Paying Employees using Modulr

BrightPay’s integration with Modulr provides a fast, secure and easy way to pay employees through BrightPay, eliminating the need to create bank files and the manual workload associated with making payments to employees.

To avail of this integration, users will require an active Modulr account. For more information about Modulr or if you would like to book a demo, please click here.

Please note: this functionality is currently only available for BrightPay for Windows at this time.

Paying Employees using Modulr through BrightPay

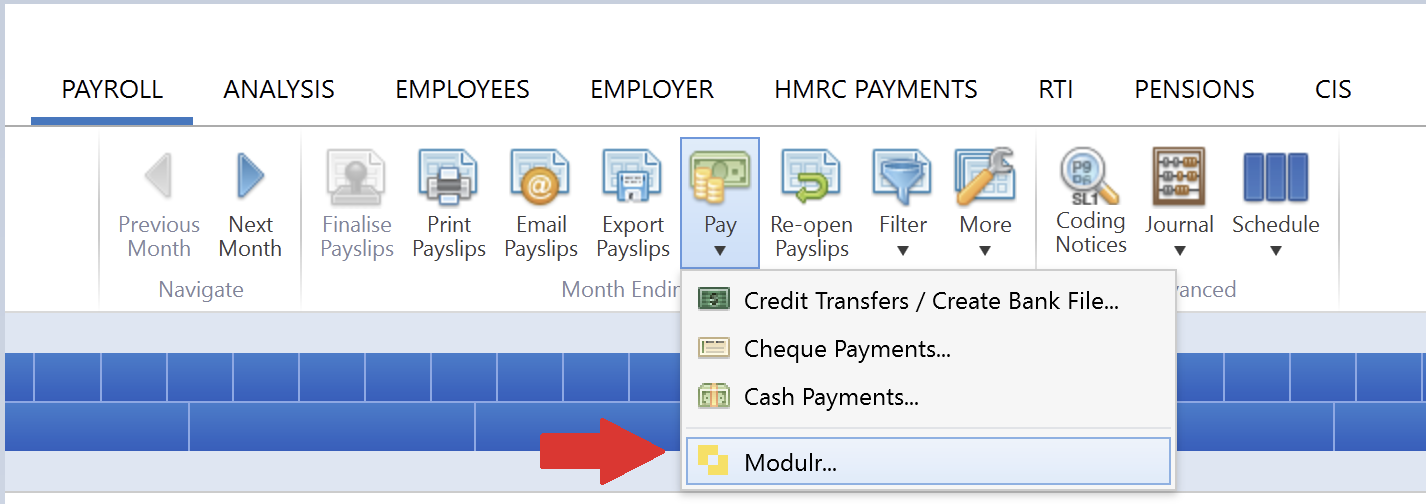

1) After finalising your payslips in the normal manner, simply click 'Pay > Modulr' to access the Modulr utility:

2) Click Continue on the next screen:

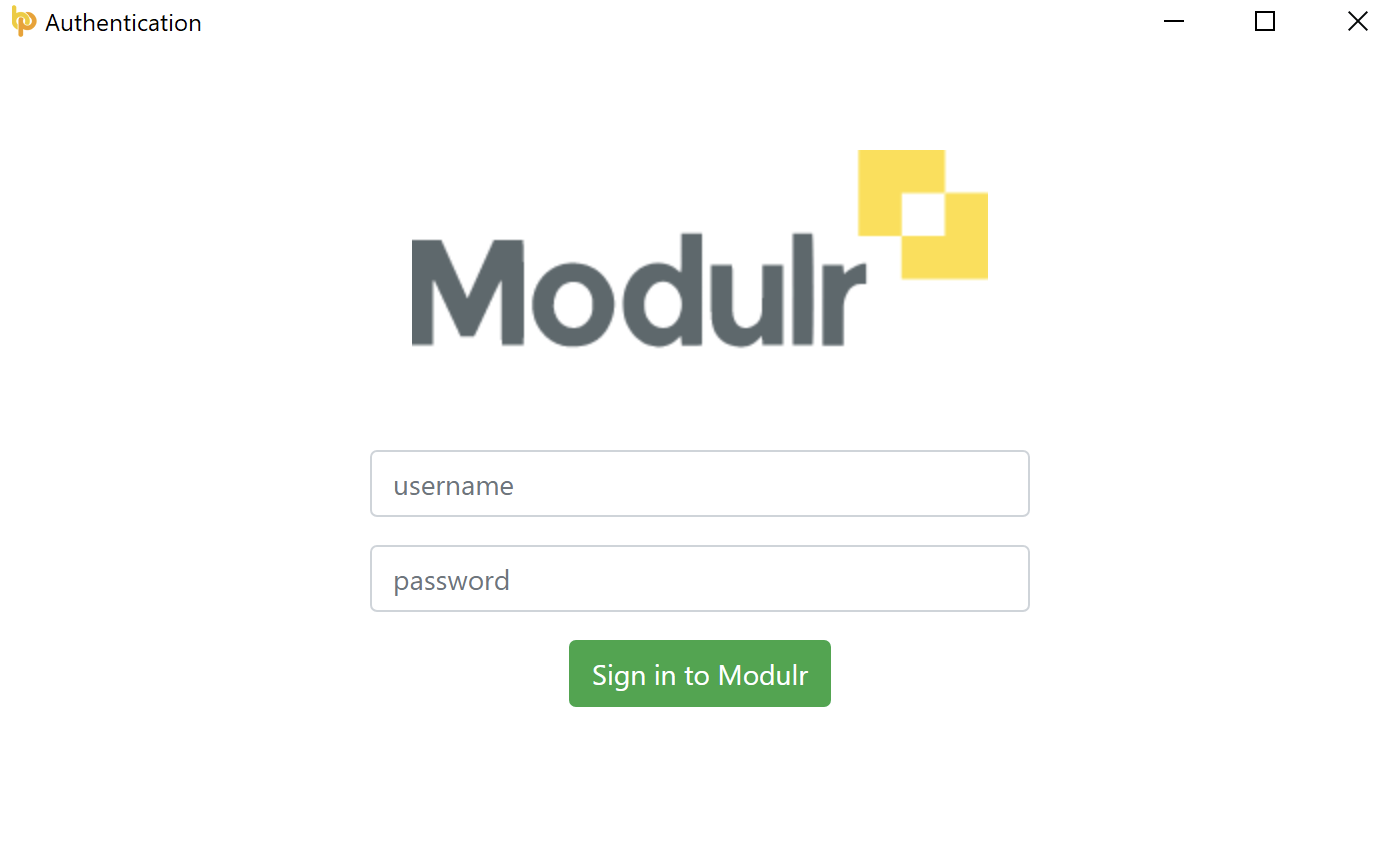

3) Next, enter your Modulr username and password in the fields provided, followed by 'Sign in to Modulr':

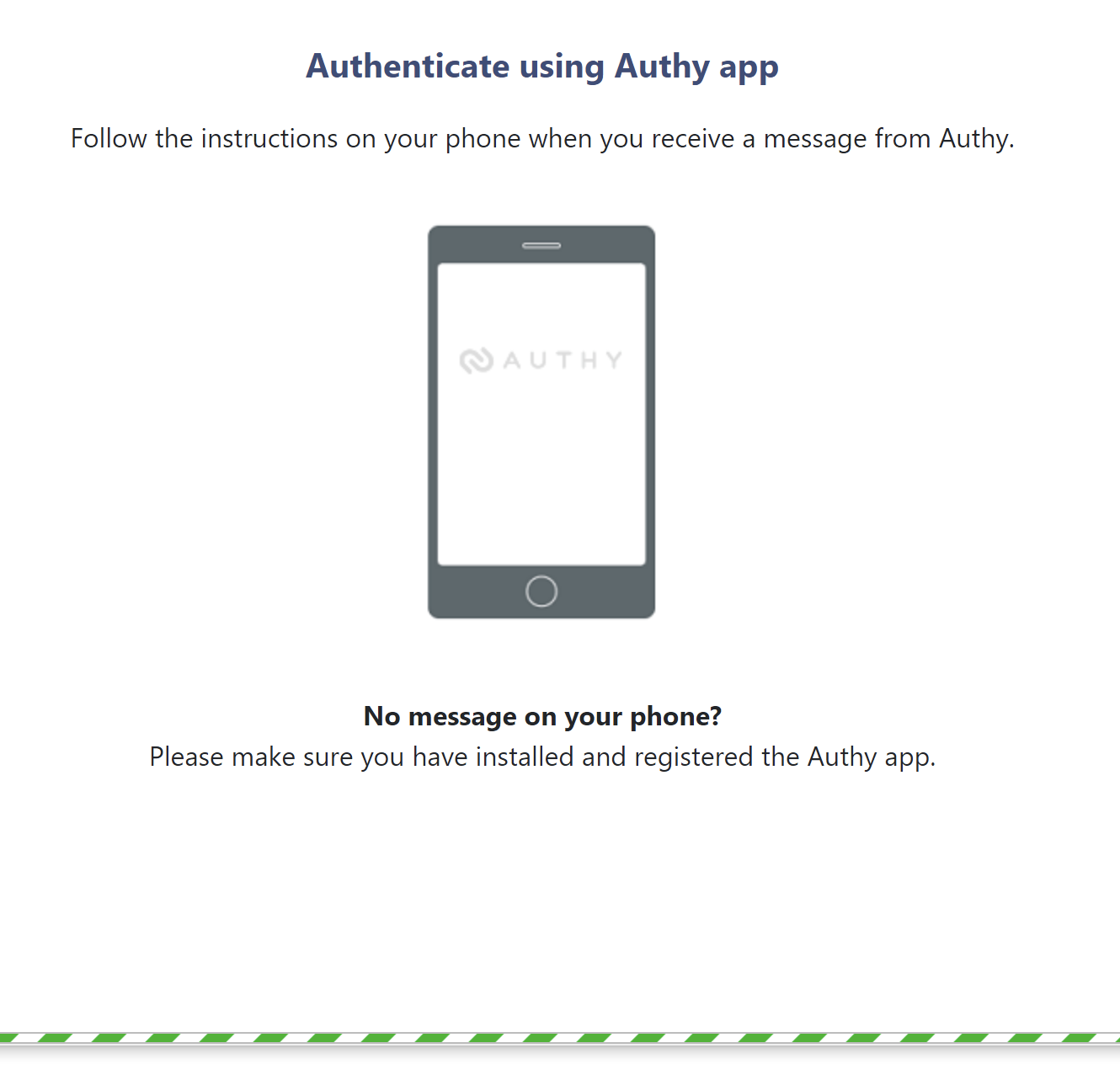

4) You will now be asked to authenticate your Modulr account using Authy. To do so, you will need to have installed and registered Authy on your mobile device.

- Simply follow the instructions on your phone when you receive the message from Authy:

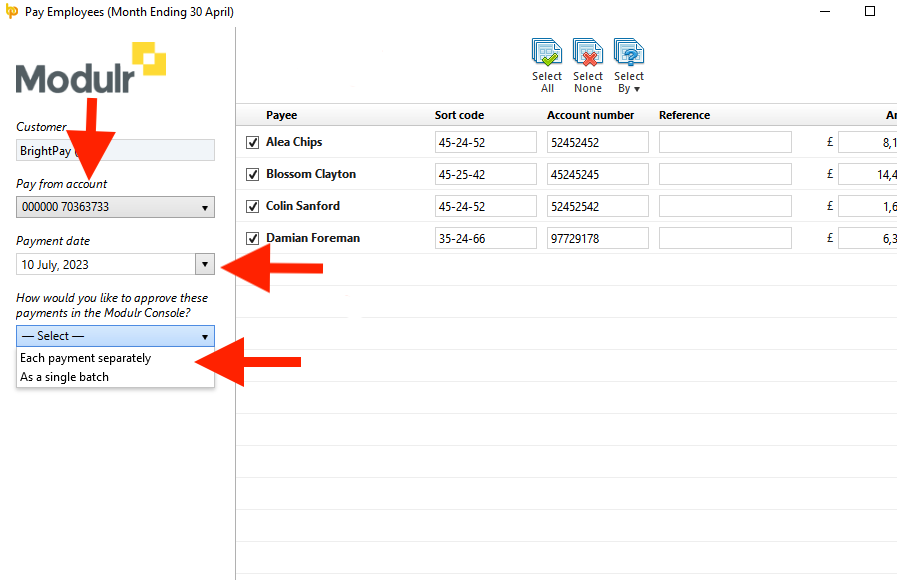

5) Once signed in, a list of customers linked to your Modulr account will now be made available for selection.

Please note: bureau customers will require the necessary permissions to send a payment request on behalf of clients.

Simply select the applicable customer making the payment from the drop-down menu:

6) Employees whose payment method has been set to credit transfer will now be displayed for review.

a) Pay from Account - select the account you wish to make payment from using the drop-down menu

b) Payment Date - select the payment date required

c) Select how you would like to approve the payments in the Modulr Console:

-

Each Payment Separately - Payments are submitted together but the operations (approve, reject, cancel) on the payments in the submission are actioned individually

- As a Single Batch - Payments are submitted and operated on (approve, reject, cancel) as a single batch (new feature)

For more information please see here.

d) Payee - review the list of payees for payment and de-select any who you wish to exclude from the payment run

e) Sort Code & Account number - ensure the correct bank details are entered for each applicable employee

Please note: bank details which have been entered on the employee's record will be displayed by default.

f) Reference - enter a reference for the payment, if desired

Please note: where you would like to use the same reference for each employee, this can be entered once and quickly copied to all other employees by clicking the spanner symbol which will appear to the right of the reference field.

In addition, payment references must consist of at least 6 alphanumeric characters that are not all the same. Total of all characters must also be less than 18. Optional, uncounted characters include space, hyphen, full stop, ampersand and forward slash.

g) Amount - the payment amount for each employee will reflect the employee's 'take-home pay' on their payslip for the pay period being paid

Please note: in the event you wish to amend an employee's payment amount to be paid through the Modulr utility (e.g. where an employee has been given an advance payment), simply amend the amount accordingly. It is important to note that this will not change any payslip amounts, simply the amount being submitted to Modulr.

7) Click Continue when ready to proceed

A summary of your payment request will now be displayed for final review.

When ready to submit your payment request to Modulr, click 'Send to Modulr'. A further Authy request will now be sent to your mobile device asking for you to approve the payment request submission.

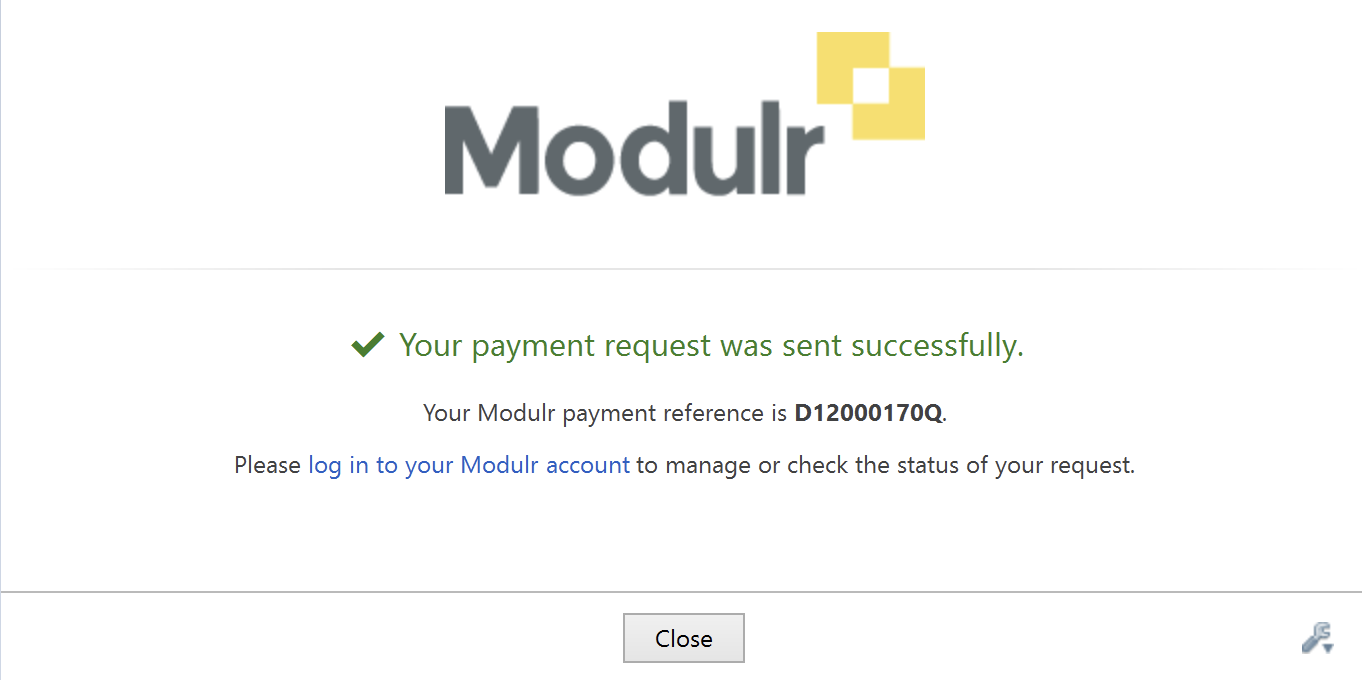

8) On approval, confirmation that your payment request has been successfully sent to Modulr will now be displayed:

On successful submission to Modulr, the person authorised on the associated Modulr account to approve payments should now log into their Modulr account, or when ready to do, to approve the payments.

Our short video provides a walk through of both the BrightPay and Modulr process should this be of further assistance:

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.