Processing Opt-out Notices in BrightPay

BrightPay is able to process opt-out requests and issue refunds, where applicable.

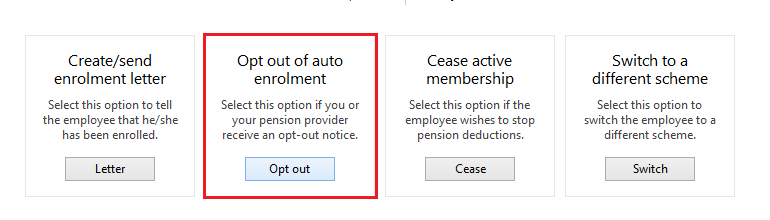

If an opt-out notice is received for an employee, simply access the employee’s automatic enrolment utility and select the opt-out option:

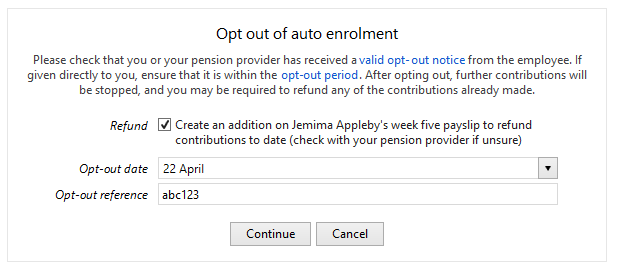

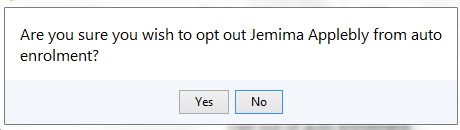

Simply enter in the opt-out date and opt-out reference (if applicable) and press Continue, followed by OK.

Please note: the opt-out date is the date that the opt-out request is received.

If the employee has already made contributions, and you wish to refund these through the payroll, ensure that the Refund button remains ticked, as shown above.

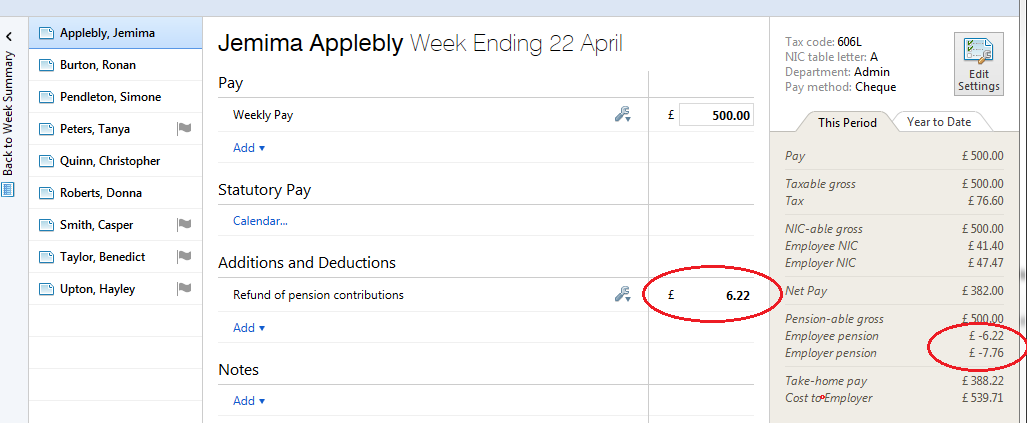

Contributions already made by the employee will subsequently be refunded to them as follows in the next pay period processed for them:

Opting out will also refund any employer contribution made. This will be shown on the employee's payslip along with the refund of the employee contribution.

Please note: employees can only opt out of automatic enrolment if they are within their opt-out window.

If their opt-out window has expired, you must 'Cease' them instead. In this instance, no refund of contributions to date will be made.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.