Magistrates Court Attachment of Earnings Order

Since 5 April 2004, AEOs issued under the Courts Act 2003 (“the 2003 Act”) by the magistrates’ courts in England and Wales have been deductible by fixed tables in a similar way to Council Tax attachments currently deducted by employers.

How to Comply with an Order

Making deductions

The order comes into force on the day you receive it. You should begin to make deductions the next time you pay your employee and on each future pay day.

You should make deductions from your employee’s earnings until the total debt owed by your employee is reached. If you receive an order for ongoing maintenance, you should make deductions until the court tells you to stop.

How much to deduct on a periodic basis?

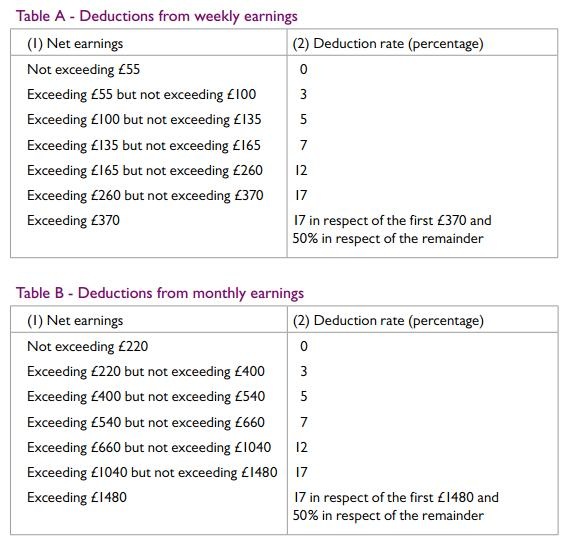

Upon receiving the Magistrates court order it will show the total amount to be deducted from the employees’ NET pay until the order is fully paid. Use the below tables to calculate how much to deduct until the total amount is paid.

BrightPay will automatically calculate the employee's periodic deduction based on the below tables:

Administrative costs

Where an attachment of earnings order is in operation, an employer may take up to £1.00 each pay period from their employee’s earnings towards their administrative costs.

Please note: you cannot deduct the admin charge of £1 if it takes your employee's income below the National Minimum Wage. It's a criminal offence for employers to not pay someone the National Minimum Wage or National Living Wage.

Employers should check The National Minimum Wage and Living Wage or contact the ACAS helpline for advice.

Attaching an Order to an Employee within BrightPay

1) Go to Payroll, and select the employee from the listing

2) Under Additions & Deductions, click the Add button

3) Select Attachment Orders…

4) Click ‘Add Attachment Order’ and select the appropriate Attachment Order from the listing.

Setting up the Order in BrightPay

Type and Dates

1) Enter a description for the Attachment Order.

2) Enter the reference number of the Attachment Order, which can be found on the documentation received.

3) Enter the date the Order was made.

4) Enter the date to apply the Order from.

5) Enter the date to stop – the Order should only be stopped once the full amount of the Order has been paid or you have received notification from the Courts to stop it.

Amount and Status

1) Priority – tick the box provided if the Order is a priority order.

2) Admin Charge – tick the box provided if you, the employer, wish to deduct £1 as an administration charge for operating the Order.

3) Enter the total amount to be paid.

4) Cumulative amount paid at start - if the employee has already paid some of the attachment (for example in a previous employment) enter the amount here.

5) Enter any Year to Date deductions, if applicable

6) Click Save.

Notes

Use the Notes section to enter any relevant notes relating to the employee's attachment order

BrightPay will now apply the Attachment Order on the employee’s payslip from the relevant period.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.