What is IR35?

IR35 is also known as the ‘off-payroll working rules’, and it’s an anti-avoidance tax legislation that was brought in to tackle ‘disguised’ employment, i.e. individuals working through their own company, who would be employed if engaged directly, therefore having the right to all the tax breaks that those working under limited companies receive.

The IR35 reforms were rolled out in the public sector in 2017, and in the private sector in 2021. The reforms meant that instead of the individual being responsible for letting HMRC know whether they’re an employee or a contractor, it is now up to the client engaging them to let HMRC know.

Inside IR35 vs. Outside IR35

For contractors working with public sector bodies or medium to large sized clients in the private sector, the client is now responsible for determining whether the contractor falls inside IR35 or outside IR35. The client must also deduct the right tax and National Insurance contributions (on top of the fees paid to the contractor) and report this directly to HMRC through RTI on behalf of the worker.

Small businesses are exempt from the IR35 reforms, so if the contractor works for a small client, the contractor will still be responsible for working out their own employment status.

CEST (Check employment status for tax), which is HMRC’s online tool, helps determine whether a contractor is inside IR35 or outside IR35. These phrases are crucial to defining and understanding the contactors status, and considering whether or not the legislation will impact their future contractual work.

- If a contractor is outside IR35 it means HMRC sees the contractor as 'genuinely' self-employed, and therefore operating outside of the IR35 rules. When outside IR35, the contractor continues to be responsible for ensuring that they are paying the right amount of National Insurance and tax on the money that they receive for their work. They are not subject to PAYE by the contracted employer.

- If a contractor is deemed to be inside IR35, they become a worker of the deemed employer, even if they are acting through an intermediary, e.g. their own limited company. The worker is required to pay the same tax and National Insurance contributions as employees. However, the rules do not entitle the worker to employment rights in respect of their work for the deemed employer – the worker is instead treated as an employee solely for tax purposes. They may still remain employed by their own intermediary, but any salary from this intermediary will now be exempt from employment taxes as these have already been deducted and paid by the client, or deemed employer.

Find out more: Watch BrightPay’s IR35 Demo | Watch IR35 Webinar On-Demand

What are off-payroll workers not entitled to?

Off-payroll workers are not entitled to receive or have deducted from their pay:

- Statutory payments: SSP, SMP, SAP, SPP, ShPP or Statutory Parental Bereavement Leave & Pay

- National Minimum Wage / National Living Wage rates

- Annual leave entitlement / holiday pay

- Student Loans or Postgraduate Loans

- Automatic enrolment pension scheme contributions

Off-Payroll / IR35 in BrightPay

(for the public sector or large/medium sized private company who has contractors deemed to be inside IR35)

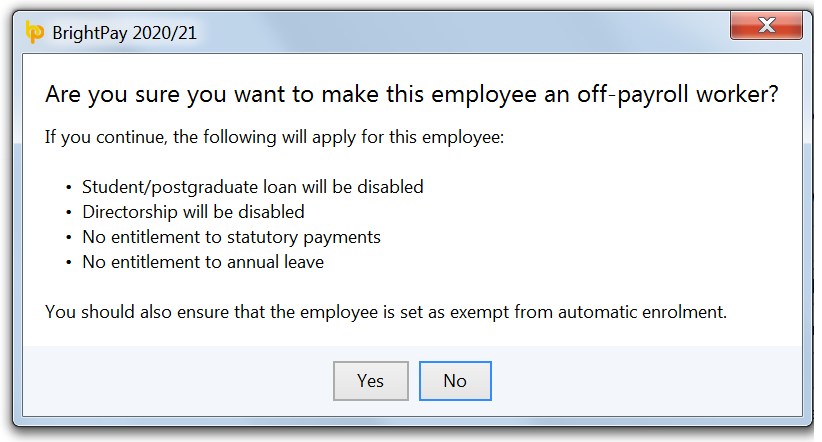

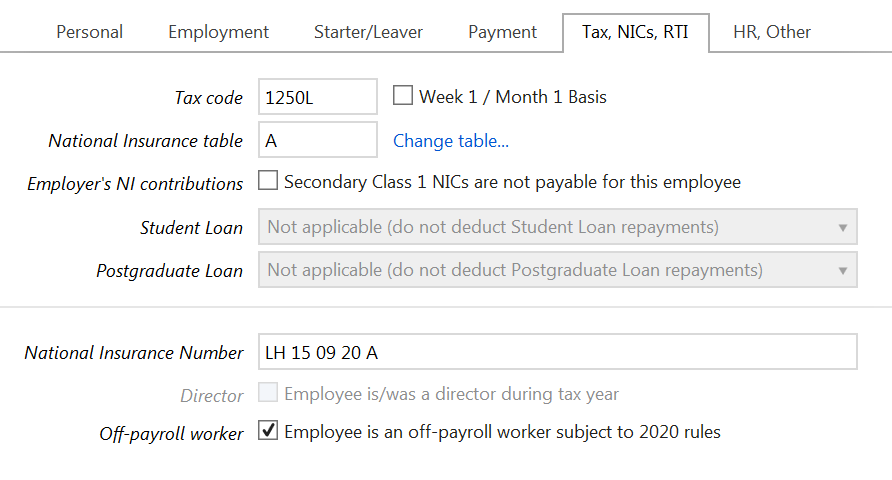

BrightPay will be able to cater for workers who are inside IR35. When setting up the worker as an employee, tick ‘off-payroll worker’ within the Tax, NICs, RTI tab. This will disable entitlements that do not apply to contractors who fall inside the off-payroll working rules.

Once an employee is set up in BrightPay as an off-payroll worker, some settings will be automatically disabled, including student loans, postgraduate loans, directorship, and annual leave entitlements.

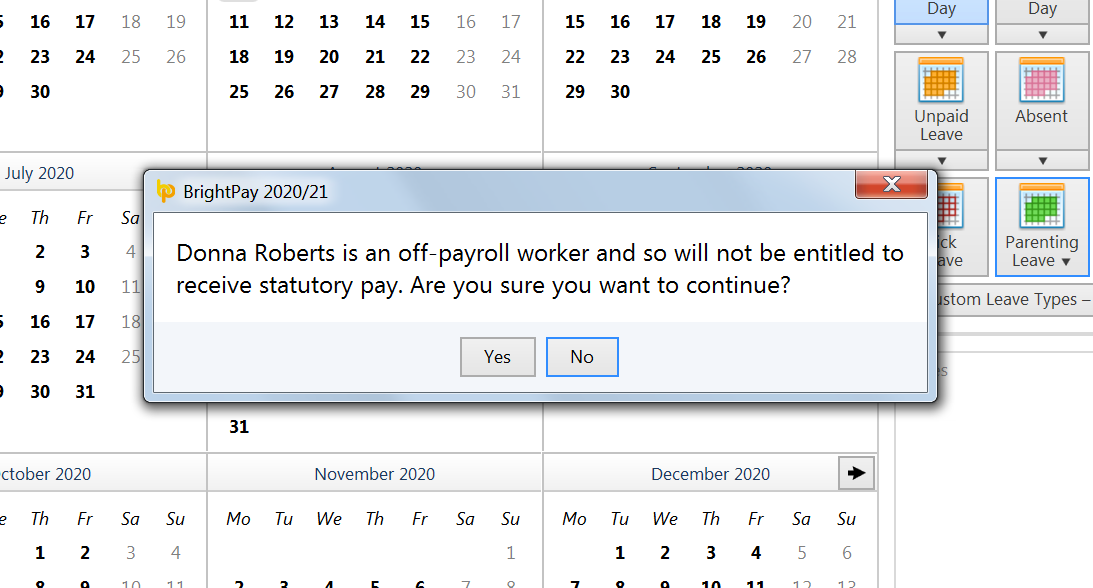

If a user adds statutory leave, a notification will highlight that the worker is not entitled to statutory pay, and the payment will not flow through to the payroll. However, the calendar can still be used if the user wishes to track this information internally.

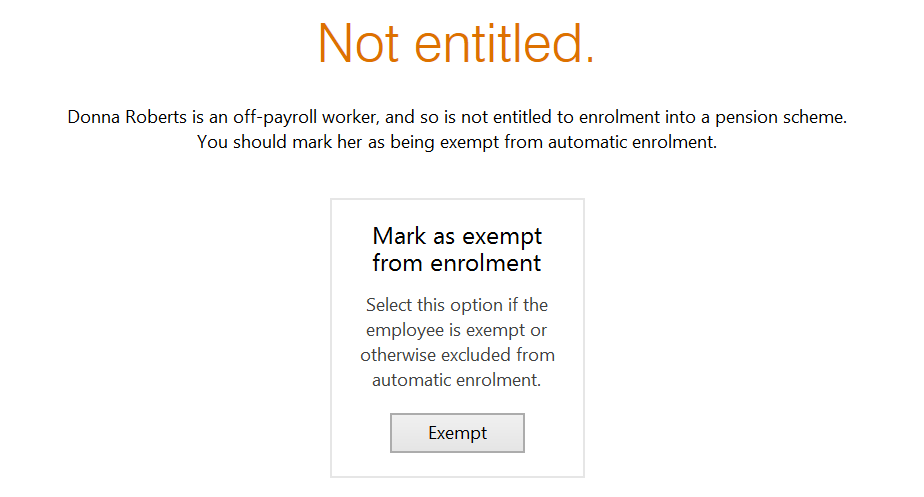

For automatic enrolment, an alert will appear for off-payroll workers where the user can mark them as being exempt from auto enrolment. This will disable any automatic enrolment features that may appear for the off-payroll worker.

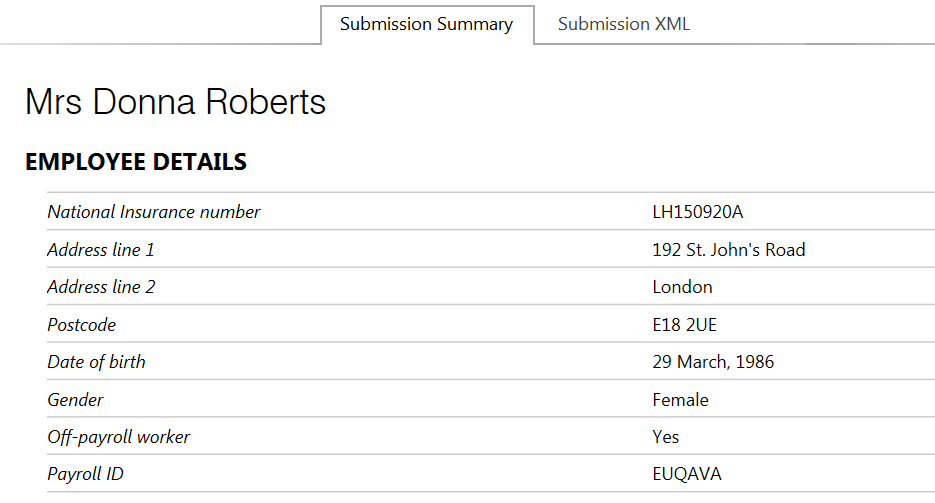

When a full payment submission has been created, it will automatically include details of workers who fall inside IR35, ready to send to HMRC.

Off-Payroll / IR35 in BrightPay

(for the contractor who is working for the public sector or large/medium sized company and who is deemed to be inside IR35)

Salaries paid to you by your own limited company can be paid without deduction of PAYE and NIC. This is because payroll taxes have already been suffered on the payments from your client.

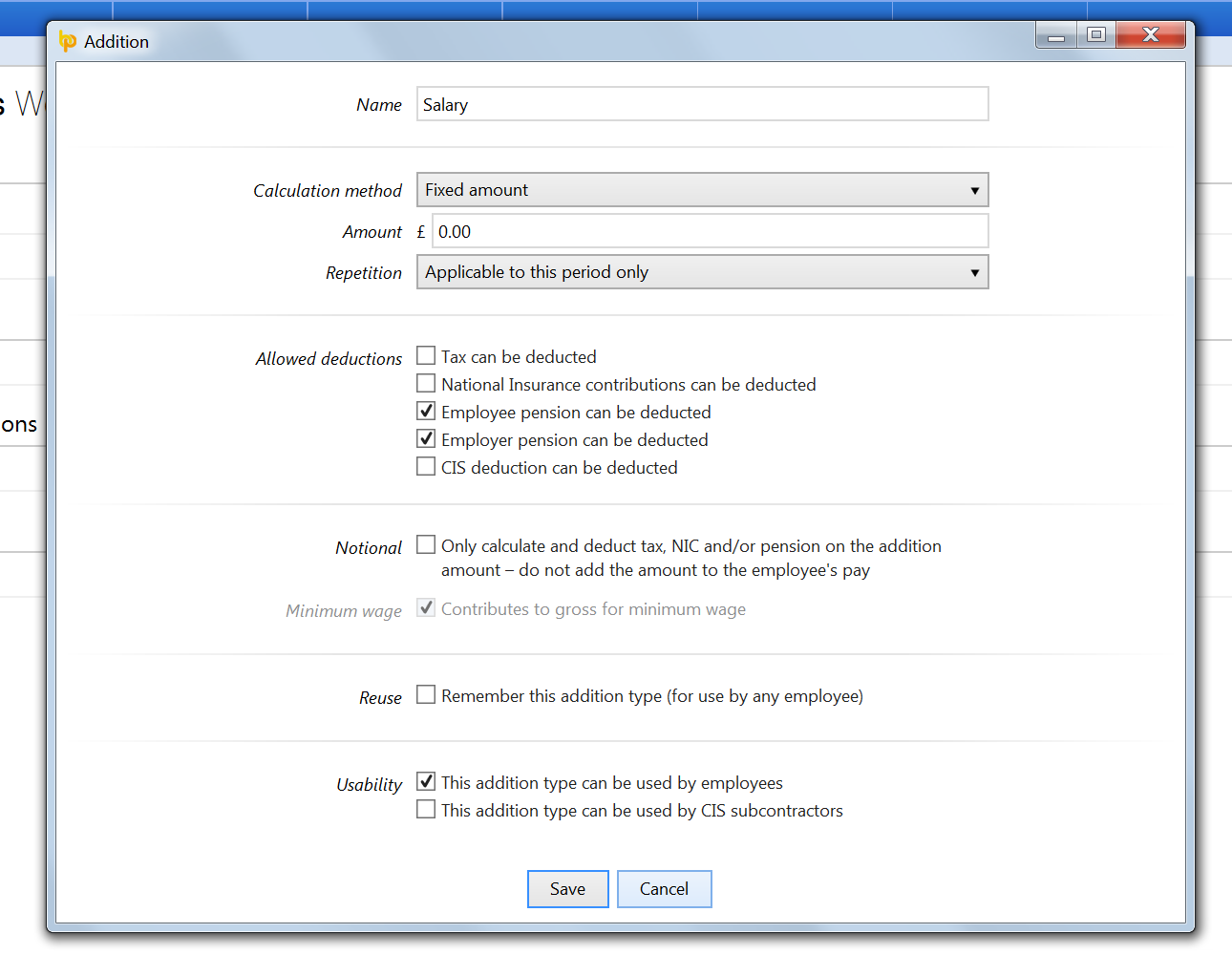

To achieve this, add a new addition type, give it a name (e.g. Salary) and untick the boxes ‘Tax can be deducted’ and ‘National Insurance contributions can be deducted’.