Period Summary View (Payroll Preview)

Every time your company file is opened and the Payroll utility accessed, employees will be listed in a 'summary view'.

This summary view provides an overview of pay information entered in the pay period selected for all the employees on that pay frequency. It is most commonly used as a final check of pay information entered before a pay period is finalised.

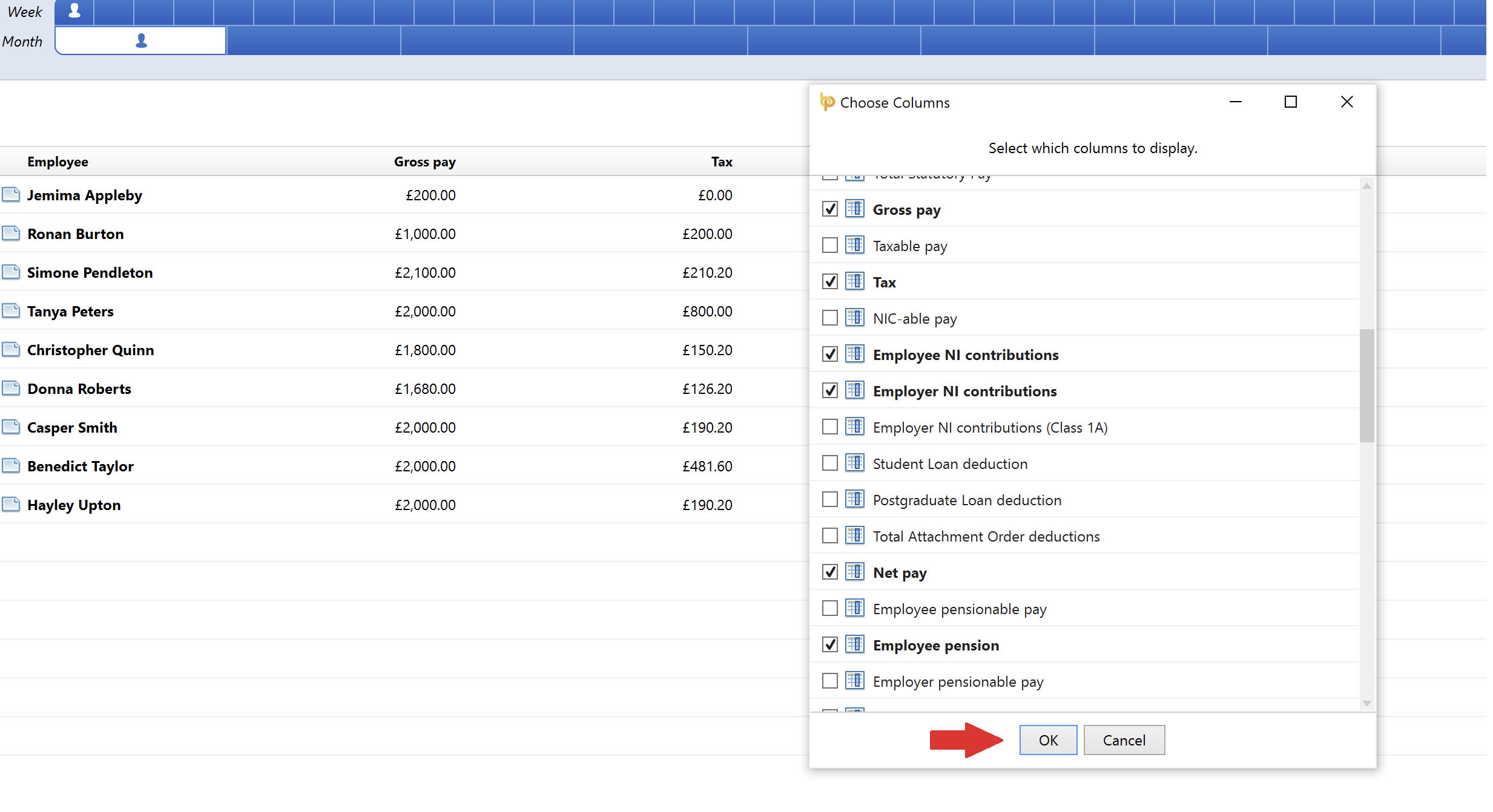

- BrightPay applies a default selection of columns, which the user can subsequently customise to suit their own requirements e.g. to show columns for number of hours worked, pension contributions, previous pay period amounts, etc.

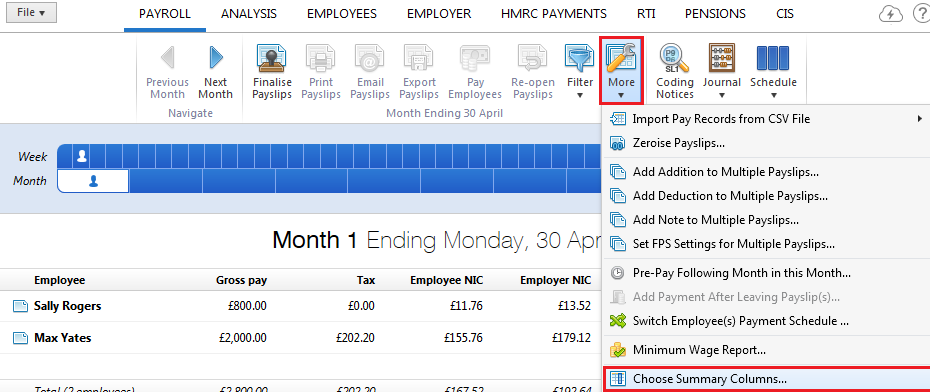

a) To choose which columns to display, simply click 'More' on the menu bar, followed by 'Choose Summary Columns...':

b) select the columns you wish to display and click 'OK':

c) The summary view will now reflect your chosen criteria

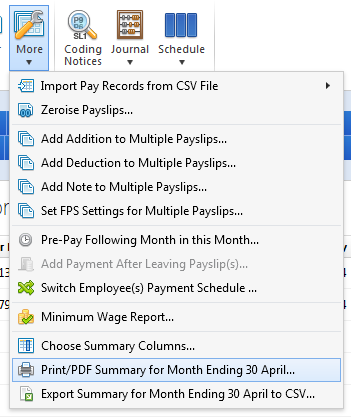

- To print or email the period summary at any time, click 'More > Print/PDF Summary for period ending...':

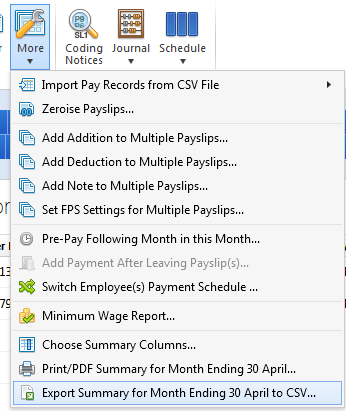

- To export the period summary at any time, click 'More > Export Summary for period ending...':

Additional Information

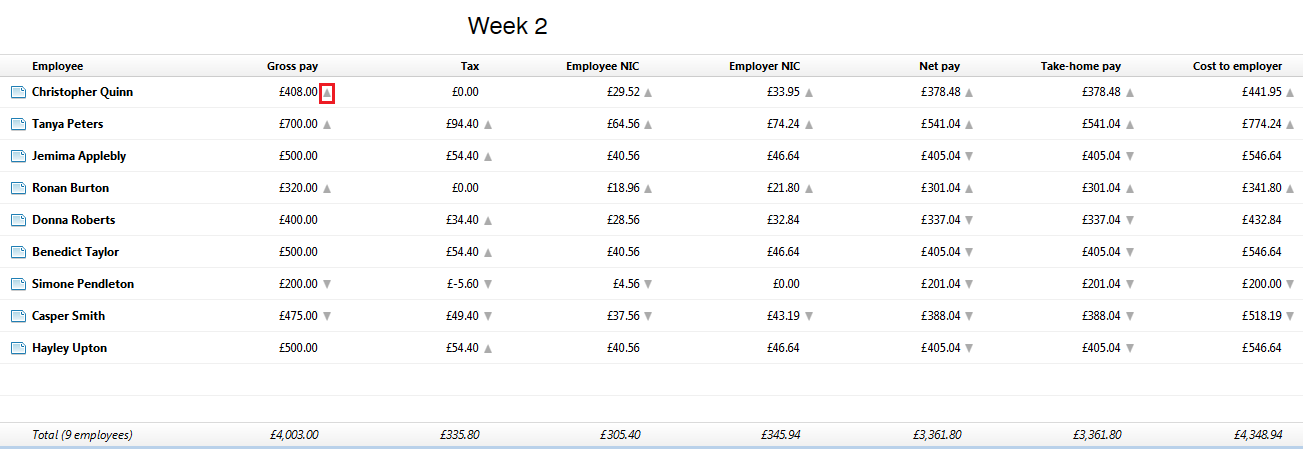

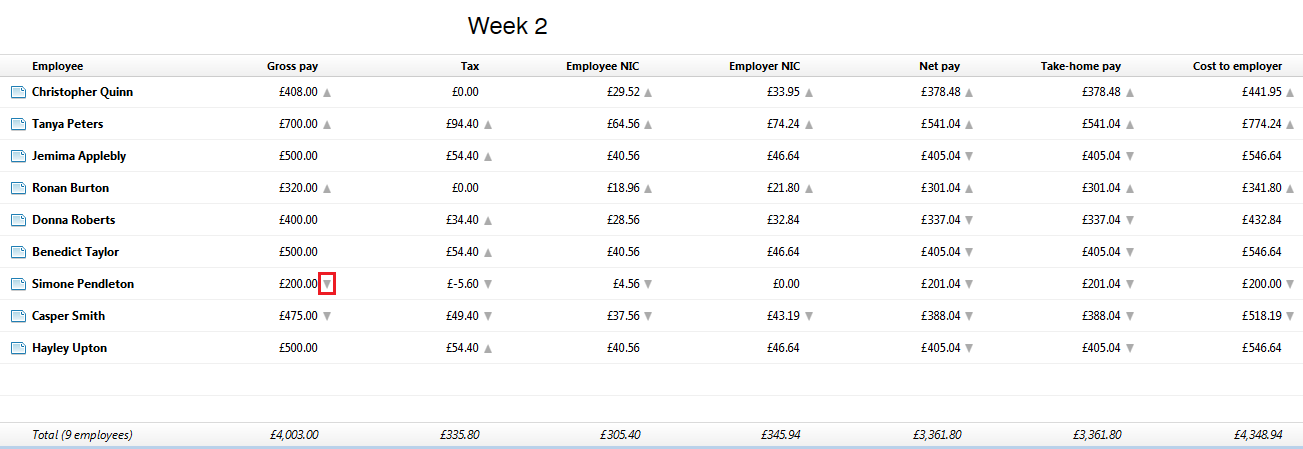

The 'summary view' will also indicate variances in pay information when comparing the period selected to the previous pay period.

- An upward arrow next to a pay amount will indicate that that pay amount has increased when compared to its equivalent in the previous pay period:

- A downward arrow next to a pay amount will indicate that that pay amount has decreased when compared to its equivalent in the previous pay period:

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.