Recovering CIS deductions suffered

If you wish to claim recoverable amounts for CIS deductions suffered, these must first be entered within your HMRC Payments utility.

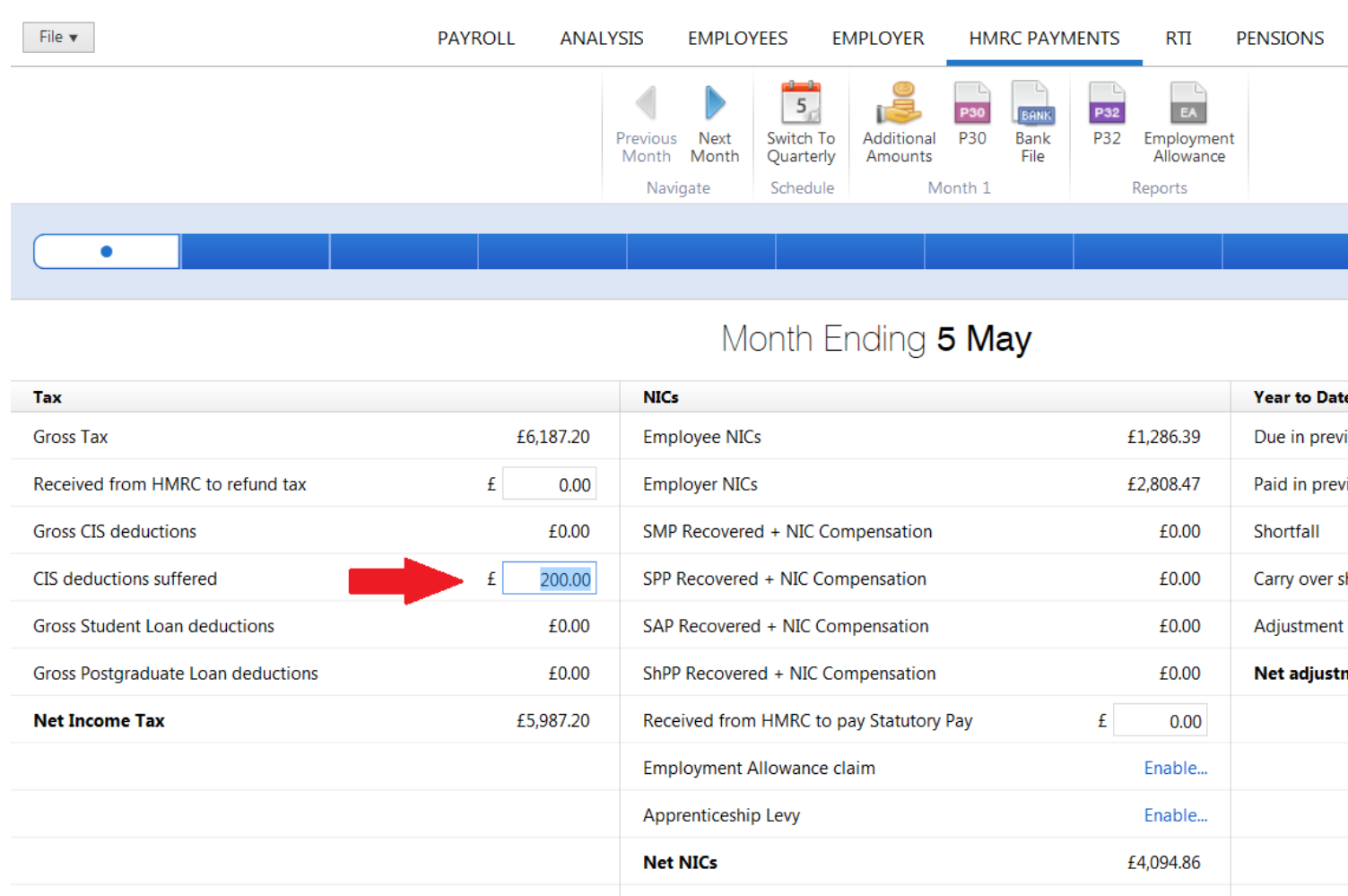

1) Select the applicable tax period on the blue schedule bar and enter the periodic amount in the CIS deductions suffered field

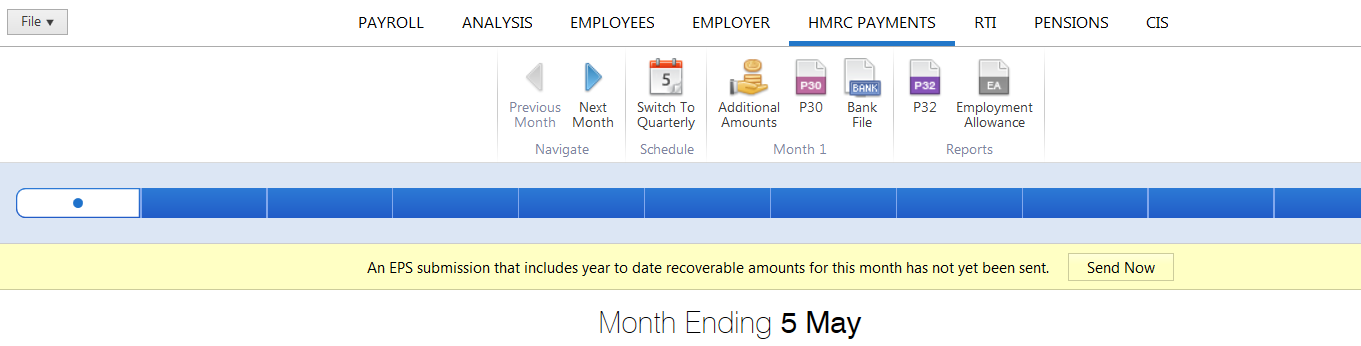

While in HMRC Payments, if CIS recoverable amounts are detected in a tax period, BrightPay will prompt you that an EPS is due:

If you have no further items you wish to report via the EPS, simply click 'Send Now' and submit your EPS to HMRC.

Important Note regarding the EPS

From April 2022, when submitting CIS deductions suffered to HMRC, it will be a requirement to include your Corporation Tax (CT) UTR on the EPS.

Your Corporation Tax UTR can be entered Employer > Edit Employer Details > Registration Details

Once entered, BrightPay will automatically include this on the EPS and your EPS will submit with no issues.

Creating an EPS within the RTI utility

Alternatively, an EPS can be created and submitted to HMRC via the RTI utility. This process will facilitate reporting more than one item on the same EPS, if required e.g including bank details, final submission indicator for the tax year etc.

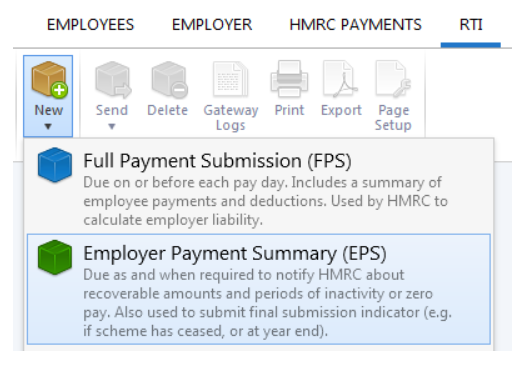

1) Simply select 'RTI' on the menu bar

2) Click 'New' on the menu toolbar and select 'Employer Payment Summary (EPS)'

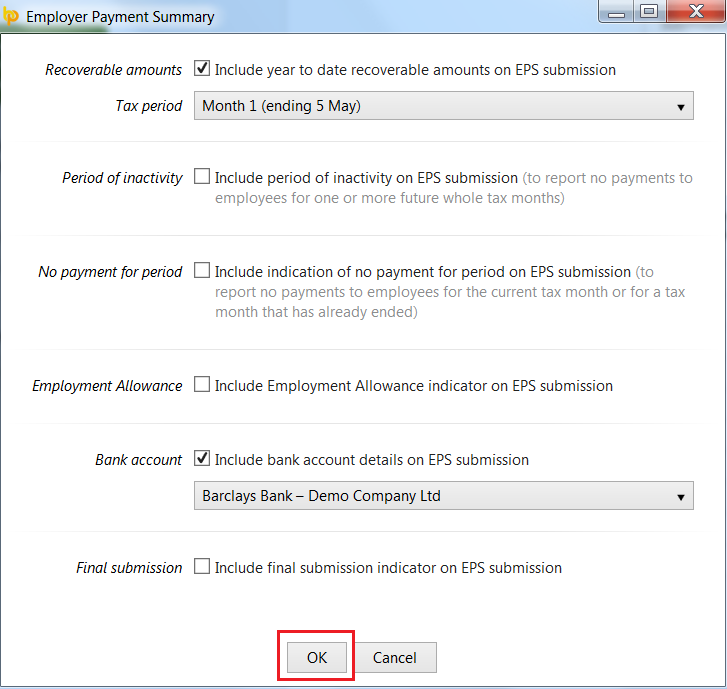

3) Complete the EPS accordingly and click 'OK' to save

4) Submit to HMRC when ready

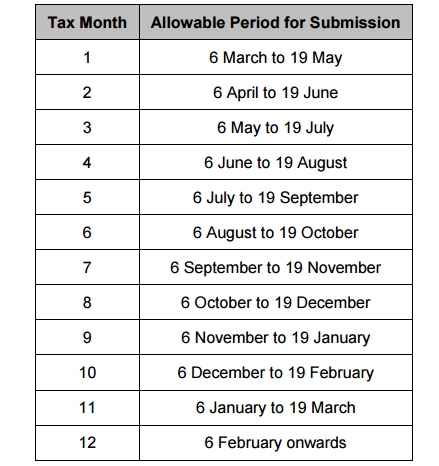

Allowable Period for Submission of an EPS with an Entry in Tax Month:

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.