Directors appointed during the tax year

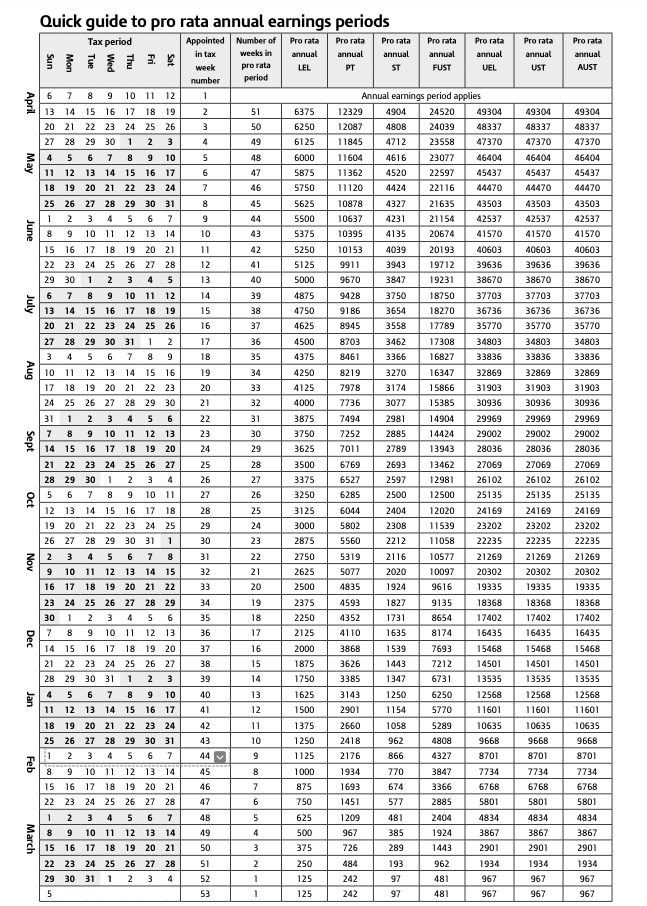

Directors first appointed during the tax year have a pro rata annual earnings period for the remainder of that tax year for the calculation of NIC.

The number of weeks in the pro rata annual earnings period is

- the tax week of appointment, and

- the remaining tax weeks in the tax year

Please note: there are 53 weeks in the tax year but only 52 weeks are used when working out the pro rata period. If someone is appointed in week 53, the pro rata period is 1 week.

Example

A director is appointed in tax week 30.

The number of weeks in the pro rata annual earnings period is 23 weeks and the director will therefore have the following pro rata annual NI thresholds:

- Pro rata annual LEL: £2,875

- Pro rata annual PT: £5,560

- Pro rata annual ST: £2,212

- Pro rata annual UEL: £22,235

Quick Guide to the Pro Rata Annual Earnings Periods for 2025-26

Please note: if someone is appointed in week 53, the pro rata period is 1 week.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.