IImporting from SAGE 50 Payroll - using a CSV File (mid year)

BrightPay facilitates the importing of employee information in CSV format from SAGE 50 Payroll.

If you are migrating to BrightPay mid tax-year, both employee and their mid-year pay information can be imported from SAGE 50 Payroll into BrightPay using this import option.

Apologies for the poor representation of Sage screens below. We were asked by Sage to desist from using actual screen shots.

Importing into BrightPay mid Tax Year

Please log in to BrightPay with your Bright ID. If you have already purchased BrightPay or another Bright product or used BrightPay Connect you will already have a Bright Id. If you do not have a Bright Id please click sign up for a Bright Id.

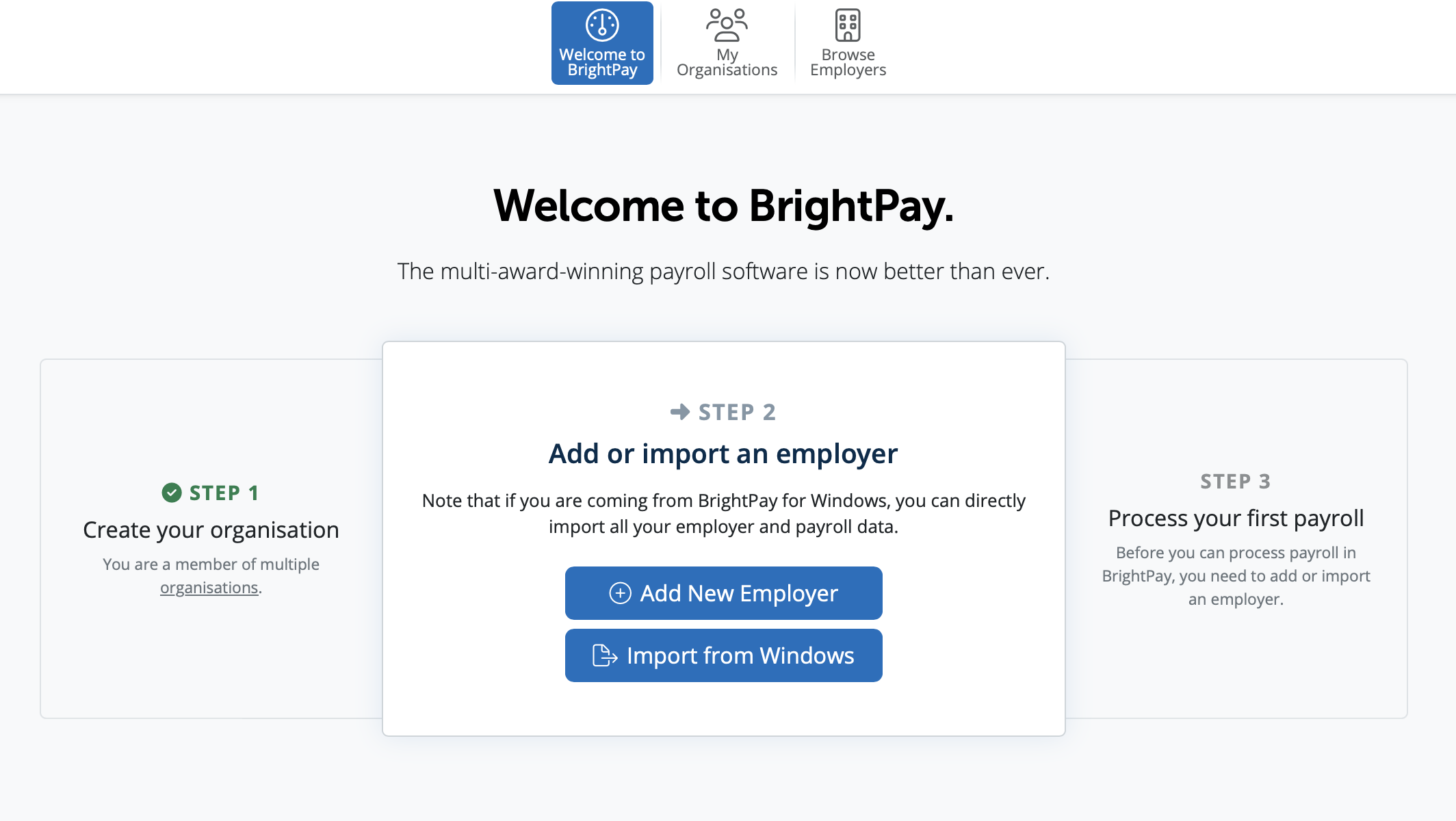

As a new user, when you log into BrightPay, on the Welcome to BrightPay you will have a step by step guide on how to set up your information.

Step 1 - You will need to set up an Organisation. For assistance on setting up your organisation please see here.

Step 2 - Please Create or Import an employer - For assistance on setting up your employer please see our step by step guide.

Step 3 - Open the employer in order to import your employee and pay information into BrightPay.

In order to export your data from Sage to csv file(s) please:

1) Export your CSV file containing your employee information from within your Sage 50 Payroll Software

Apologies for the poor representation of Sage screens below. We were asked by Sage to desist from using actual screen shots.

In Sage 50 Payroll go to > 'File > Data Export > Payroll Data Export':

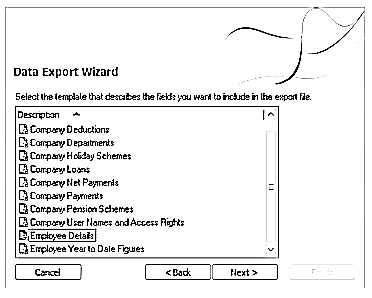

1 a) Select Employee Details and click 'Next'

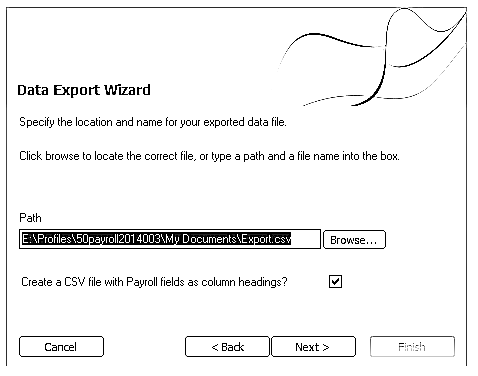

1 b) Select the location where you would like to save your file to using the 'Browse' button - click 'Next' when ready.

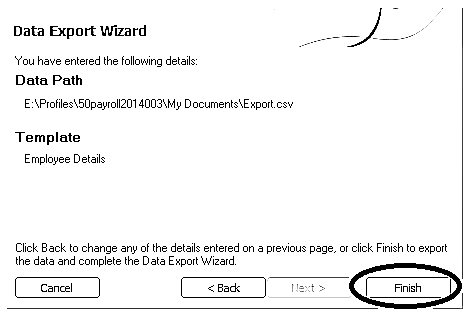

1 c) Click 'Finish'

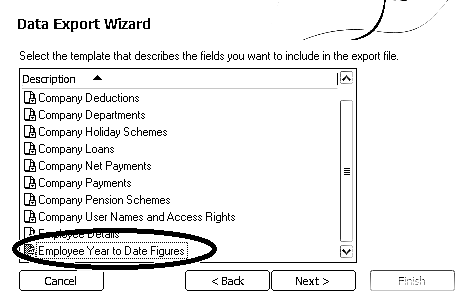

1d) Repeat the above process, to now export your employees' 'year to date' amounts.

Select 'Employee year to date figures' from the listing and click 'Next'.

Follow steps 1b) and 1c) above to complete the export of this CSV file.

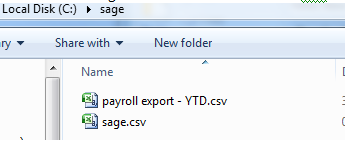

1 e) Now go to the location where you have saved your Employee CSV file to and change the name of this file to 'sage.csv'. This can be done by right-clicking on the file name and selecting 'Rename'. By doing this, BrightPay will be able to recognise that you are importing from SAGE 50 Payroll.

Please note: it is important that only the employee CSV file is renamed to 'sage.csv'. There is no requirement to rename your 'year to date' CSV file.

In addition. do not open the CSV file, as Excel will format items such as sort code and account numbers and they may no longer be importable into BrightPay.

2) Now create your Employer into BrightPay.

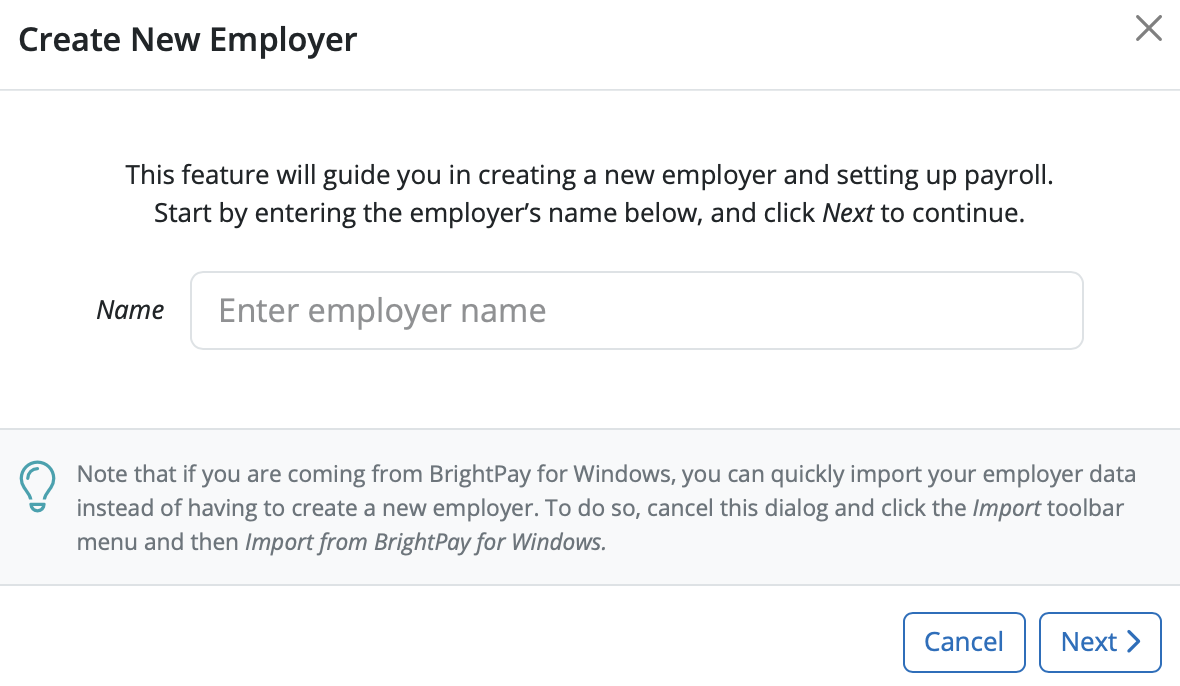

2 a) To manually create an employer in BrightPay select Add New Employer.

2 b) You can manually enter in the name of your employer. This is the name you have registered with Revenue and will appear on the payslips for your employees. Select 'Next'.

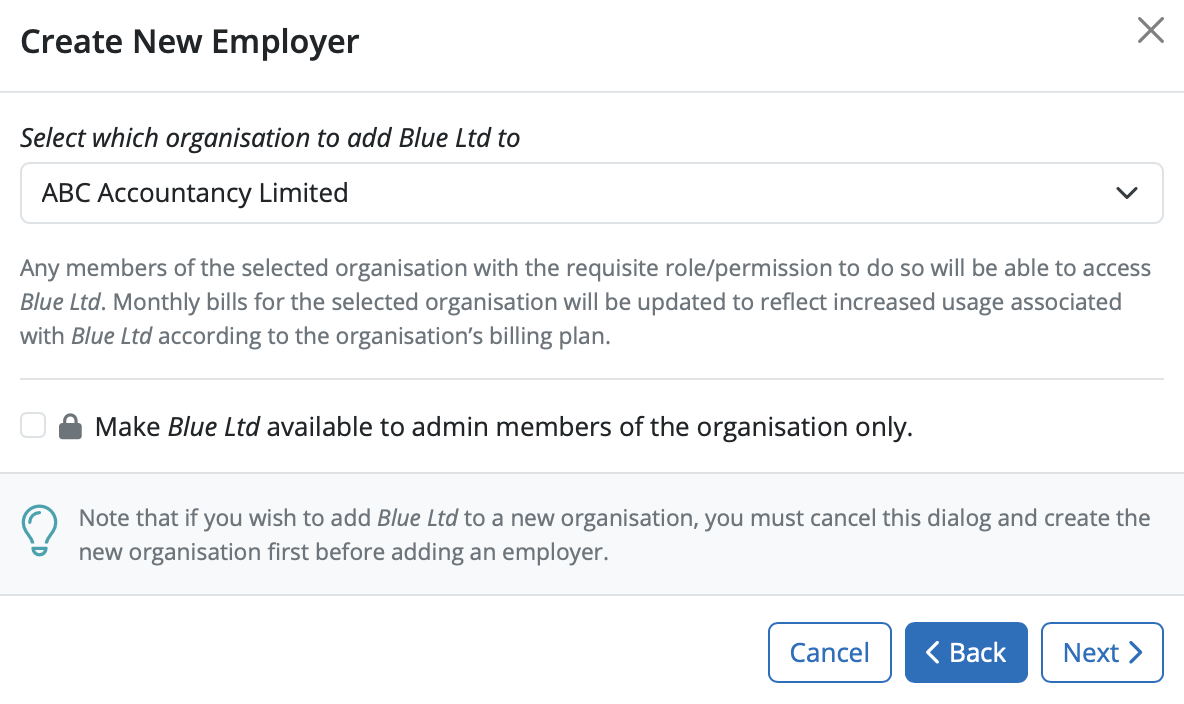

2 c) A new employer has to be assigned to an organisation. Select the organisation you wish to add your employer to.

If you wish you can mark an employer as available to admin members of the organisation only. This means that only the owner and administrator members of the Organisation will be able to see this employer when they access BrightPay.

Select 'Next'

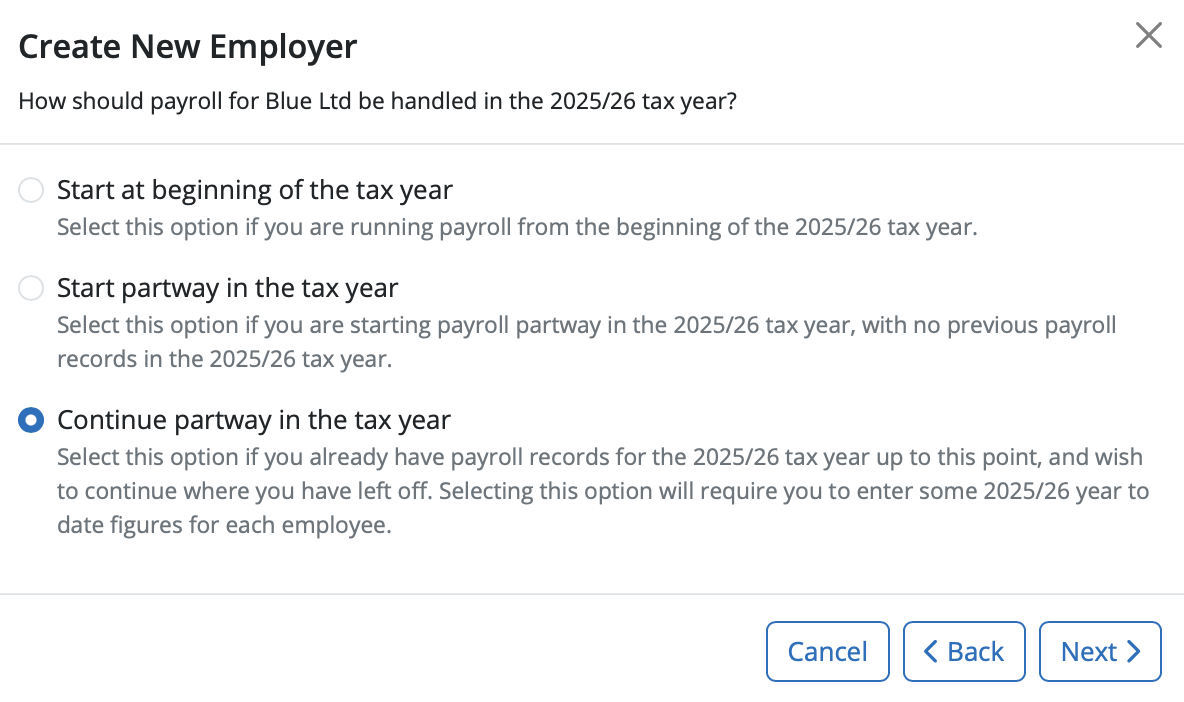

2 d) You’ll be asked how would you like to use BrightPay – three options are available:

1. Start at the beginning of the tax year - select this option if you are running payroll from the start of the tax year

2. Start Partway in the tax year – you should select this option if you are starting payroll partway in the tax year with no previous payroll records in the same tax year

3. Continue Partway in the tax year – you should select this option if you have already have payroll records for the tax year up to this point and wish to continue from where you have left off. Selecting this option will allow you to enter in year-to-date figures for each employee.

If you wish to import employee information partway through the tax year Select 'Continue partway in the tax year' and Select 'Next'

2 e) Complete each screen accordingly with your relevant employer information.

For further assistance with this, please see our support section on Adding a New Employer.

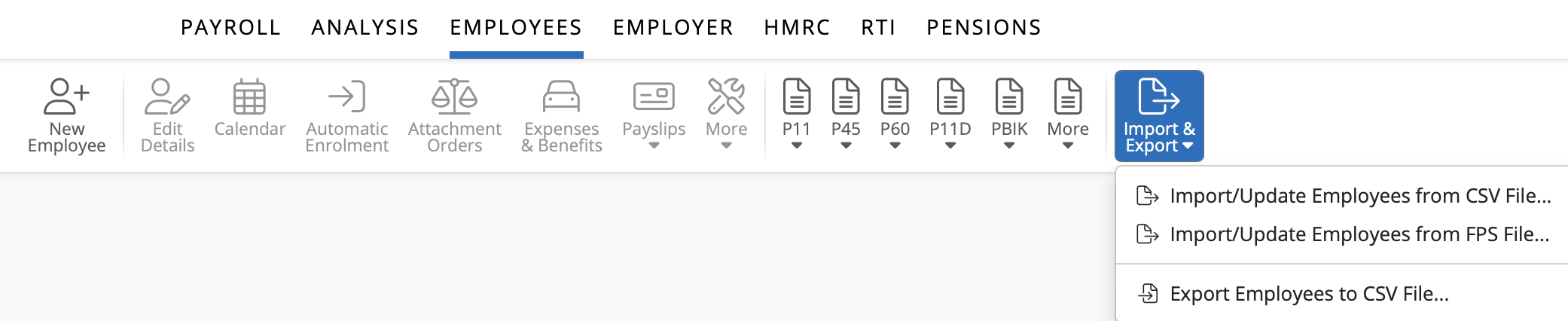

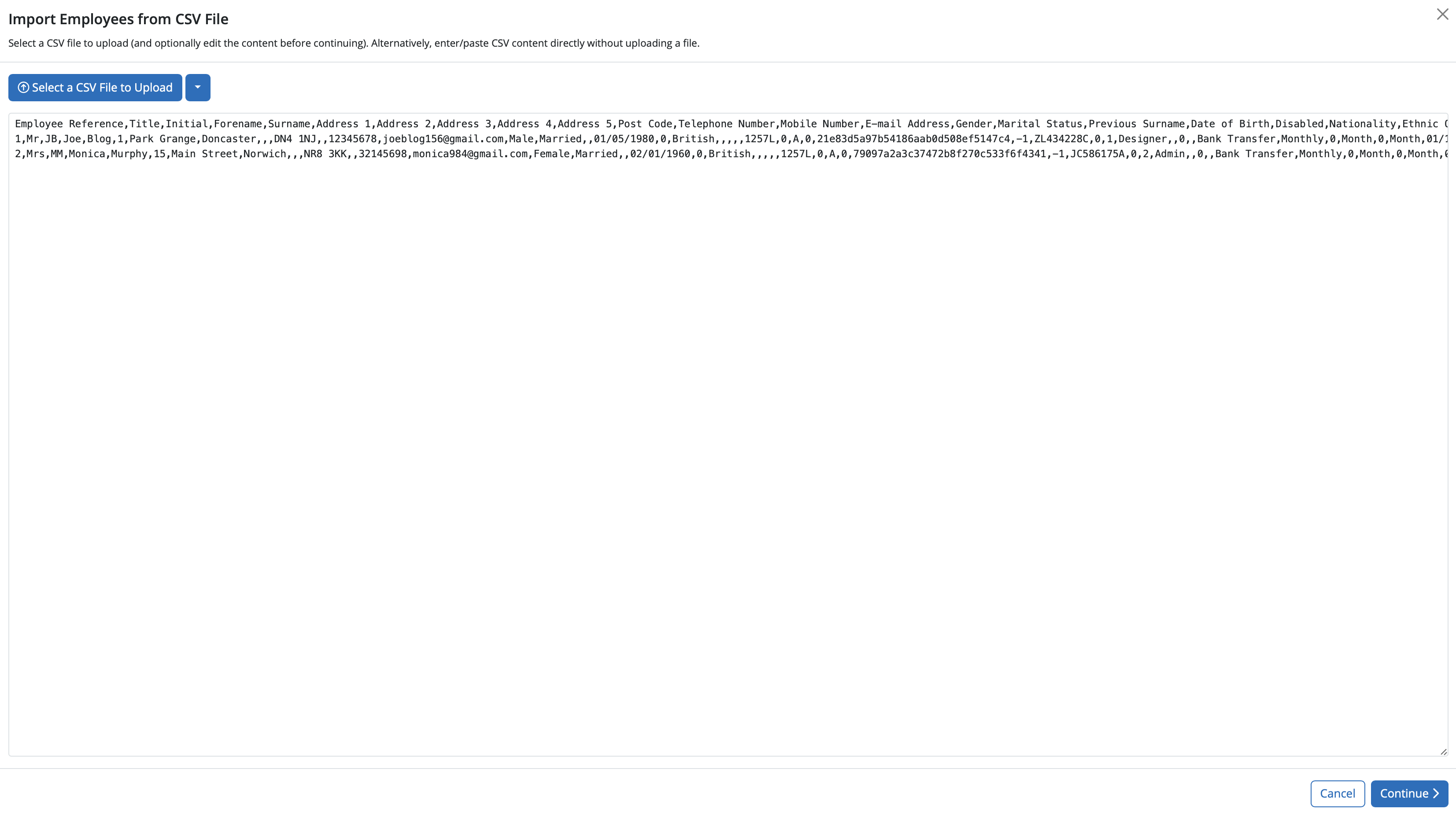

3 ) Once you have entered in and saved your employer information, go to > Employees > Import & Export > Import/Update Employees from CSV File....

4 ) On the Import Employees from CSV File window select 'Continue'

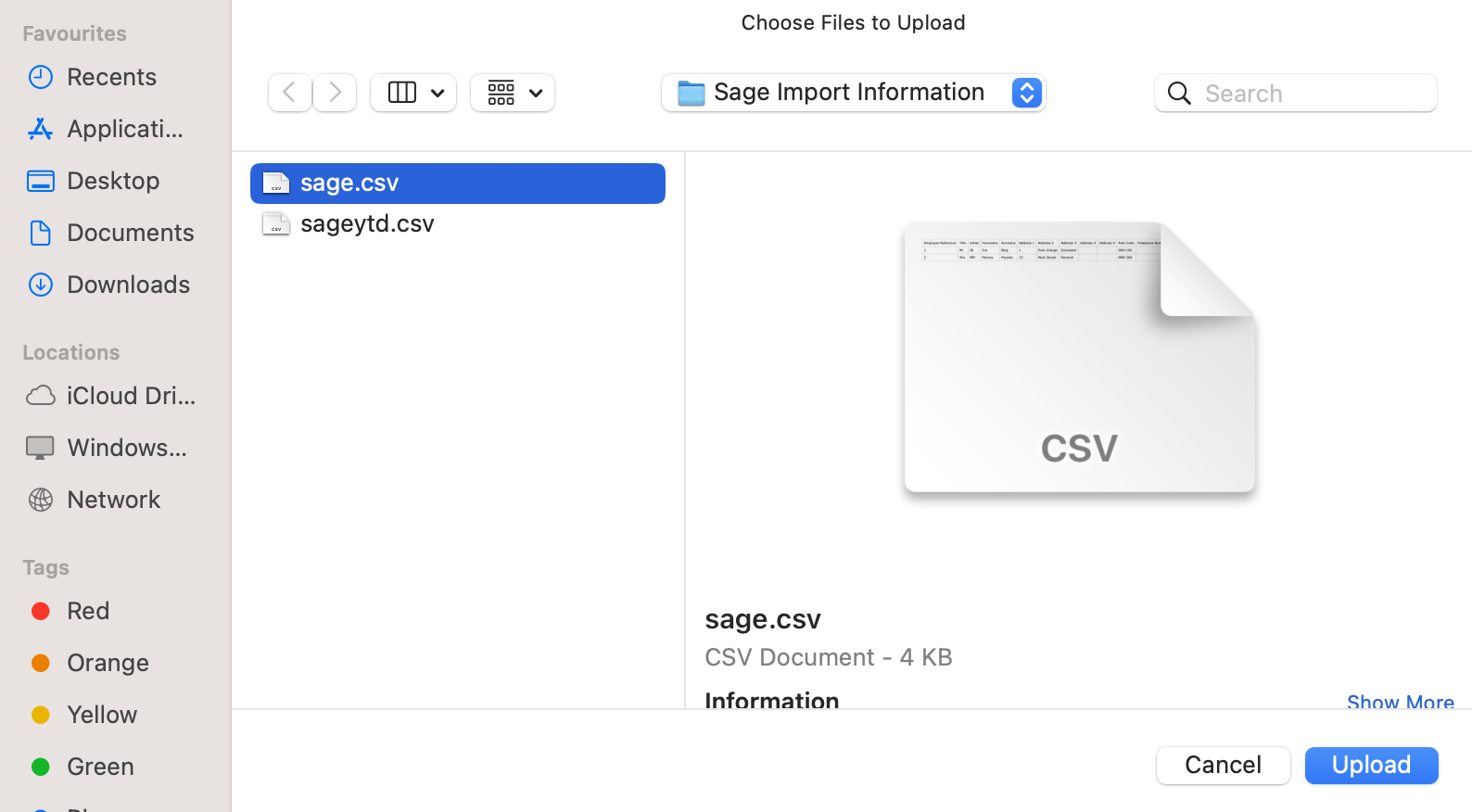

5 ) Browse to the location of your SAGE CSV file, select it and press 'Upload'.

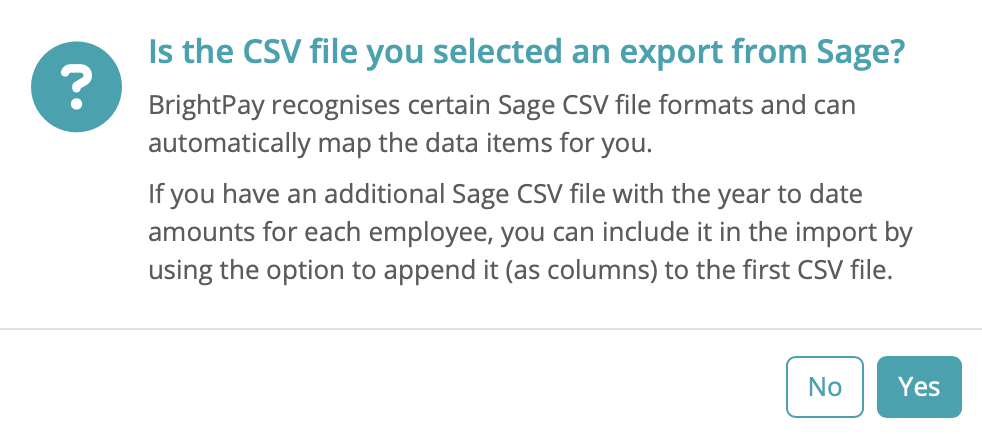

6 ) BrightPay will ask you to confirm that this is a SAGE file - click yes to confirm. If you have an additional SAGE CSV file with the year to date totals for each employee, you can include it in the import by using the

7 ) Your employee information will be displayed on screen. Please select Continue to move forward to the import screen.

8 ) On the import screen BrightPay will automatically match up your column information and will automatically untick the header row. Please untick any rows you do not wish to be imported into your employer.

9 ) Click Import to compete the import of your employee information.

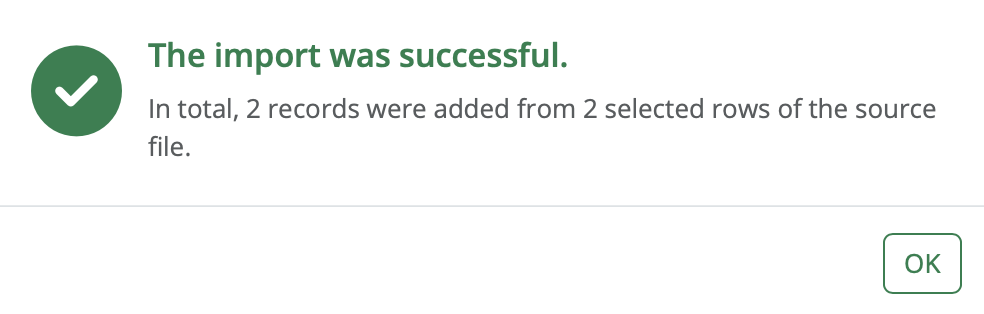

Your employee information will be imported into BrightPay.

Important Notes - please read

Please note: where an employee has had previous employment in the same tax year, the employee's 'gross pay to date', 'taxable pay to date' and 'tax to date' amounts that are imported in from SAGE will include their 'previous employment' gross pay and tax figures. As these previous employment amounts will already be catered for within the Starter/Leaver section of the employee's record in BrightPay, users must ensure that the employee's 'Gross Pay to date' amount, the 'Taxable Pay to date' amount and 'Tax to date' amount within their 'Mid Year Totals' utility are reduced by these amounts prior to processing any payroll. This will avoid the overstatement of gross pay and tax amounts going forward.

Following the import, further employee information can be manually entered within 'Employees', if required. Alternatively you may wish to update missing employee information using CSV file.

It is also recommended that all employee details are reviewed before processing any payroll to ensure information imported in is correct and applicable for the tax year in question.

If you have migrated to BrightPay mid-year, any mid-year cumulative pay information imported in via your CSV file can also be viewed here in each employee’s ‘Mid-Year Totals’ section.

After reviewing your employee information, simply click the 'Payroll' tab to commence processing payroll.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.