CJRS Flexible Furlough Scheme - Timetable of Changes

The Coronavirus Job Retention Scheme (CJRS) is a temporary scheme open to all UK employers from 1st March 2020 to 30th September 2021, designed to support employers whose operations have been severely affected by coronavirus (COVID-19).

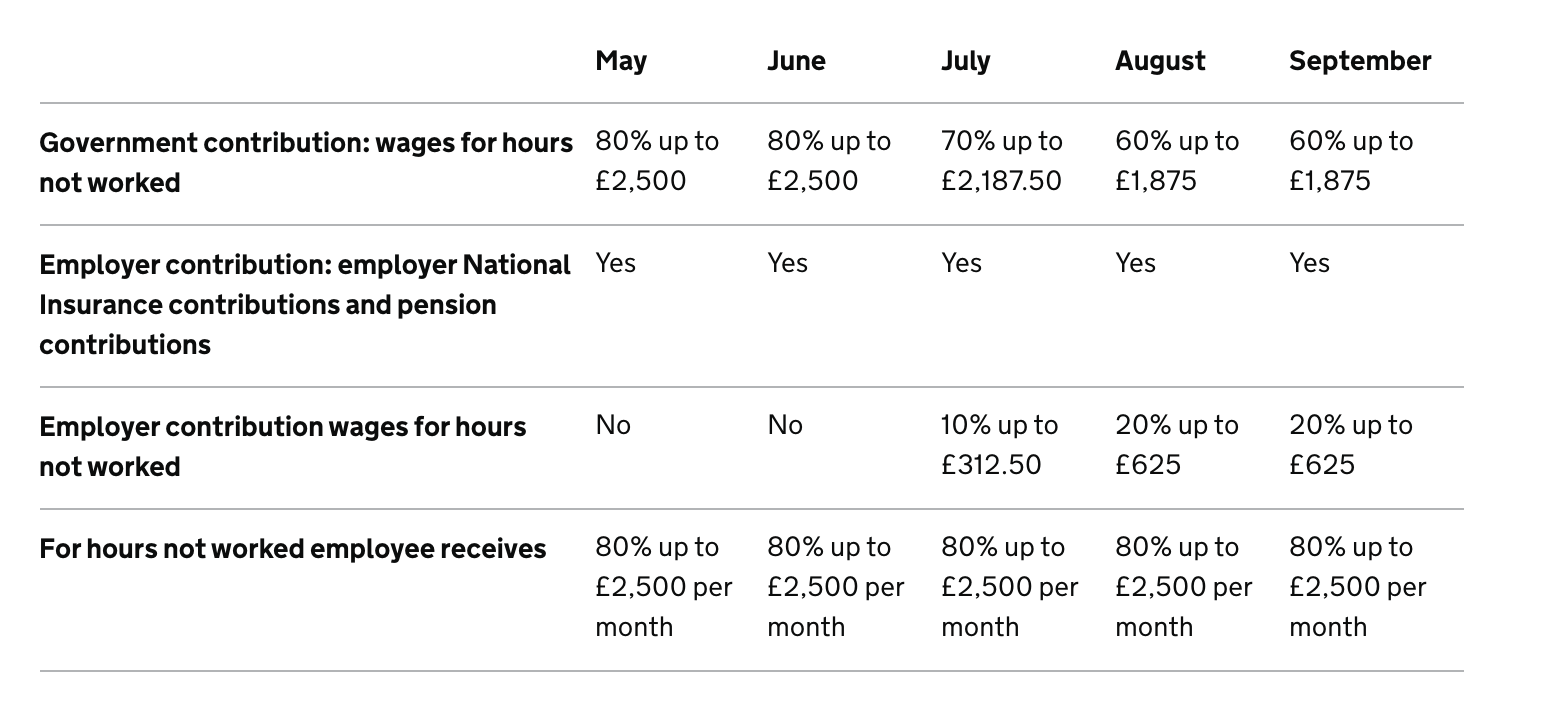

Timetable of Changes for CJRS:

- Up until 30th June 2020 - employers could claim for 80% of furloughed employees' usual wage costs (up to £2,500 a month) plus associated Employer NICs and minimum automatic enrolment employer pension contributions on that wage.

- From 1st July 2020 - employees can return to work part-time while still receiving furlough pay.

- From 1st August 2020 - employer NIC and pension contributions no longer claimable.

- In September 2020 - the reclaimable rate reduced to 70%.

- In October 2020 - the reclaimable rate reduced to 60%.

- From November 2020 - June 2021 - employers can claim 80% of an employee’s usual wages for hours not worked, up to a cap of £2,500 per month.

- In July 2021 - employers will be able to claim 70% of an employee’s usual wages for hours not worked, up to a cap of £2,187.50 per month.

- In August and September 2021 - employers will be able to claim 60% of an employee’s usual wages for hours not worked, up to a cap of £1,875 per month.

- The scheme will close on 30th September 2021.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.