Importing From The Previous Tax Year

2024-25 BrightPay (effective for pay periods on or after 6th April 2024) is now available to download.

Each annual installation of BrightPay installs separately to each previous tax year version. Therefore, once installed, you will see a new icon appear on your desktop for you to access 2024-25 BrightPay:

![]()

If you used 23-24 BrightPay, you will need to instruct 24-25 BrightPay to import your employer data files and all associated employee data records from 23-24 into 24-25 by following the steps below:

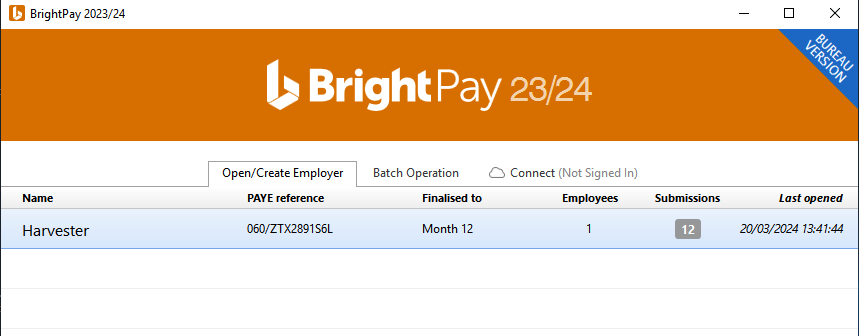

1) First establish the location of your 23-24 BrightPay employer data file(s). You can do this by simply hovering over an employer name on your 23-24 starting screen (as shown). The location from which the employer data file opens will be displayed on screen:

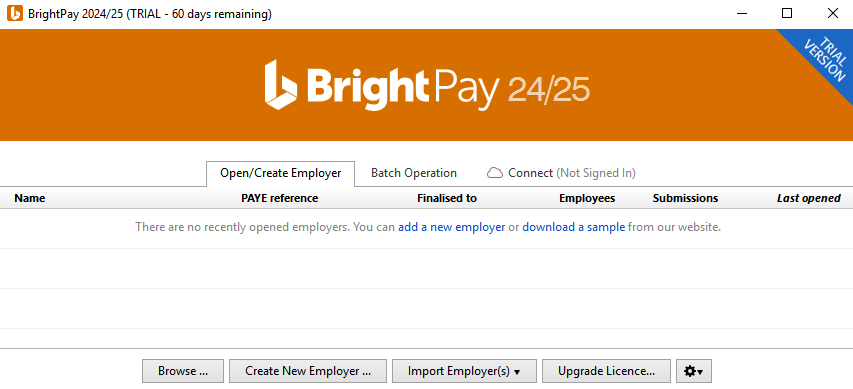

2) Open the 24-25 BrightPay software

3) Click 'Import Employer' followed by 'Import BrightPay 2023/24 files(s)...'

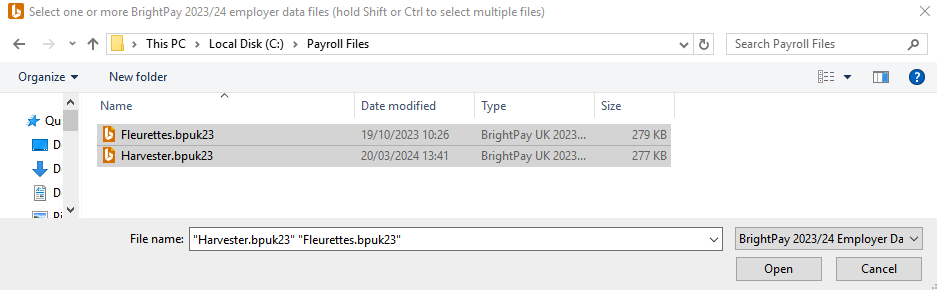

4) Browse to the location of your 23-24 employer data files, highlight the employer data file and simply select Open.

5) If you are importing multiple employer data files:

Either:

- Hold the Shift key on your keyboard and select the first and last employer data file that you wish to import and all employer files within the start and end range will be selected.

Or:

- Hold the Ctrl key on your keyboard and individually select the employer files you wish to import.

6) Select Open

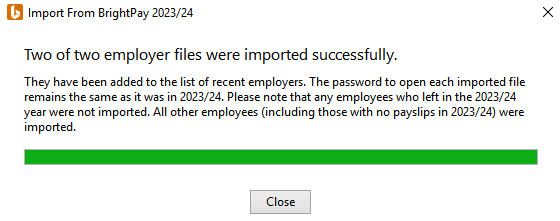

7) All selected 23-24 employer files will now be imported into 24-25 BrightPay and will be listed on your 24-25 Open Company screen.

Please note: if the employer file is password protected, the password will be the same as the previous year.

Please note: All employee data records will be reset for the start of the new tax year and all associated 2024/25 budgetary changes will be applied as per HMRC instruction.

What HMRC require before commencing payroll from 6th April 2024

Employees without a new tax code

Carry forward the authorised tax code from the employee's 2023/24 payroll record to their 2024/25 payroll record.

Do not copy or carry over any ‘week 1’ or ‘month 1’ markings.

Employees with a new tax code

Keep and use the form P9(T) or other tax code notification with the most recent date on for each employee.

HMRC advises to:

• scrap any form P9(T) or other tax code notification for the same employee with an earlier date

• copy the tax code from the form P9(T) or other tax code notification onto your payroll record

• update any tax codes where you have received form P9(T) or other tax code notification after you have set up your payroll records.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.