Importing From The Previous Tax Year

Importing from BrightPay 2015/16

BrightPay 2016/17 (effective for pay periods on or after 06th April) is available to download from mid March 2016.

Each annual installation of BrightPay installs separately to each previous tax year version. Therefore, once installed, you will see a new icon appear on your desktop for you to access BrightPay 2016/17:

If you used BrightPay 2015/16, you will need to instruct BrightPay 2016/17 to import your employer data files and all associated employee data records from 2015/16 into 2016/17 by following the steps below:

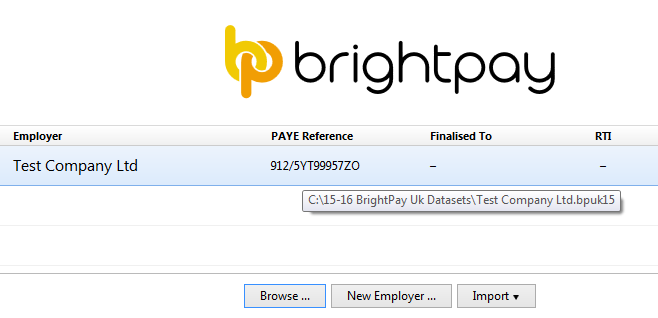

1) First establish the location of your 2015/16 BrightPay employer data file(s). You can do this by simply hovering over an employer name on the 2015/16 Open Company screen (as shown). The location from which the employer data file opens will be displayed on screen:

2) Open the BrightPay 2016/17 software.

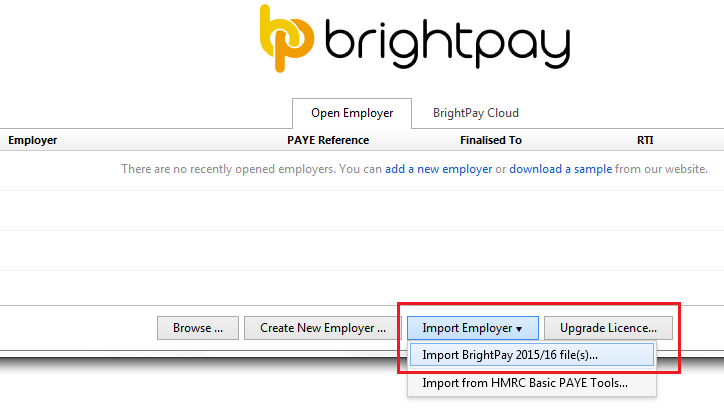

3) Click 'Import Employer' followed by 'Import BrightPay 2015/16 files(s)...'

4) Browse to the location of your 2015/16 employer data files, highlight the employer data file and simply select Open.

5) If you are importing multiple employer data files:

Either:

- Hold the Shift key on your keyboard and select the first and last employer data file that you wish to import and all employer files within the start and end range will be selected.

Or:

- Hold the Ctrl key on your keyboard and individually select the employer files you wish to import.

6) Select Open

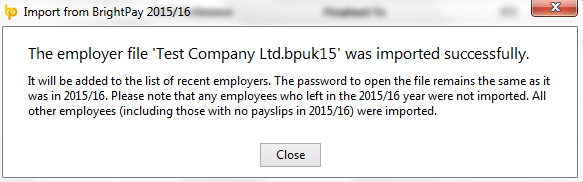

7) All selected 2015/16 employer files will now be imported into BrightPay 2016/17 and will be listed in the 2016/17 Open Company screen.

8) Please note: if the employer file is password protected, the password will be the same as the previous year.

Please note: All employee data records will be reset for the start of the new tax year and all associated 2016/17 budgetary changes will be applied as per HMRC instruction.

What HMRC require before commencing payroll from 06th April 2016

Employees without a new tax code

Carry forward the authorised tax code from the employee's 2015/16 payroll record to their 2016/17 payroll record. Authorised codes include BR, D0, D1 and NT.

However, if you have received a 2015/16 tax code on a form P6 too late to use in 2015/16, carry forward this code instead.

- Add 40 to any tax code ending L, for example 1060L becomes 1100L

- Add 44 to any tax code ending in M

- Add 36 to any tax code ending in N

Do not copy or carry over any ‘week 1’ or ‘month 1’ markings.

Please note: BrightPay will automatically uplift all L codes by 40, all M codes by 44 and all N codes by 36 and will remove any Week 1 or Month 1 tax marker on import from 2015/16 BrightPay into 2016/17 BrightPay.

Employees with a new tax code

Keep and use the form P9(T) or other tax code notification with the most recent date on for each employee.

HMRC advises :

• scrap any form P9(T) or other tax code notification for the same employee with an earlier date

• copy the tax code from the form P9(T) or other tax code notification onto your payroll record

• update any tax codes where you have received form P9(T) or other tax code notification after you have set up your payroll records.

Need help? Support is available at 0345 9390019 or brightpayuksupport@brightsg.com.