Importing Daily Payments using CSV file

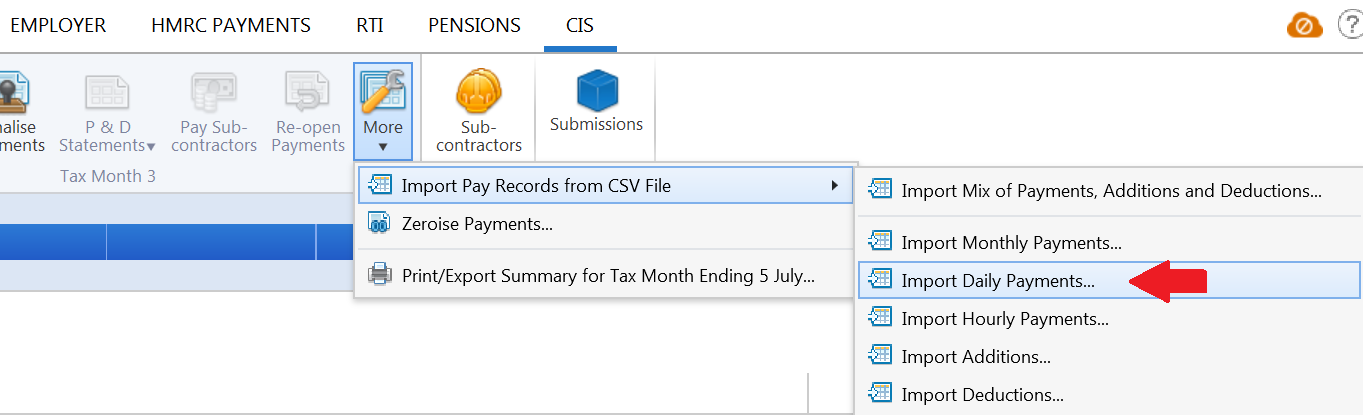

To import daily payments, go to 'CIS' > 'Payments' > 'More' > 'Import Pay Records from CSV File' > 'Import Daily Payments':

1) Browse to the location of your CSV File

2) Select the required file and click 'Open'

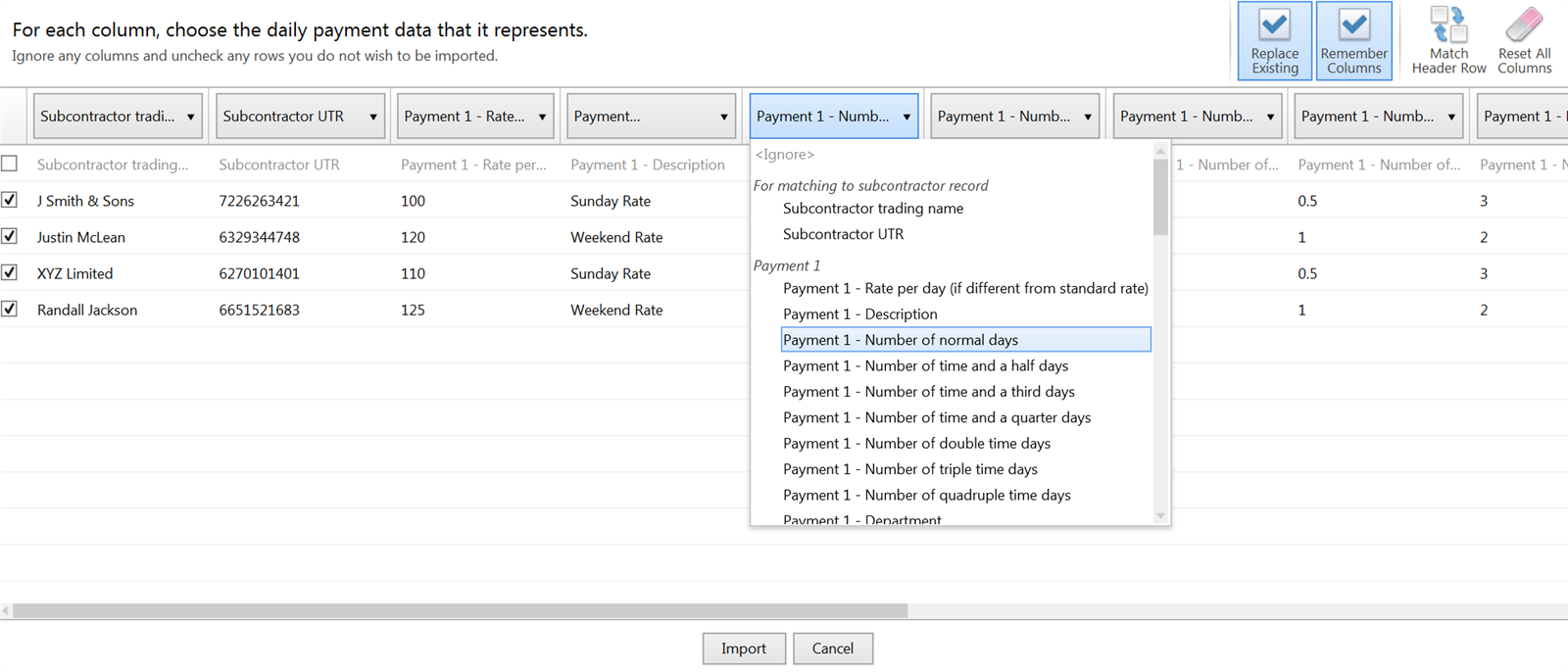

3) Your subcontractor data will be displayed on screen. For each column, choose the payment data it represents. Ignore any columns and uncheck any rows you do not wish to be imported.

- To assist with column selection, simply select 'Match Header Row'. BrightPay will try and match as many columns as it can for you

- Also indicate whether you would like to replace the equivalent pay items that are already present on each subcontractor's payment screen with the new amounts being imported in by selecting/de-selecting 'Replace Existing'

- Should you wish to remember your column selection for future imports, instruct BrightPay to 'Remember Columns'. BrightPay will subsequently remember the column selection used in the previous import when next importing a CSV file.

- Should you wish to reset your column selection at any time, select 'Reset All Columns'.

4) Click Import to complete the import of your payment information.

Fields which can be imported into BrightPay using the Daily Payment CSV File option are:

For matching to subcontractor record:

Subcontractor trading name

Subcontractor UTR

Payment 1:

Rate per day (if different from standard rate)

Description

Number of normal days

Number of time and a half days

Number of time and a third days

Number of time and a quarter days

Number of double time days

Number of triple time days

Number of quadruple time days

Department

Is CIS deduction deductible

Payment 2:

Rate per day (if different from standard rate)

Description

Number of normal days

Number of time and a half days

Number of time and a third days

Number of time and a quarter days

Number of double time days

Number of triple time days

Number of quadruple time days

Department

Is CIS deduction deductible

Payment 3:

Rate per day (if different from standard rate)

Description

Number of normal days

Number of time and a half days

Number of time and a third days

Number of time and a quarter days

Number of double time days

Number of triple time days

Number of quadruple time days

Department

Is CIS deduction deductible

Payment 4:

Rate per day (if different from standard rate)

Description

Number of normal days

Number of time and a half days

Number of time and a third days

Number of time and a quarter days

Number of double time days

Number of triple time days

Number of quadruple time days

Department

Is CIS deduction deductible

Payment 5:

Rate per day (if different from standard rate)

Description

Number of normal days

Number of time and a half days

Number of time and a third days

Number of time and a quarter days

Number of double time days

Number of triple time days

Number of quadruple time days

Department

Is CIS deduction deductible

Other:

Cost of materials

VAT

A CSV file template for the above can be accessed here.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.