Importing using an FPS File - Other Software

BrightPay facilitates the import of employee information, and if applicable mid-year totals to date, using a Full Payment Submission (FPS) file.

Using an FPS file created in your previous software is the quickest way to bring across your basic employee information.

Important Notes

- This import option will only bring across employee information that is required by HMRC in a Full Payment Submission.

Further manual entry may thus be required in each employee record for employee information that is not included on an FPS e.g. email addresses, bank details, annual leave entitlement, departmental allocation, in-year previous employment gross pay and tax details etc.

For a more comprehensive import option, please see the support section on 'Importing using a CSV file'- Other Software'.

- BrightPay can import an FPS from any tax year, therefore care must be taken that the correct FPS file is being selected at the import stage.

Please note that importing an FPS from a previous tax year into the current tax year version of BrightPay will not automatically uplift tax codes. Therefore employee tax codes will need to be updated in each employee record to reflect the correct current year tax code applicable to each employee.

Importing into BrightPay using an FPS file

1. Locate your FPS file

Before proceeding any further, ensure that you know the location of where your FPS file can be found within your previous software and that you have access to this. Some software packages may require you to save the FPS file first, whilst others may have already saved the FPS file automatically for you in a folder. FPS files are in XML format and may be given a name similar to 'FPSFile.xml'

2. Now create your Employer into BrightPay.

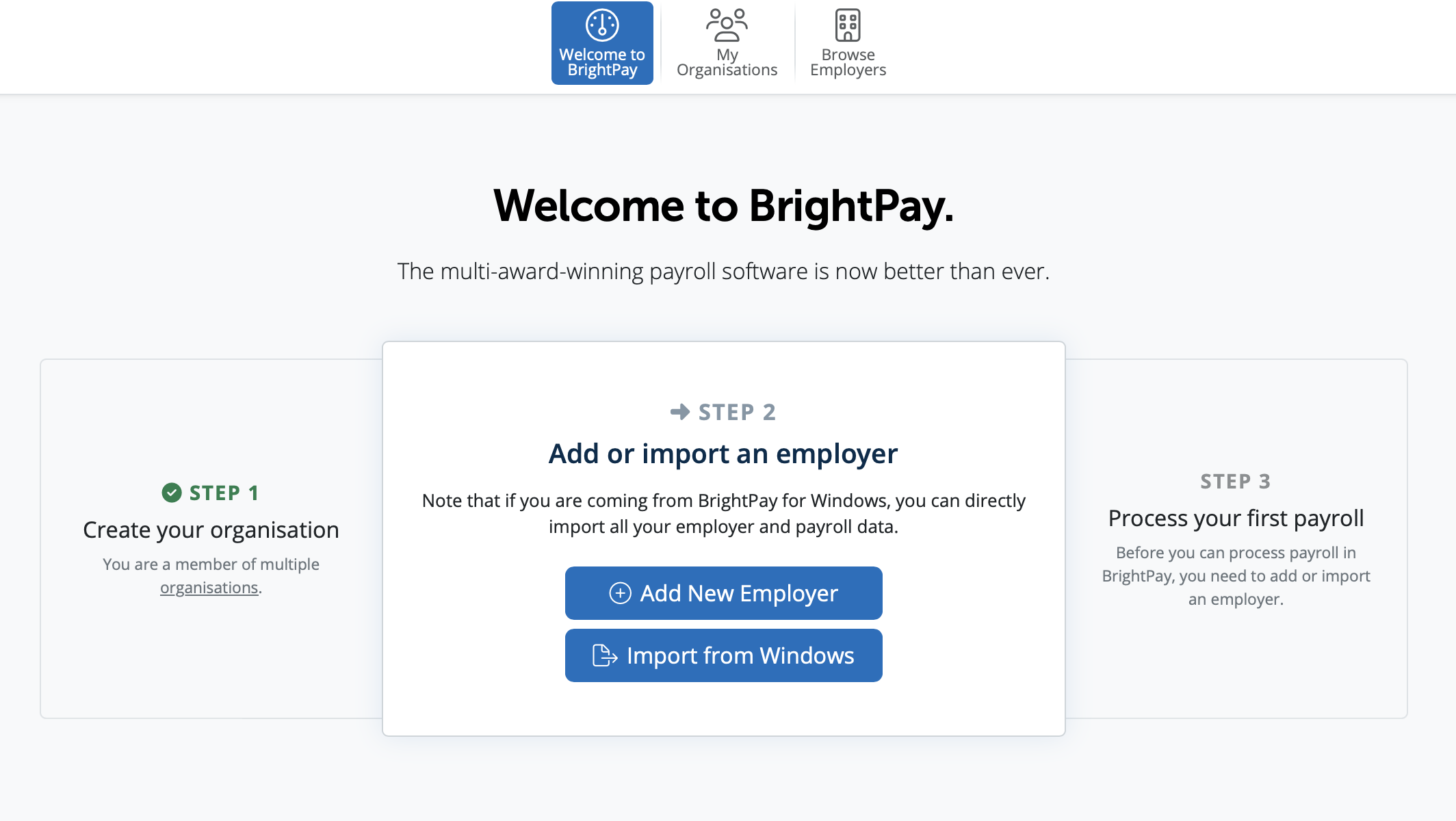

2 a) To manually create an employer in BrightPay select Add New Employer.

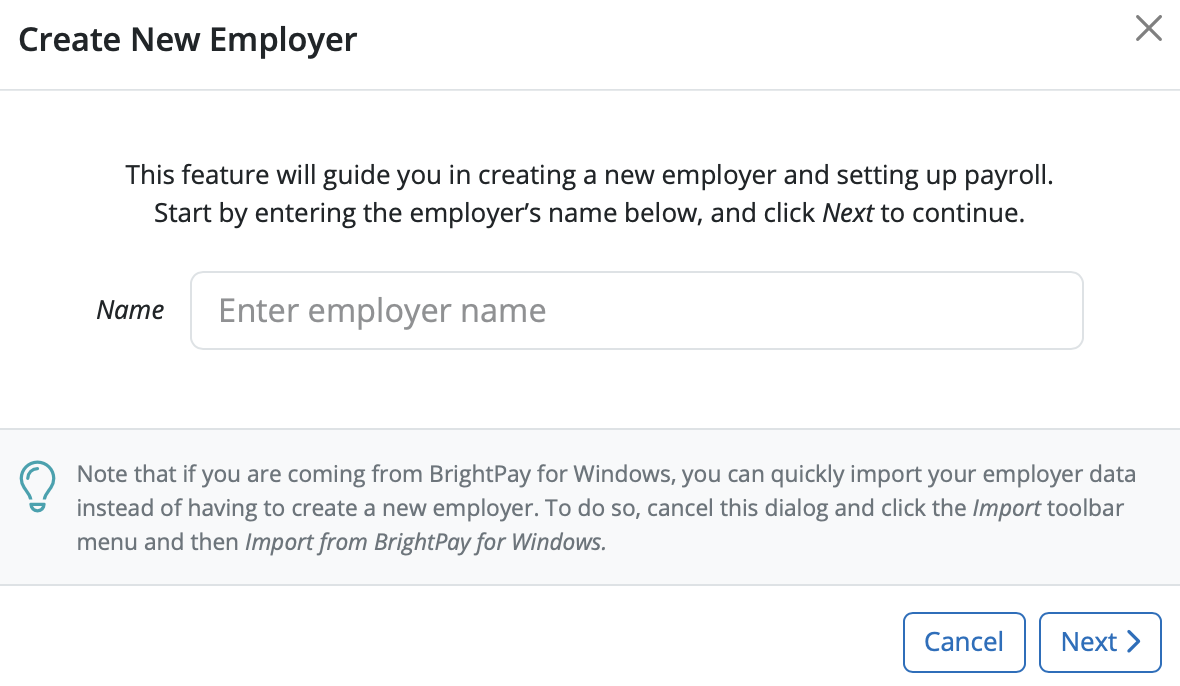

2 b) You can manually enter in the name of your employer. This is the name you have registered with Revenue and will appear on the payslips for your employees. Select 'Next'.

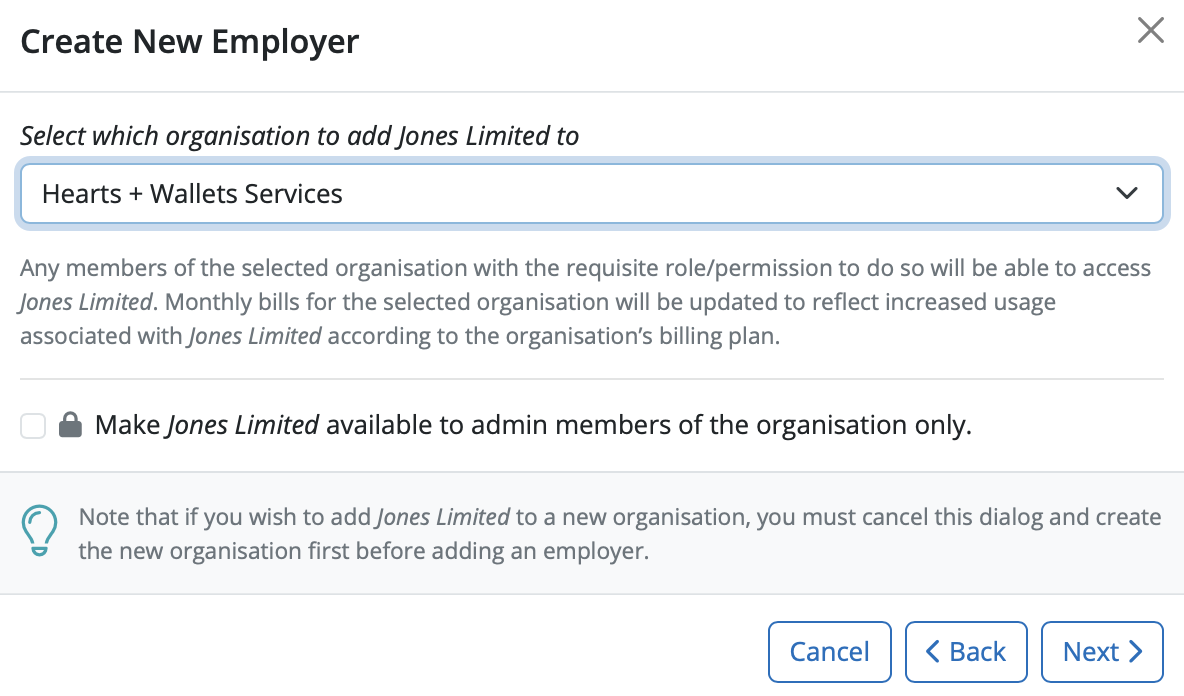

2 c) A new employer has to be assigned to an organisation. Select the organisation you wish to add your employer to.

If you wish you can mark an employer as available to admin members of the organisation only. This means that only the owner and administrator members of the Organisation will be able to see this employer when they access BrightPay.

Select 'Next'

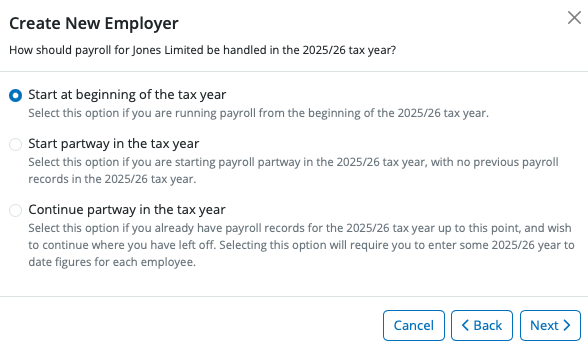

2 d) You’ll be asked how would you like to use BrightPay – three options are available:

1. Start at the beginning of the tax year - select this option if you are running payroll from the start of the tax year

2. Start Partway in the tax year – you should select this option if you are starting payroll partway in the tax year with no previous payroll records in the same tax year

3. Continue Partway in the tax year – you should select this option if you have already have payroll records for the tax year up to this point and wish to continue from where you have left off. Selecting this option will allow you to enter in year-to-date figures for each employee.

If you wish to import employee information at the start of the tax year Select 'Start at beginning of the tax year' and Select 'Next'

This will ensure that no year-to-date amounts will be imported into BrightPay, in the event you are using a previous year's FPS for example.

If you have already processed payroll in your previous software for the current tax year and wish to import year-to-date pay amounts as well as your employee information, select 'Continue Partway in the Tax Year'.

3. Complete each screen accordingly with your relevant employer information.

For further assistance with this, please see our support section on Adding a New Employer

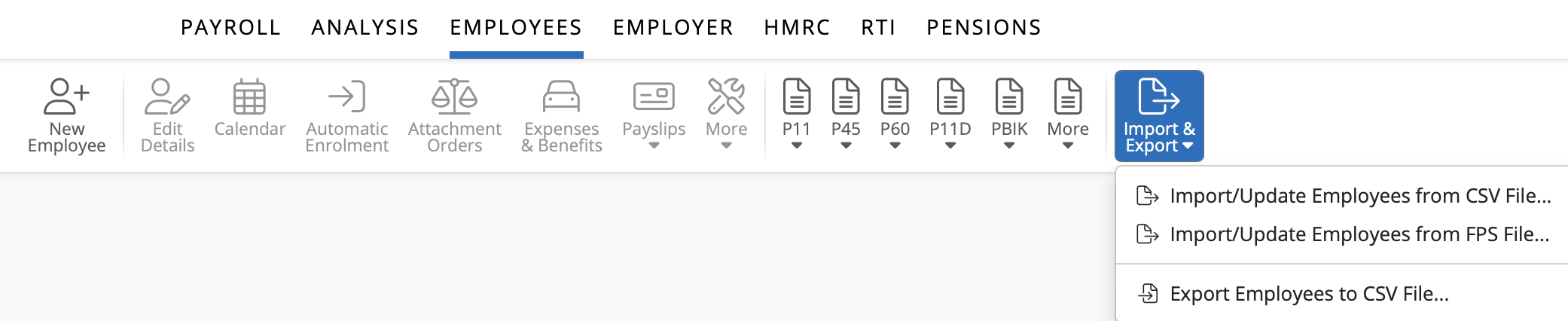

4. Once you have entered and saved your employer information, go to 'Employees > Import & Export Data > Import/Upate Employees from an FPS File... '

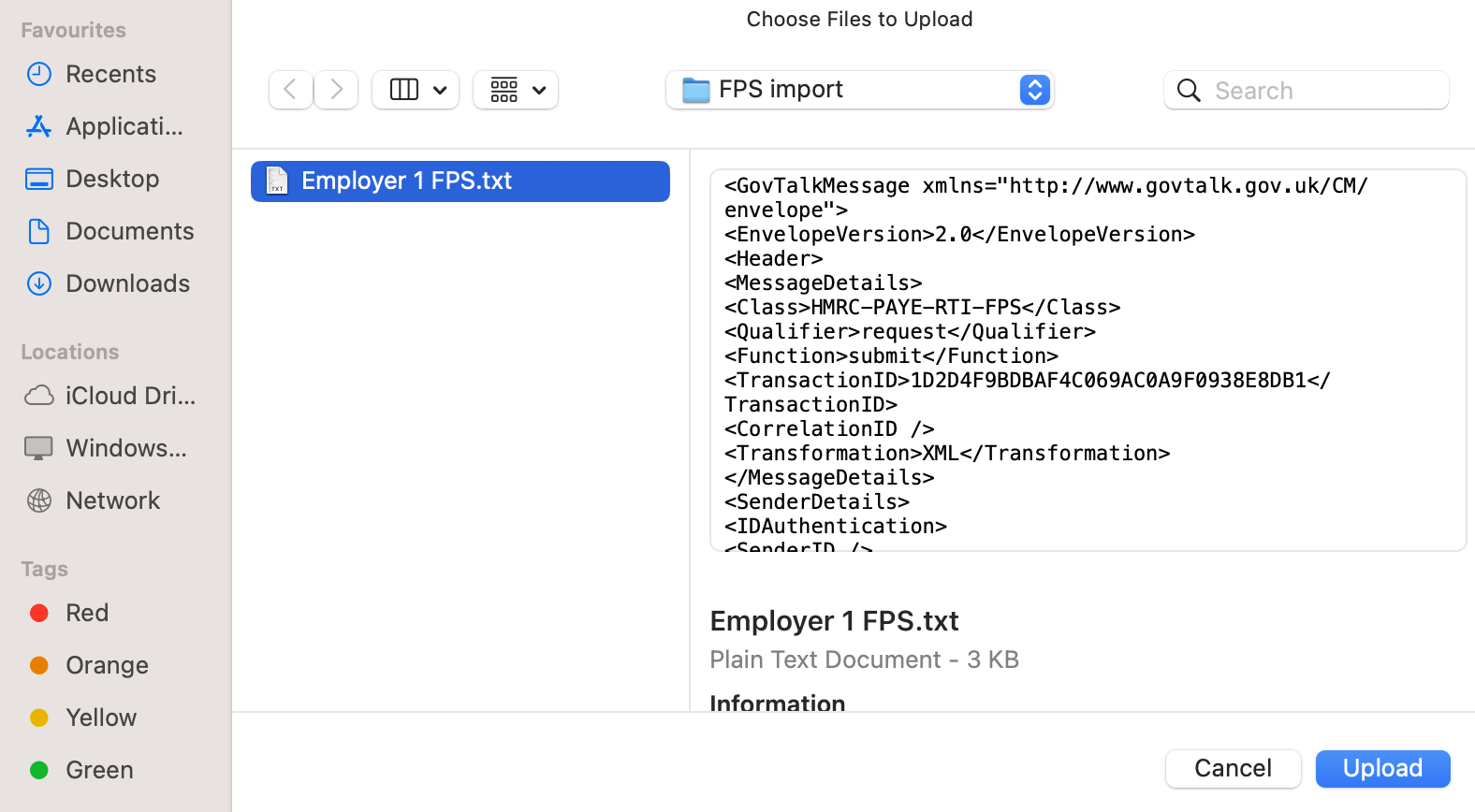

5. Browse to the location of your FPS file, select it and press 'Upload'

Important note: make sure that the FPS with the most recent modified date is chosen, to ensure that the most up-to-date employee information (and year to date amounts, if applicable) is imported.

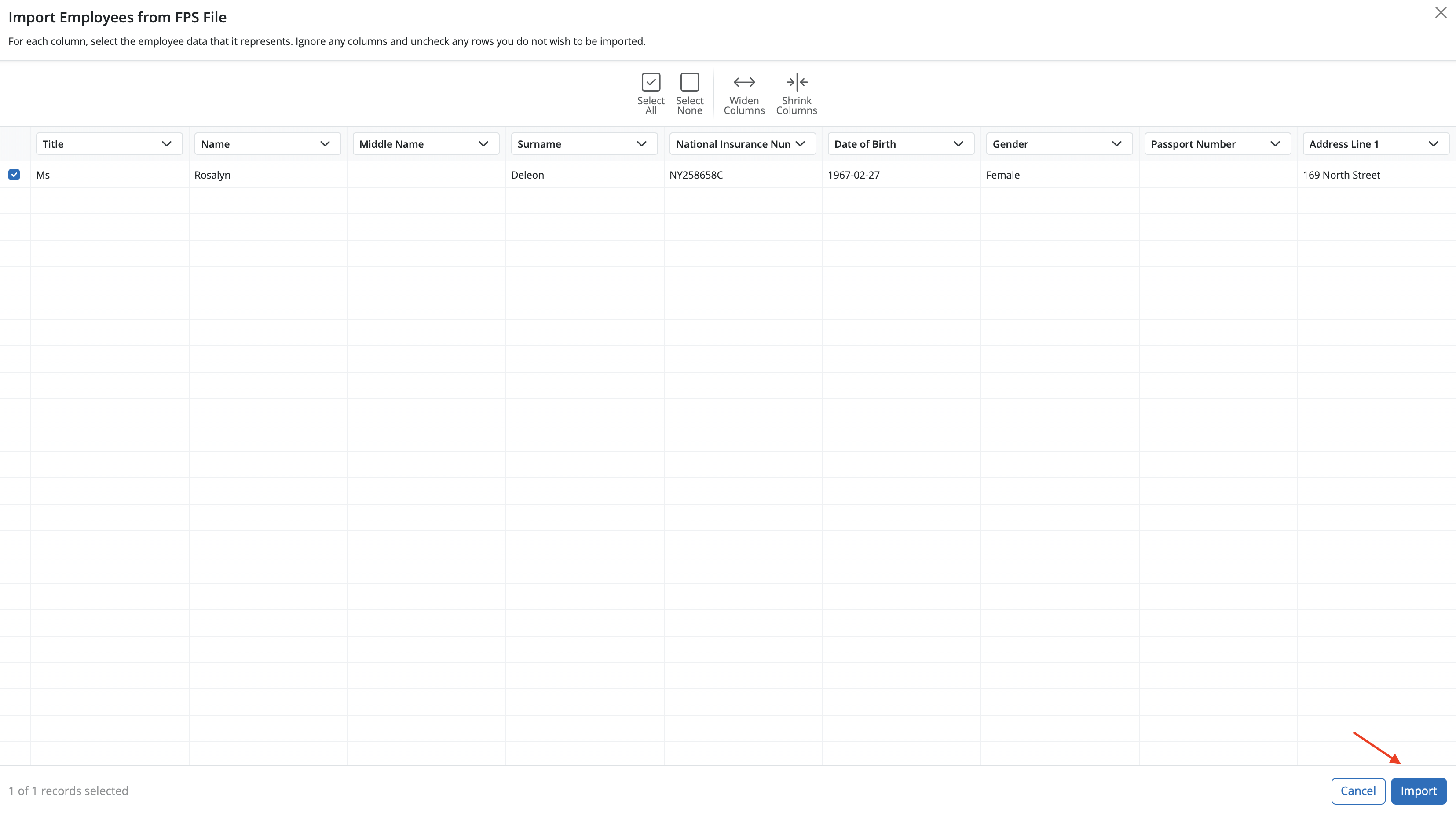

6. Employee information contained within the FPS selected will now be displayed on screen.

Review your employee information to ensure that the correct FPS has been selected. Should you not wish to import an employee, simply untick their name.

7. When ready press Import to complete the import

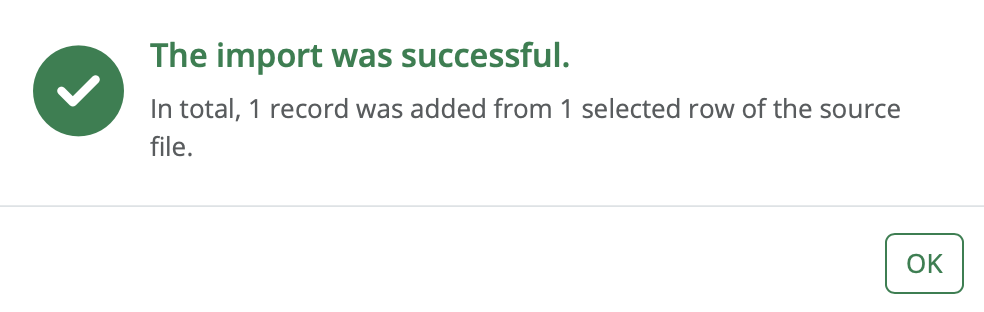

Employees and their mid year totals to date (if applicable) will now be imported into BrightPay

Following the import, further employee information can be manually entered within 'Employees', if required. Alternatively you may wish to update missing employee information using CSV file.

It is also recommended that all employee details are reviewed before processing any payroll to ensure information imported in is correct and applicable for the tax year in question.

If you have migrated to BrightPay mid-year, any mid-year cumulative pay information imported in via your CSV file can also be viewed here in each employee’s ‘Mid-Year Totals’ section.

After reviewing your employee information, simply click the 'Payroll' tab to commence processing payroll.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.