Adding Expenses & Benefits - Cars and fuel

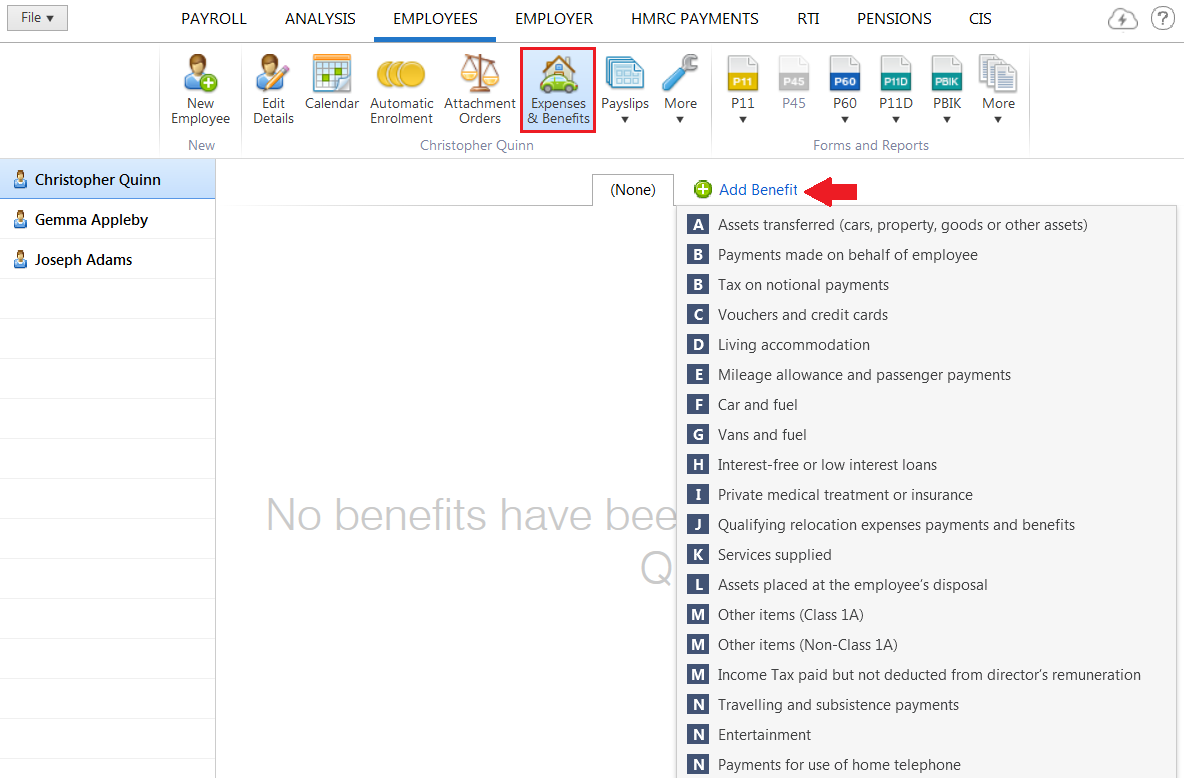

To add expenses & benefits to an employee record, go to Employees > choose the Employee from the listing > select Expenses & Benefits on their menu toolbar.

1) Select Add Benefit:

2) Select Car and Fuel

3) Enter the Make and model, Vehicle Registration Number and the date the car was first registered

4) For cars registered after the 1 January 1998, enter the approved CO2 emissions figure if the car has one (this will determine the appropriate percentage for calculating the car benefit charge)

Further details of the appropriate percentage for calculating car benefit charge can be found in TC2B and can be found here

5) Enter the engine size of the car

6) Select the appropriate fuel/power used using the drop down menu

7) Enter the dates the car was made available to the employee if within the current tax year.

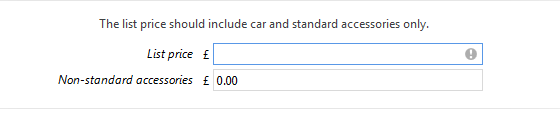

8) Enter the list price of the car and the value of any non-standard accessories

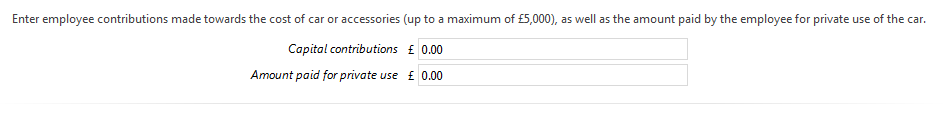

9) Enter any employee contribution, where applicable

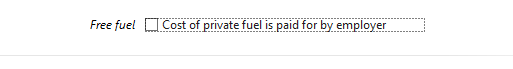

10) Indicate if the cost of private fuel is paid for by the employer

11) When the benefit information is complete, select Save

12) If any required information has not been entered for the benefit, Brightpay will alert you to this.

13) Using the information entered, BrightPay will now calculate the cash equivalent of the car and fuel, where applicable. It will then determine the number of pay periods still remaining in the tax year and distribute the cash equivalent of the benefit equally across these remaining pay periods.

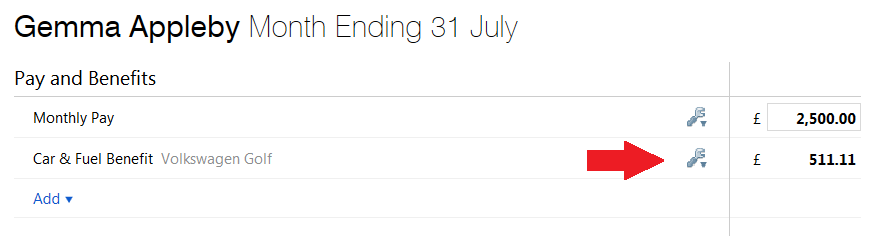

14) If the tax accounting method chosen is PAYE (payrolling of benefits), the benefit will now appear under Pay & Benefits on the employee's payslip going forward:

15) To view or edit the benefit details, simply click the Edit button next to the amount.

On finalising the employee's payslip, the benefit figure will subsequently appear on their payslip.

Please note: the details of payrolled car benefits are included on the Full Payment Submission. They are included in the first pay period in the tax year that the car is first payrolled. They are re-included in a subsequent submission if any of the car details change (with an “Amended” flag).

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.