Rates & Thresholds at a Glance 2024-25

Tax Rates and Thresholds

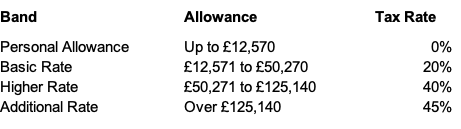

England and Northern Ireland

The standard employee personal allowance for the 2024 to 2025 tax year is:

£242 per week

£1,048 per month

£12,570 per year

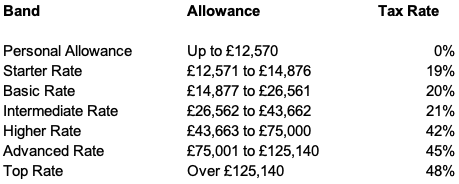

Scotland

The standard employee personal allowance for the 2024 to 2025 tax year is:

£242 per week

£1,048 per month

£12,570 per year

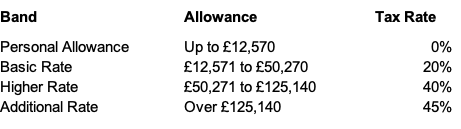

Wales

The standard employee personal allowance for the 2024 to 2025 tax year is:

£242 per week

£1,048 per month

£12,570 per year

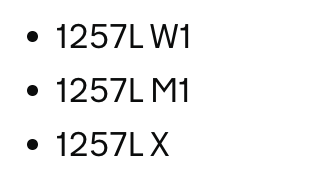

Emergency Tax

The emergency tax codes from 6th April 2024 are:

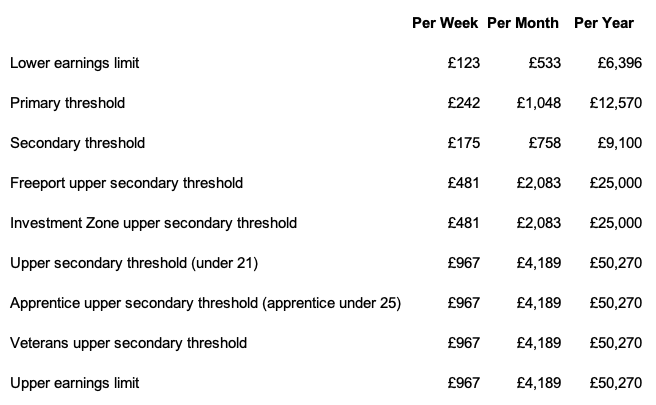

Class 1 National Insurance Thresholds

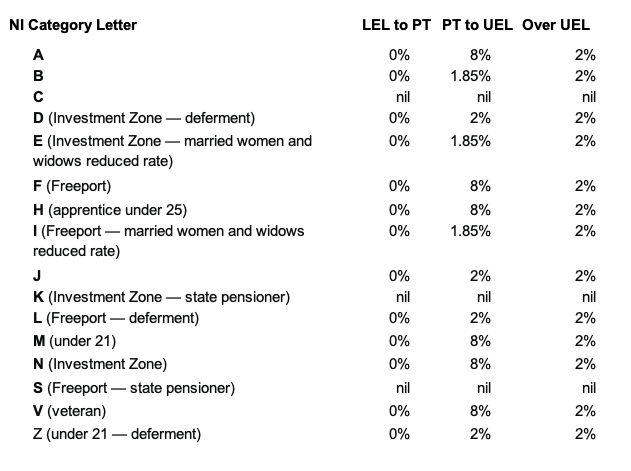

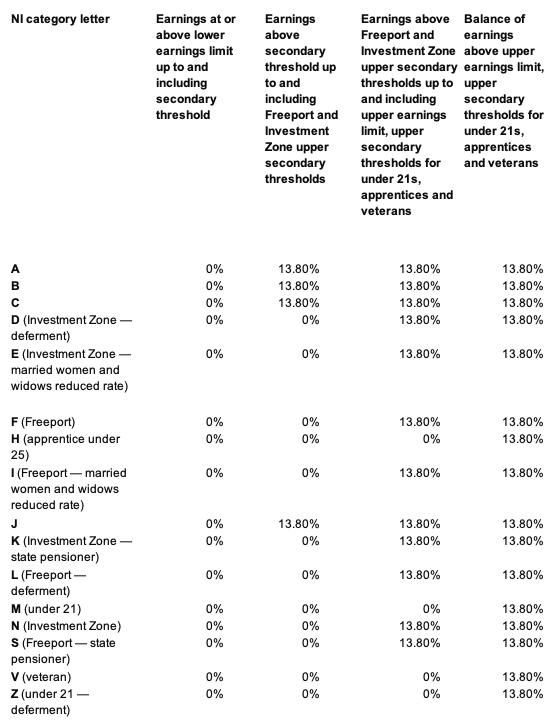

Class 1 National Insurance Rates

Employee (primary) contribution rates:

Employer (secondary) contribution rates:

Class 1A National Insurance Rate for Expenses and Benefits

The National Insurance Class 1A rate on expenses and benefits for 2024 to 2025 is 13.8%

Class 1A National Insurance Rate for Termination Awards and Sporting Testimonials

The National Insurance Class 1A rate on termination awards and sporting testimonial payments for 2024 to 2025 is 13.8%

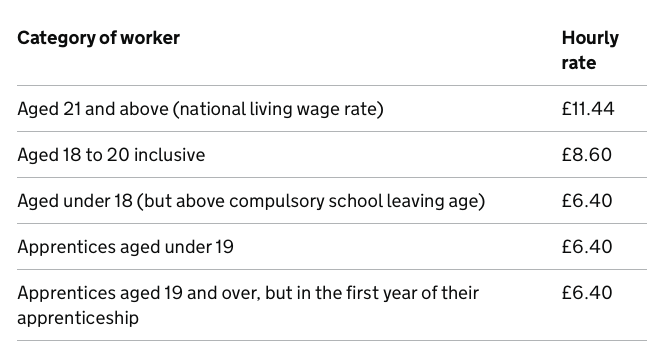

Minimum Wage Rates from 1st April 2024

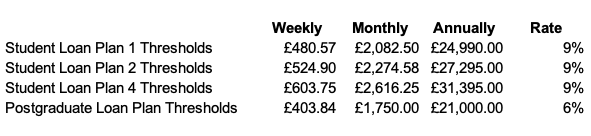

Student and Postgraduate Loan Rates 2024-25

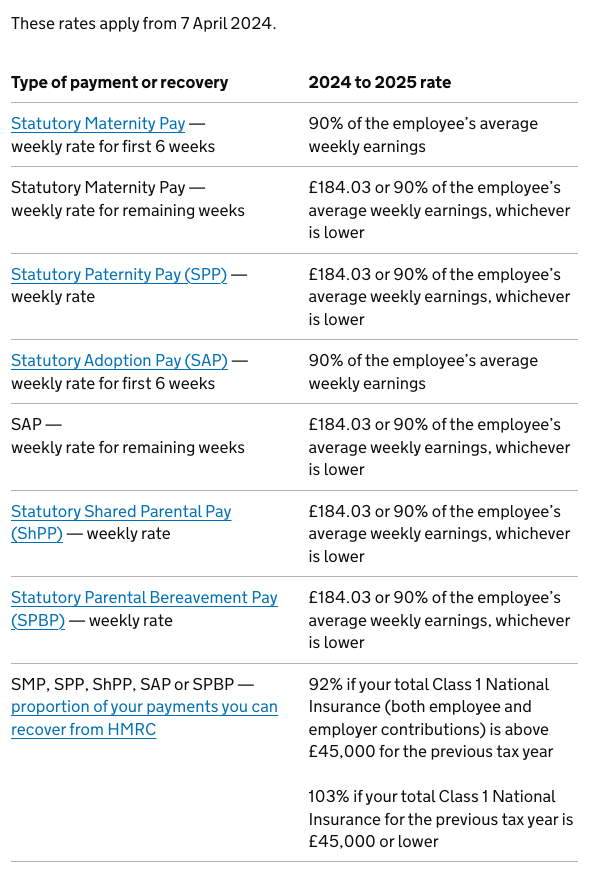

Statutory Payments

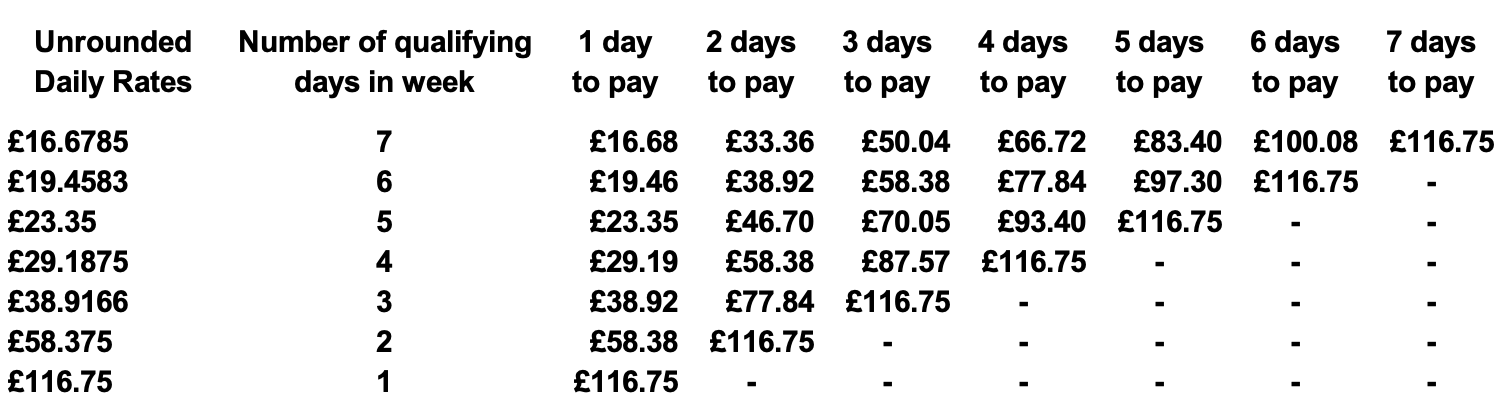

Statutory Sick Pay (SSP)

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.