Force including an employee's starter declaration on an FPS submission

BrightPay facilitates the ability to force include an employee's starter declaration on an FPS submission that covers a different period to the employee's starting period.

This scenario may arise where for some reason their starter information has not been sent to HMRC, for example:

- the employee's start date was not originally entered

- a new employee was processed in different software but their starter declaration was never sent

- a new employee was not paid in their first pay period and they were excluded from the FPS submission (click here for more details)

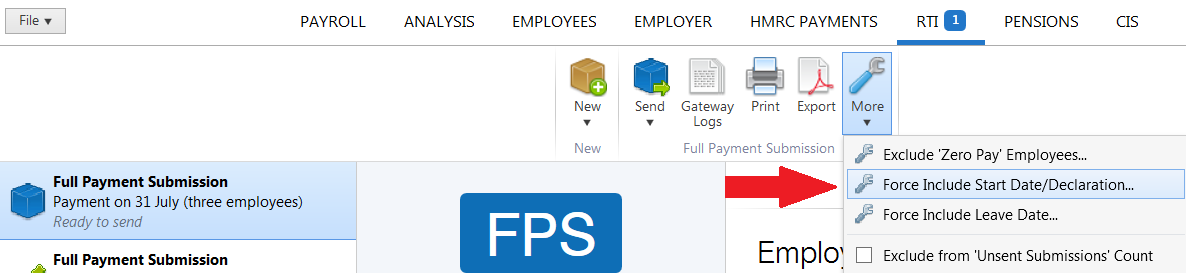

To force include an employee's starter declaration information on an FPS, within the RTI utility:

- Select the appropriate FPS submission from the left hand listing

- Click More > Force Include Start Date/Declaration...

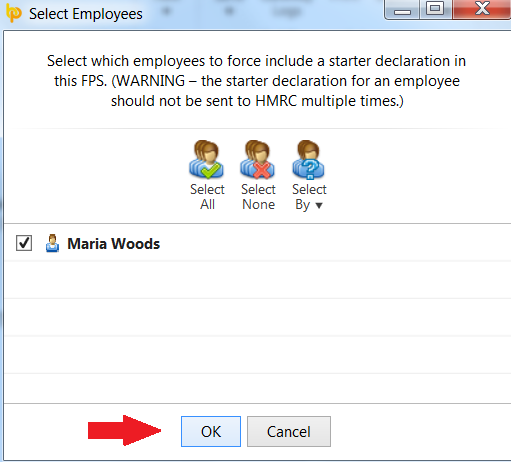

All employees for whom a start date in the current tax year is detected will be available for selection.

- Select the employee(s) you wish to force include a starter declaration for in the FPS selected and click OK.

Please note: care should be taken that the starter declaration for an employee is only sent once to HMRC.

The employee(s) starter declaration information will now be included in the Full Payment Submission for submission to HMRC.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.