NIC Thresholds & Rates for 2023-24

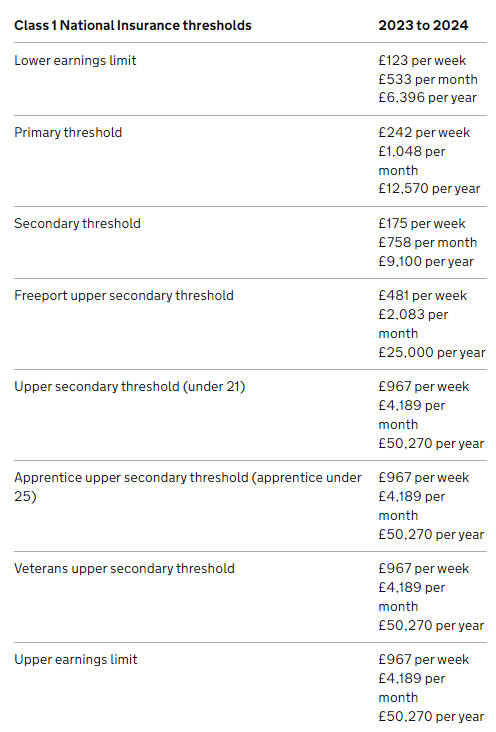

Class 1 National Insurance Thresholds

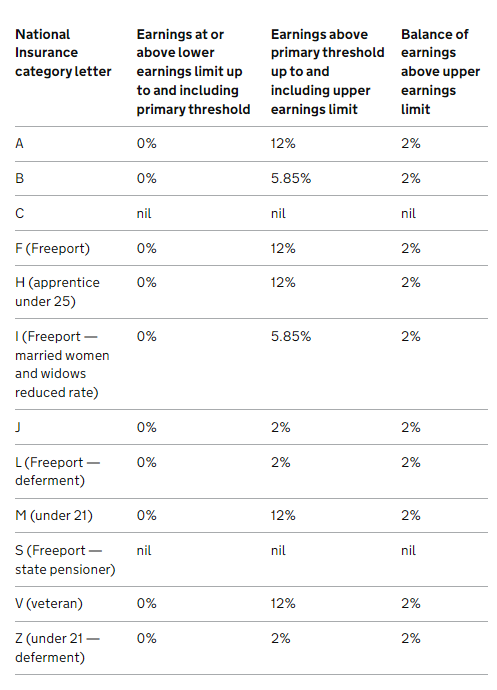

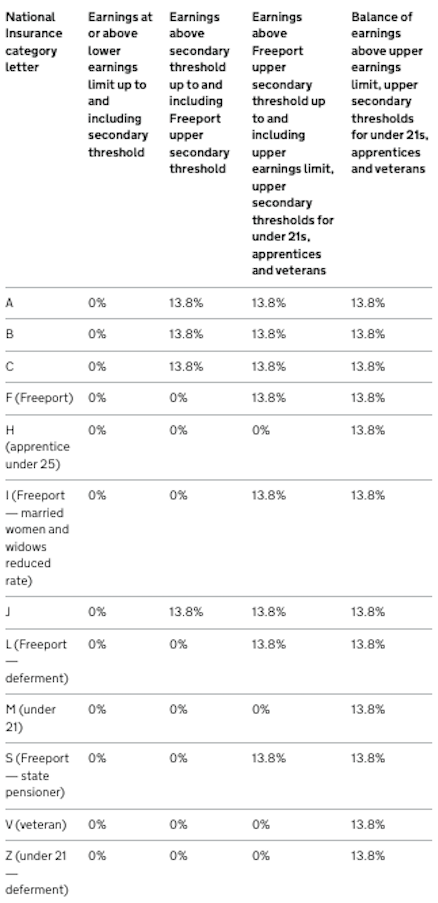

Class 1 National Insurance Rates

Employee (primary) contribution rates:

Employer (secondary) contribution rates:

Class 1A National Insurance Rate for Expenses and Benefits

![]()

Class 1A National Insurance Rate for Termination Awards and Sporting Testimonials

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.