Employer Information

In the Employer section of the Client Portal a user can access basic Employer Information. This information can be edited and saved once the user has permission to do so. Details entered or any changes saved by a user will be updated in the Client Portal and in the employer in BrightPay.

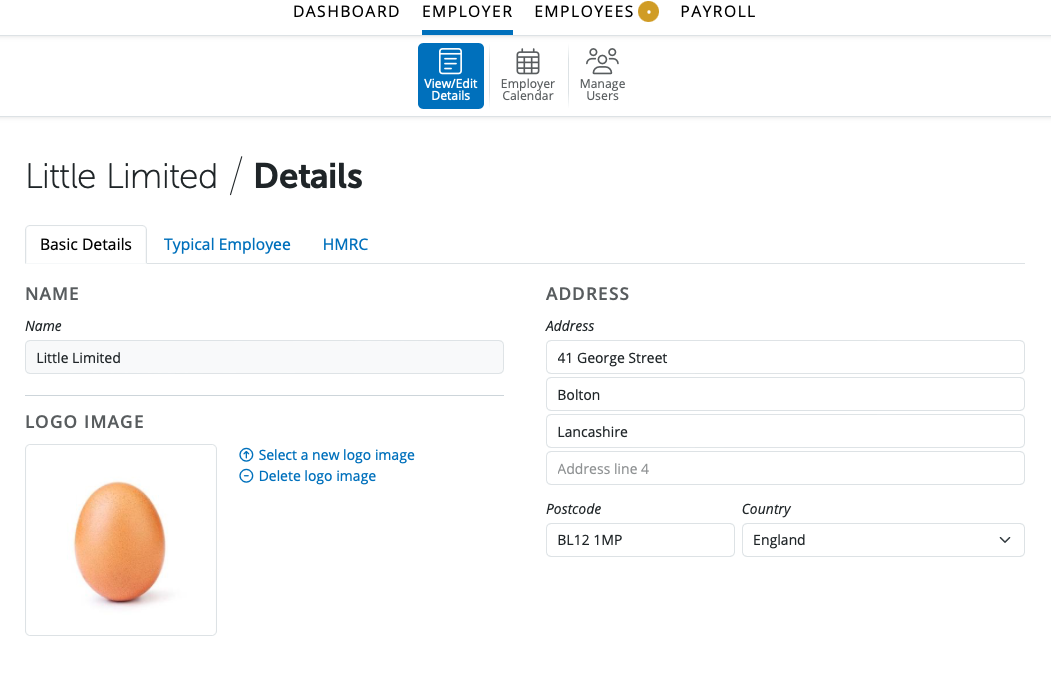

Basic Details

1) Employer Name

2) Employer Address

3) Employer Logo can be added or removed

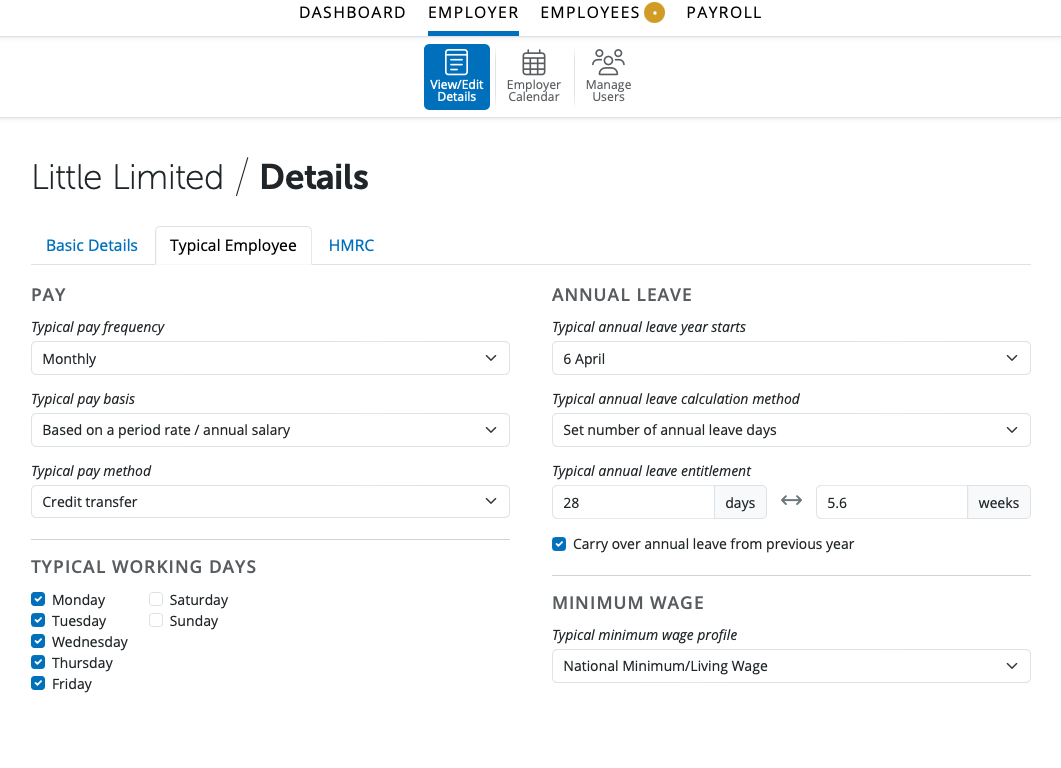

Typical Employee

This section allows the user to create settings that will be used as the default when adding a new employee. These settings are:

1) Typical Pay Frequency

2) Typical Pay Basis

3) Typical Pay Method

4) Typical Working Days

5) Typical Annual Leave Year Starts

6) Typical Annual Leave Calculation Method

7) Typical Annual Leave Entitlement

8) To carry over annual leave from previous year

9) Typical Minimum Wage Profile

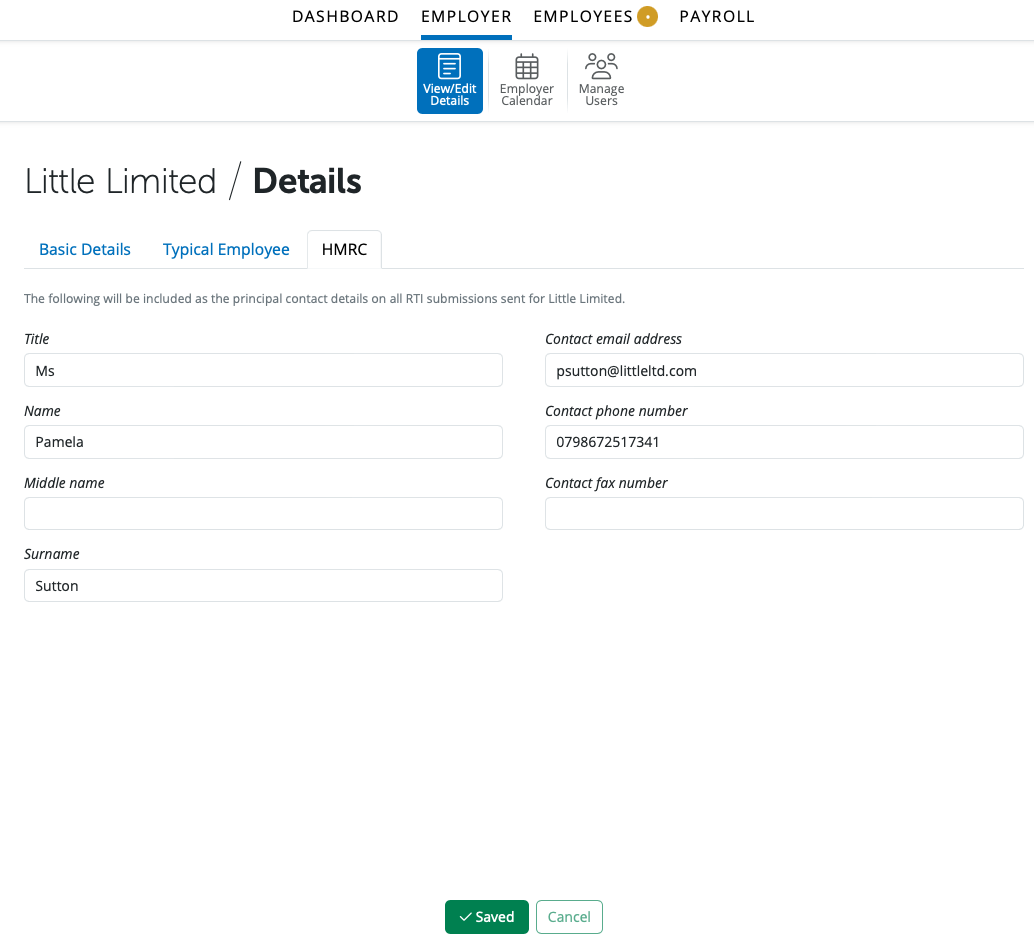

HMRC

The Contact details can be entered or edited on the Client Portal that will be the principal contact details on all RTI Submissions sent to HMRC for the employer.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.