Notifying HMRC that your PAYE scheme has ceased

If your PAYE scheme ceases, HMRC must be notified of this via the Employer Payment Summary (EPS).

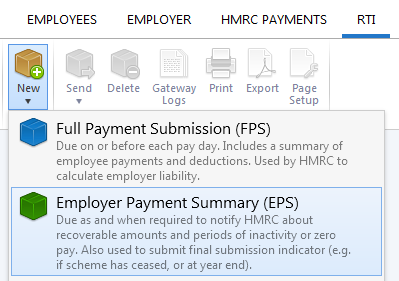

1) Select 'RTI' on the menu bar

2) Click 'New' on the menu toolbar and select 'Employer Payment Summary (EPS)':

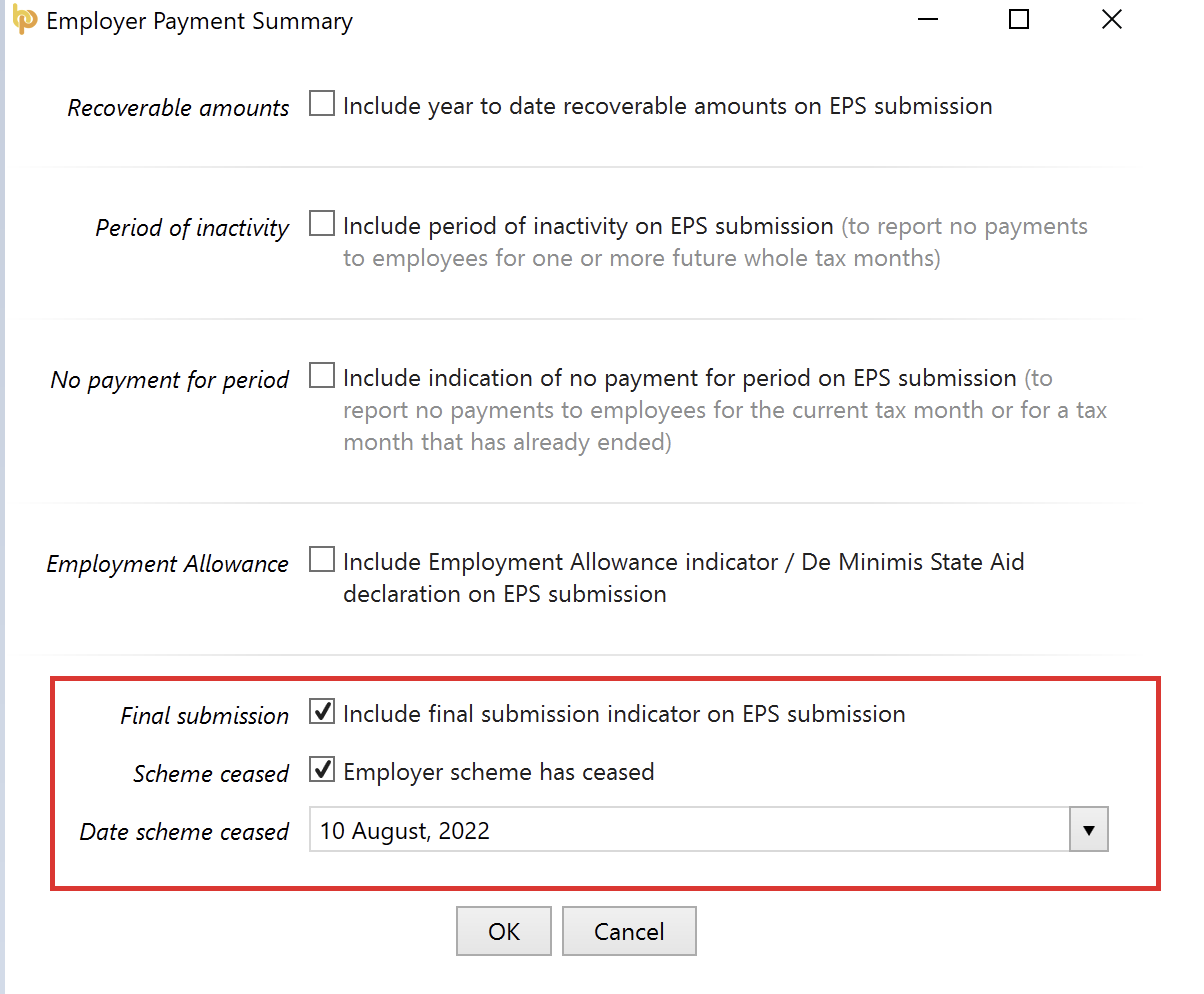

3) Tick the 'Final submission' marker

4) Tick the 'Scheme ceased' marker

5) Enter the date the scheme has ceased

6) Click 'OK' and submit to HMRC when ready

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.