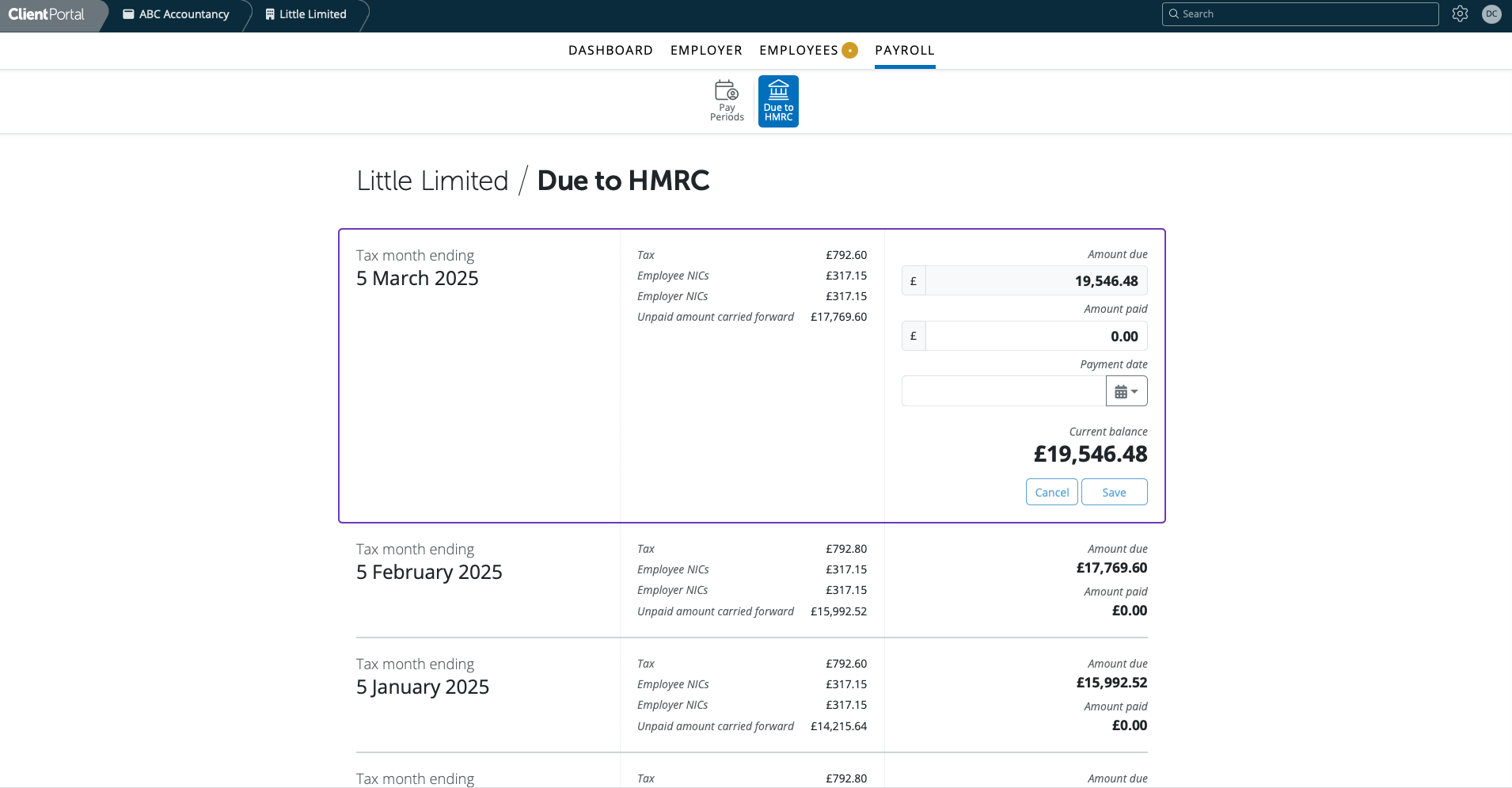

Due to HMRC

In the Payroll section a user can view amounts due to HMRC for the employer. A summary of liabilities of tax and NICs for the employer will be visible for each tax month/quarter and the unpaid amount carried forward. HMRC payment periods will show if their tax period start date is on or before the current date and there is an amount due. (this does not include a shortfall only carry over)

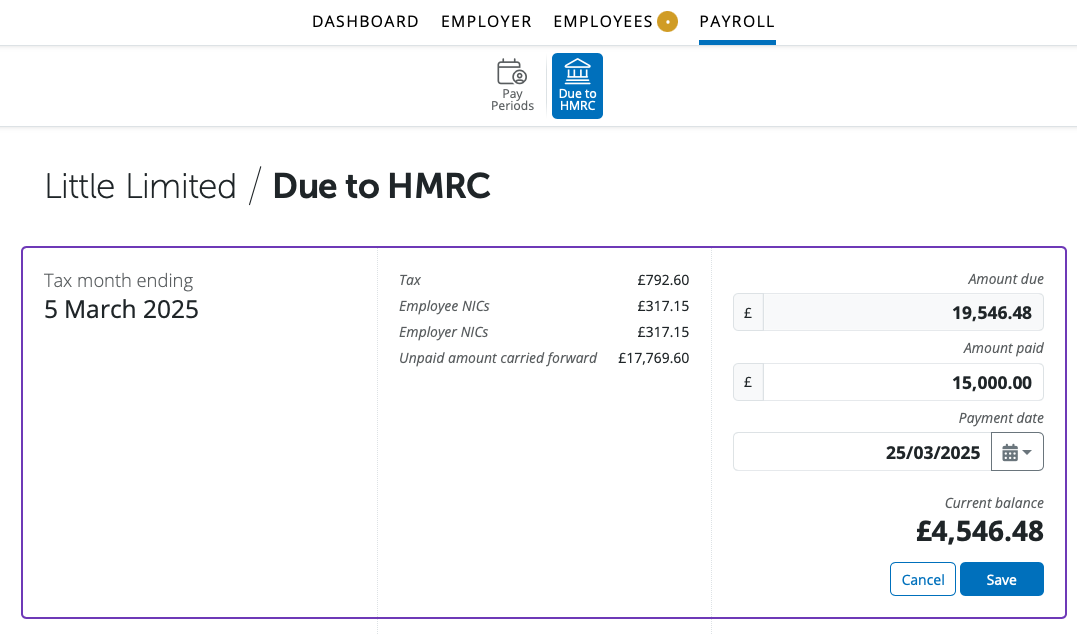

A user can enter in the amount paid to HMRC for the current tax month/quarter in the 'Amount Paid' field if desired, and can select the payment date for the payment made to HMRC. Select Save to update the information. Any details entered and saved will update in the employer in BrightPay.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.