Xero - Introduction to using the API

Using API technology, BrightPay offers full integration with Xero allowing both the payroll software and accounting software system to directly communicate with each other.

BrightPay will produce the payroll journal in a file format that is unique to Xero, allowing users to easily send their payroll figures into their general ledger. The BrightPay API facility eliminates the manual export and import process, automating tedious, repetitive and time-consuming tasks.

By using BrightPay and Xero together, users will be able to increase efficiency, avoid duplication of efforts and reduce the possibility of manual processing errors.

How does the BrightPay and Xero integration work?

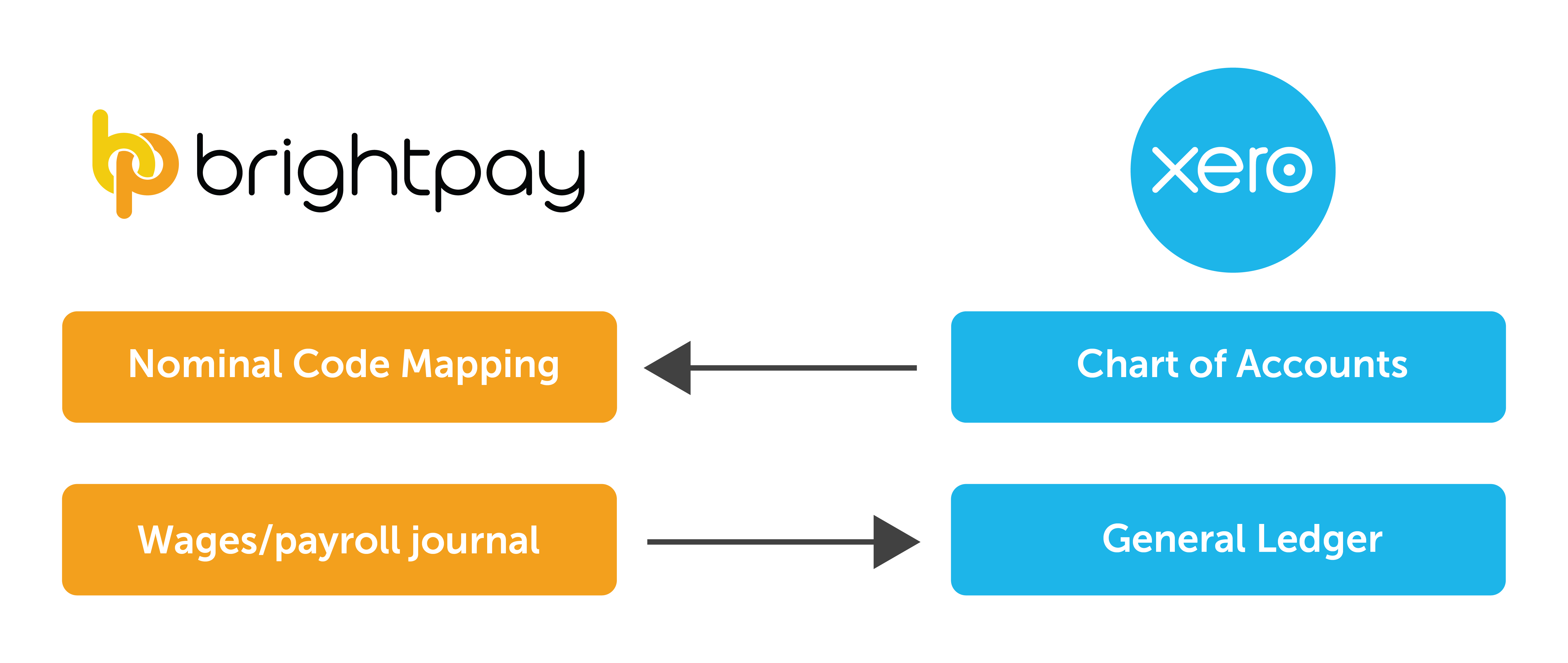

- When you sign into your Xero account in BrightPay, your chart of accounts will be retrieved from Xero

- Using this chart of accounts, map each payroll data item to the relevant nominal account.

- Based on the mapping applied, simply submit your journal to Xero

For assistance with submitting your payroll journal from BrightPay to Xero using API, click here .

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.