Moving to BrightPay - Continuing Auto Enrolment from a previous software

If your automatic enrolment duties have already started in a previous tax year and you were using different payroll software for tax year 2025-26 or you are switching to BrightPay during the current tax year, please see the instructions below for updating BrightPay with your automatic enrolment information:

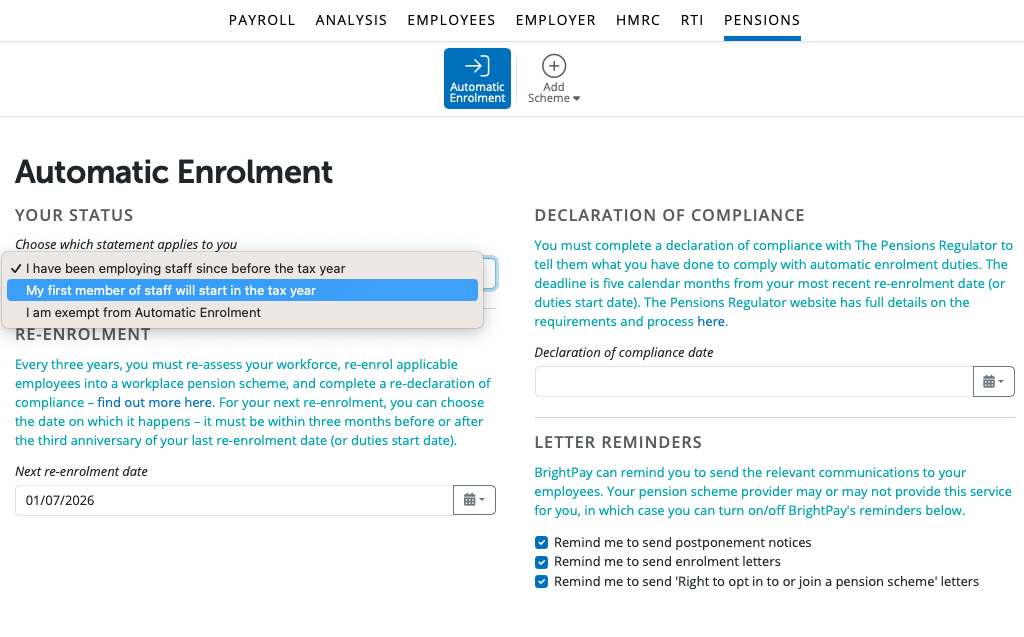

1) Before finalising any pay periods, first complete the Automatic Enrolment section accordingly within the Pensions utility:

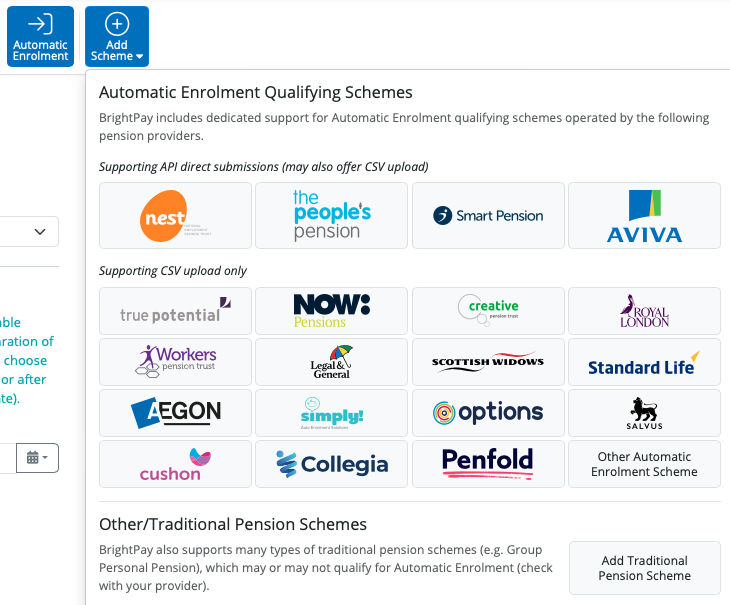

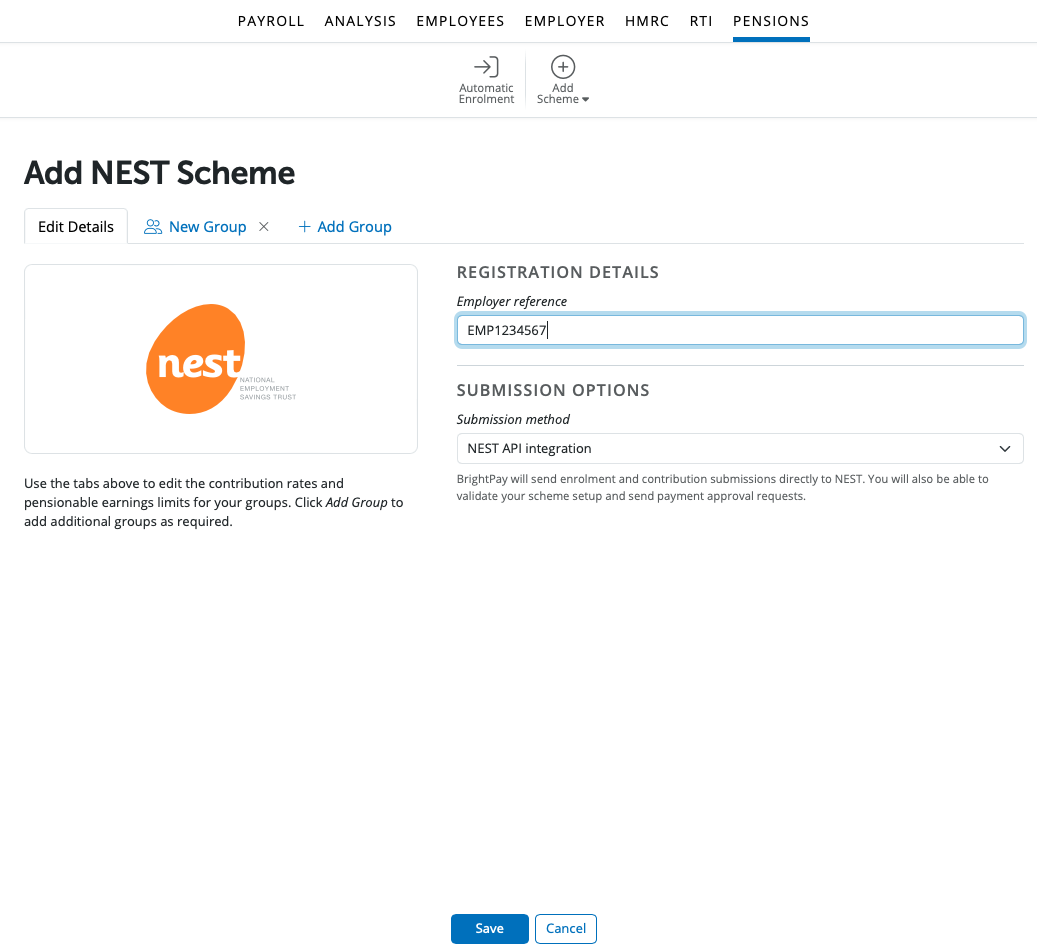

2) Next, enter the details of your automatic enrolment pension scheme(s) within the Pensions utility.

- click Add Scheme and select the pension scheme option you require from the listing

- enter in the details of the pension scheme accordingly, and click Save

3) Return to Payroll and set up your Payment Schedule, if you have not done so already. Enter the pay details for each employee in your first pay period if known.

4) Within Employees, select the first employee in the listing and click their Automatic Enrolment tab on the menu toolbar.

- If the employee is being assessed as an 'eligible jobholder' and this is correct, select the appropriate status for the employee:

- Enrol - if the employee is currently enrolled into the pension scheme.

- Postpone - if the employee is currently in a postponement period.

- Go - if the employee was enrolled in a pension scheme but has now opted out or ceased. Should this apply, enter the correct 'opt-out' or 'cessation' date on the next screen. The information entered here will be used at your re-enrolment date to assess whether the employer qualifies for re-enrolment.

- If the employee is being assessed as a 'non eligible jobholder' and this is correct, select the appropriate status for the employee:

- Letter - if the employee has been issued with their 'right to opt-in letter' and have not taken any further action, simply click 'Letter' followed by 'Mark as Done' .

- Opt in - if the employee is currently opted into the pension scheme.

- Postpone - if the employee is currently in a postponement period.

- If the employee is being assessed as an 'entitled worker' and this is correct, select the appropriate status for the employee:

- Letter - if the employee has been issued with their 'right to join letter' and have not taken any further action, simply click 'Letter' followed by 'Mark as Done' .

- Join - if the employee has joined a pension scheme.

- Postpone - if the employee is currently in a postponement period.

Please note:

- If the employee is currently in a pension scheme but is being assessed under a different worker category (possibly due to lack of pay information or a differing pay amount has been entered placing them in a different worker category), simply select:

- Join/ Opt in

- Select the correct assessment you require from the drop down menu:

- enter the original Enrolment Date/ Join Date/ Opt-in Date

- select the AE scheme applicable to the employee

- Select the applicable Tax Relief from the drop down listing

- Press Continue

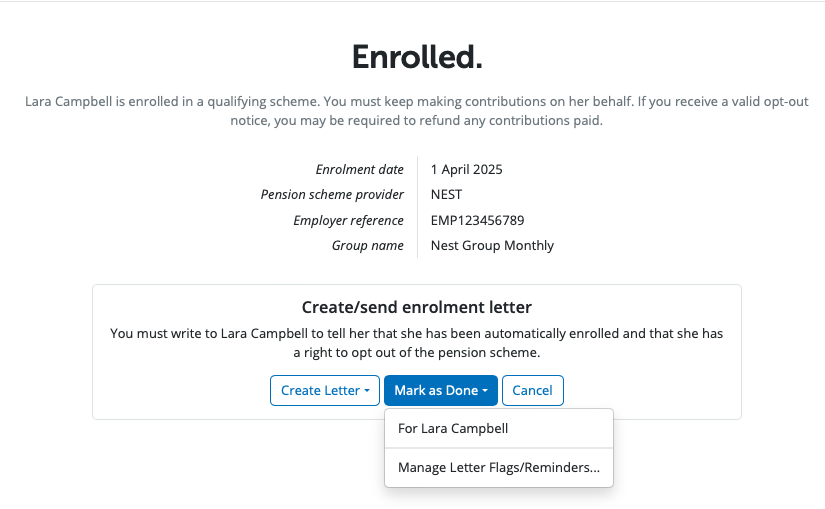

Communications

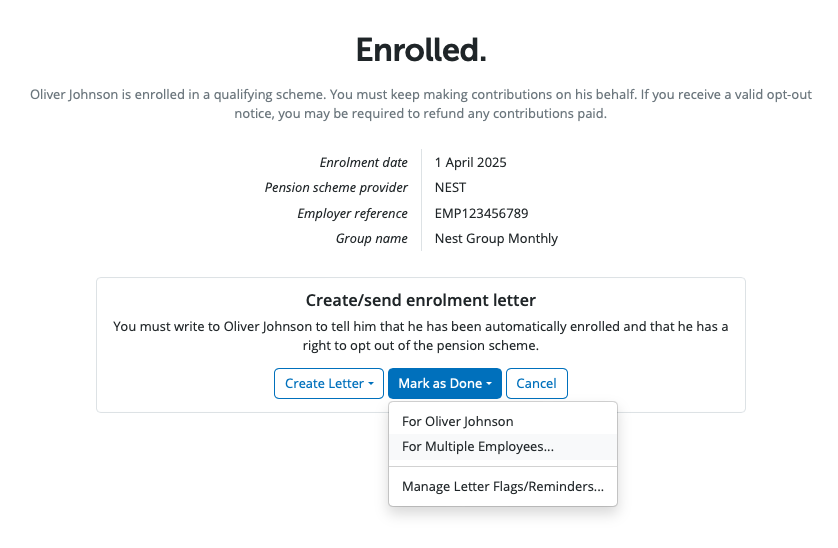

- As you will already have communicated with the employee, there is no requirement to provide the employee with any communication letters BrightPay may prompt you to do. To indicate that you have already communicated with the employee, click Letter followed by Mark as Done:

Repeat step 4 for each employee in order to update their automatic enrolment information.

Batch Processing of Employees

BrightPay facilitates the batch processing of employees who have the same automatic enrolment settings, thus eliminating the requirement to automatically enrol, postpone, etc. employees on an individual level.

For example, at the time of enrolling one employee, you will have the option to enrol multiple employees with the same settings:

- Simply select the employees who you wish to enrol and click ‘Enrol Selected Employees’ to complete their enrolment all at the same time:

- In the same manner, you will also be given the option to batch process the enrolment letters which BrightPay will automatically generate for each employee enrolled. As you will already have communicated with your employees, there is no requirement to provide the employee with the enrolment letter again. To indicate that you have already communicated with the employees, click Letter on an enrolled employee's Automatic Enrolment screen followed by Mark as Done... For Multiple Employees:

- Likewise, employees can be batch 'Postponed', if applicable:

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.