Expenses & Benefits - Overview

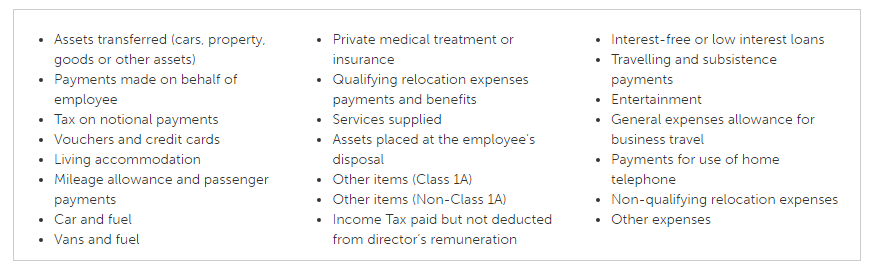

BrightPay allows you to record all types of reportable expenses and benefits that you provide to your employees:

BrightPay can also produce an Expenses and Benefits submission (EXB) to send to HMRC after year end which includes your Class 1A NICs declaration (P11D(b)) and the P11D employee details for any expenses and benefits provided.

If you have registered for payrolling of benefits by 5 April 2022, 22-23 BrightPay also supports calculating the PAYE on expenses and benefits in each pay period.

Please note: benefits that cannot be payrolled are:

- Living accommodation

- Interest-free and low interest (beneficial) loans

Payrolling Benefits

Tax due on benefits and expenses is collected by adding a notional value to an employee’s taxable pay in payroll, rather than reporting them separately on a P11D. Tax is deducted or repaid as usual by reference to the employee’s tax code.

All payrolled benefits and expenses are included in a Full Payment Submission (FPS) as per HMRC's requirement.

The details of payrolled car benefits are included on the FPS. They are included in the first pay period in the tax year that the car is first payrolled. They are re-included in a subsequent submission if any of the car details change (with an “Amended” flag).

P11Ds are not required where benefits have been payrolled, however a P11D(b) declaration must still be submitted to HMRC at the end of the tax year. This declaration can be submitted using BrightPay.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.