employer note to multiple payslips at the same time, go to Payroll > More > Add Note to Multiple Payslips.

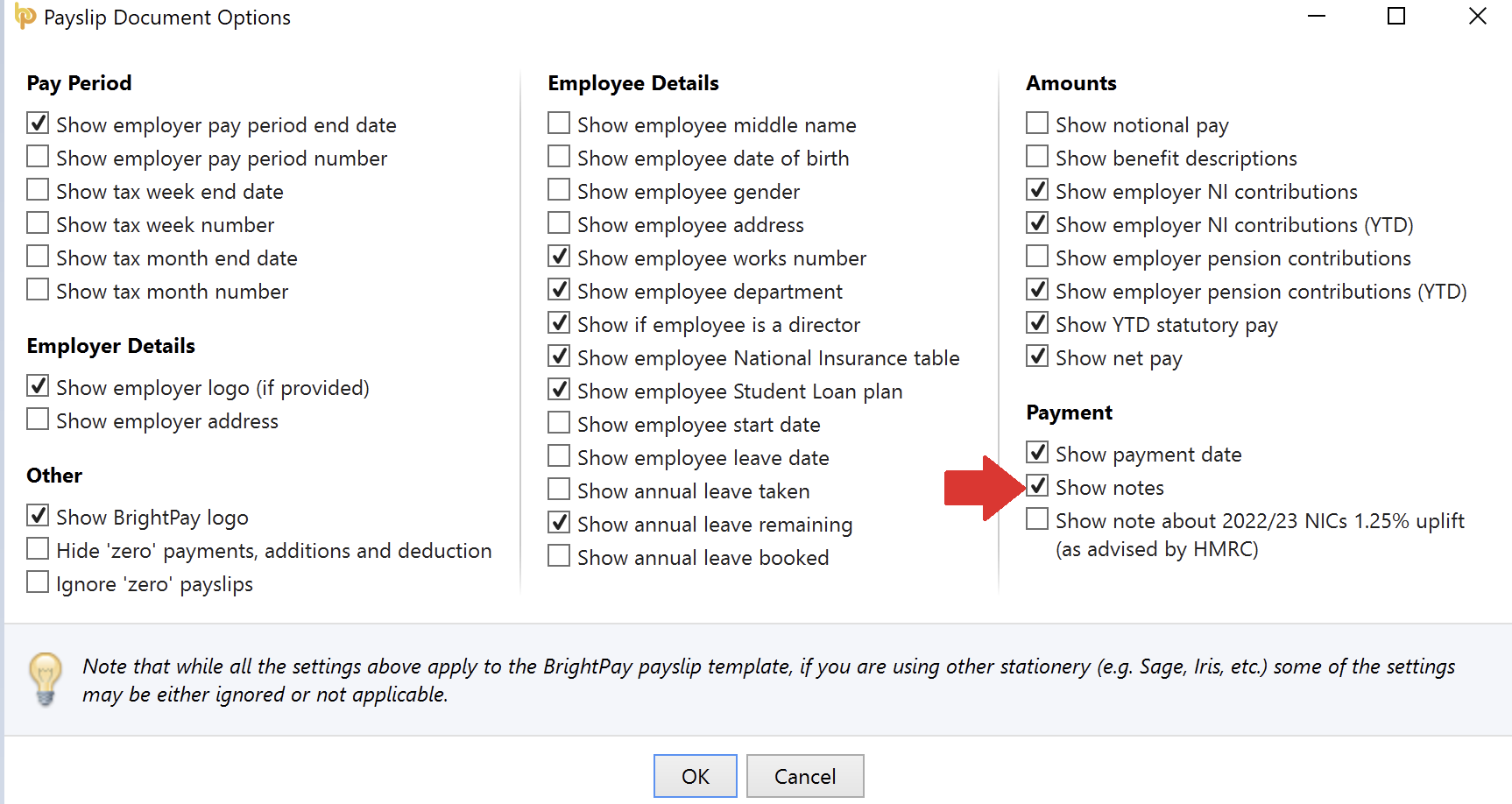

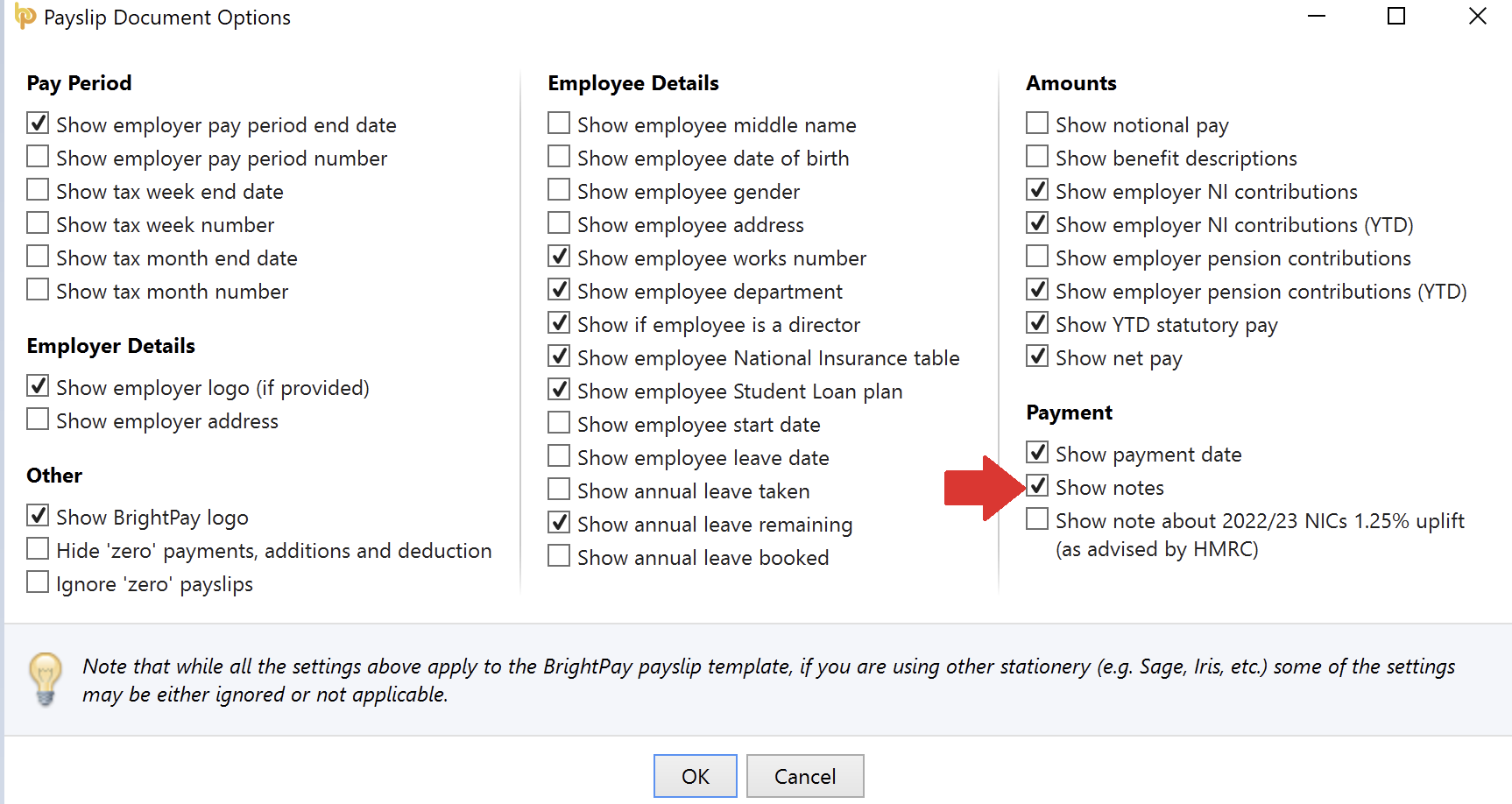

- Once an employee note has been added to a payslip, simply make sure the option to 'Show Notes' is ticked within Payroll > Print/Email/Export Payslips > Options in order for this messaging to appear on the payslip when distributed:

New Health and Social Care Levy - Payslip Messaging

On 7 September 2021 the government announced a new 1.25% Health and Social Care Levy to fund investment in the NHS, health and social care. The Levy comes into effect from April 2022 when the rate of National Insurance Contributions (NICs) for working age employees, self-employed people and employers will increase by 1.25% and be added to the existing NHS allocation. This ceases on 6th November 2022.

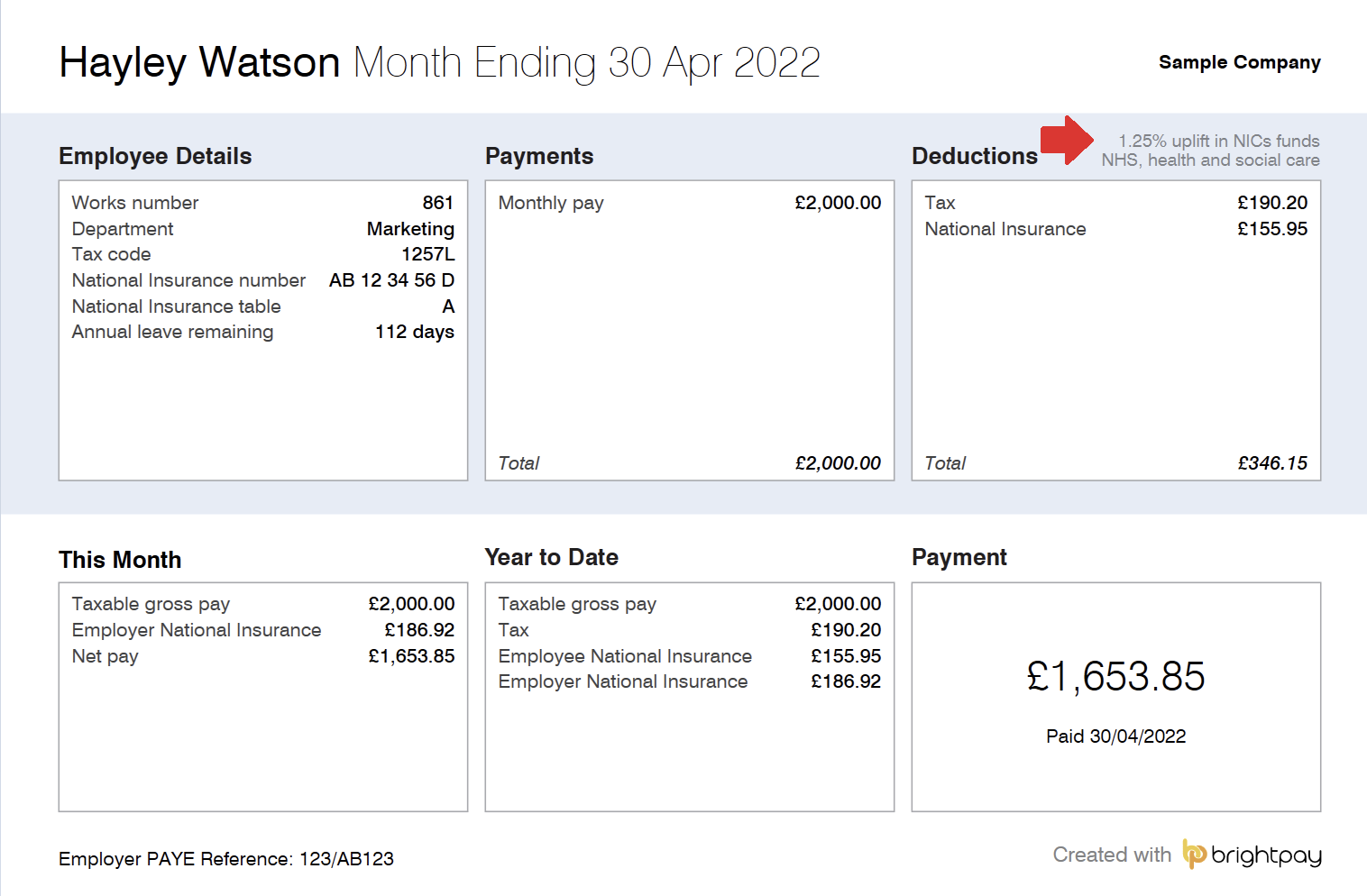

To ensure taxpayers understand that their increased NICs is helping fund public services, HMRC are requesting that employers and payroll agents put a message on payslips explaining what these funds will be used for. The message applies to all payslips in the tax year 2022-23 until 6th November 2022 and should read “1.25% uplift in NICs funds NHS, health & social care”.

Payslip Messaging in BrightPay

By default, this messaging will be applied to the BrightPay payslip templates (A4 Blank and A5 Blank) in 22-23 BrightPay automatically until 6th November only.

While the 1.25% levy will show as a message by default on the payslips up until 6th November 2022, it is optional. At the user's discretion, this option can be unticked within Payroll > Print/Email/Export Payslips.

For the other payslip templates catered for in BrightPay (Thesaurus Payroll Manager, Sage SGE011, Iris FY95) the messaging will not be automatic.

Instead users can utilise the Notes facility to add this messaging to these payslip templates.

- To add the messaging to an individual payslip, under the Notes section, simply click Add > Note for Employee on an employee's open payslip and enter the wording '1.25% uplift in NICs funds NHS, health & social care'.

Click the spanner symbol and set the repetition to repeat until a set date that falls before 6th November 2022.

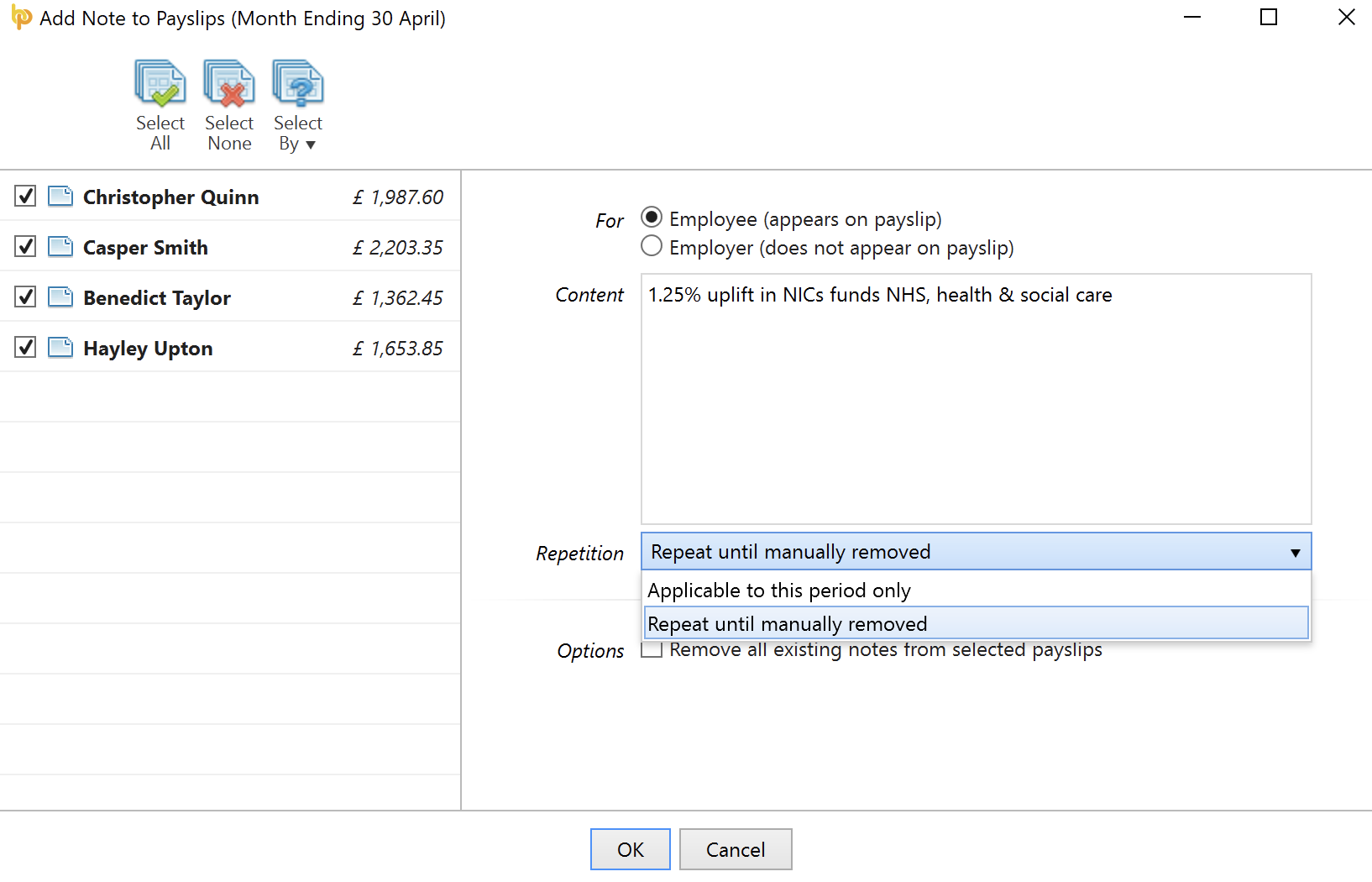

- Alternatively, to batch add a note to multiple payslips at the same time, go to Payroll > More > Add Note to Multiple Payslips:

Select the employees for whom you wish to include the messaging, enter the wording '1.25% uplift in NICs funds NHS, health & social care' and set the repetition to 'repeat until manually removed'.

Click 'OK' to apply the messaging.

- Once the note has been added to the required payslips, simply make sure the option to 'Show Notes' is ticked within Payroll > Print/Email/Export Payslips > Options in order for the messaging to appear on payslips going forward:

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.